Rate of return Bank On Yourself

Post on: 12 Август, 2015 No Comment

A recent comment made by a reader of this blog inspired this post. Ive never gone into detail on the question of how the rate of return on a Bank On Yourself policy compares with investing in stock market and mutual funds.

And is it really true that if you simply hold on long enough, investing in stocks and mutual funds will out-perform just about anything else?

So, Ive decided to lay those questions to rest – once and for all – right here. Heres the comment by a reader who calls himself Tob that sparked this post:

This is a ridiculous attempt to compare whole life insurance to the “stock market” after the worst decade. I can show you how investing blows the pants off whole life using investing basics. Balanced Funds. How many funds do you want that have produce 10% per year compounding average to convince you?

So, has Tob really found that elusive investment that gives you a 10% average return, and still lets you sleep at night?

Well get to the answer to that question in a moment.

First, let me address the question,

What the heck is the rate of return on a typical Bank On Yourself policy?

And the answer is that you would have to get a 7 – 8% annual return in a taxable account to equal the average net return in a typical and properly designed Bank On Yourself-type policy (assuming youre in the 35% tax bracket).

Keep in mind that you receive a guaranteed and predictable cash value increase every single year – in both good times and bad.

In addition, you have the potential to receive dividends. While not guaranteed, the companies used by Bank On Yourself Authorized Advisors have paid dividends every year for more than 100 years.

The growth in a whole life insurance policy is not only guaranteed, its exponential .

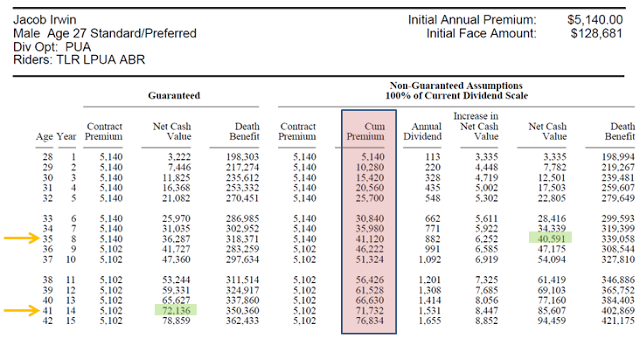

The chart below shows you the exponential nature of the growth in a properly designed Bank On Yourself policy. These policies are designed to get better (more efficient) every single year, simply because you stick with it. rather than jumping from one investment to another. Notice how this gives you some built-in protection against inflation:

This chart is based on one of my own Bank On Yourself policies, showing the actual growth I’ve received so far in the policy, and the projected future growth, based on the current dividend scale (dividends are not guaranteed and are subject to change).

However, no two Bank On Yourself plans are alike – each one is custom tailored to the client’s unique situation. To find out how much your financial picture could improve if you added Bank On Yourself to your financial plan, and to get a referral to a Bank On Yourself Authorized Advisor (a life insurance agent with advanced training in this method), request a free, no-obligation Analysis .

Unlike stocks, real estate, and other traditional investments. both your annual guaranteed cash value increase and any dividends you may receive are locked in . once credited to your policy. They do not vanish due to a market correction or crash.

Imagine if you still had every penny of gains youd received on your investments!

How much brighter do you think your financial picture might look right now?

To give you an idea of just how much of a difference having your gains locked in can make, heres a fascinating little quiz…

Do you think its possible to invest $50,000, get a 25% average annual return on your money every year for four years… and end up with only the $50,000 you started with?

If you answered no, youre in for a real surprise!

Lets assume your money increases by 100% the first year, and then goes down by 50% in the second year. But you do really well in the third year, because your money increases by 100% again. Unfortunately, however, you take a 50% hit in the fourth year.

If you add those four annual percentages together and divide by four, you have a 25% annual return.

Not bad, huh?

But lets see how much money you actually have in your account…

You started with $50,000 and your 100% increase in the first year doubled your money to $100,000. Then you lost 50% in year two, giving you a balance of $50,000.

You did great in year three, when your 100% increase doubled your balance to $100,000. But the 50% decline in the fourth year leaves you with… the same $50,000 you started with four years earlier!

So what good did getting a 25% average annual return do you?

That and a quarter wont even buy you a cup of coffee, let alone a mocha latte!

You have nothing to show for this roller-coaster ride other than heartburn and a stomach ache.

But this is the kind of smoke and mirrors the Wall Street illusionists have been using to pull the wool over your eyes for decades!

You take all the risk, and they get the rewards, whether you make money or not!

But the myths and lies perpetuated by the Wall Street propaganda machine dont stop there. Here are three shocking facts about the long-term returns people are really getting in the stock market:

Shocking Fact #1:

A recent study 1 revealed that, for the past 190 years, American stocks have averaged a REAL annual return of only 1.4 percent!

Are you wondering how that could possibly be?

As the studys author pointed out, the popular charts of stocks, bonds, bills and inflation that line the walls of brokerage offices assume full reinvestment of dividends, no commissions and no taxes.

Is that how you invest?

This study didnt even adjust for commissions and taxes, because they vary so widely. It only accounted for inflation and the fact that investors typically dont reinvest all their dividends.

Is a paltry 1.4 percent real return worth the risk and sleepless nights to you?

And remember, that figure doesnt even take into account commissions or taxes!

Shocking Fact #2:

For the last forty years . ordinary long-term treasury bonds have outpaced investing in the stock market. 2

Long-term treasury bonds are what grandma buys so she can sleep at night!

Which means the only rewards investors have received for taking the extra risk of stocks and mutual funds for the past four decades are sleepless nights and broken retirement dreams!

Shocking Fact #3:

The typical equity mutual fund investor has only earned 3.49% annually for the past 20 years, beating inflation for that period by only a hair . Asset allocation and fixed income investors havent even managed to outpace inflation for the last twenty years! 3

So, what about that 10% annual return Tob was talking about?

In your dreams, my friend!

A so-called balanced fund is a mutual fund that buys a combination of stocks and bonds to provide income and capital appreciation, while avoiding excessive risk.

However, these funds have averaged only a 2.74% annual return for the last ten years, lagging inflation. The 15-year average is a little better – 4.85%. And the 20-year average has been 6.18% (see Wall Street smoke and mirrors revelation above), however, the fees charged by mutual fund companies for this type of fund are around 1.3% Whats left barely outpaced inflation during that period.

Oh yeah – in 2008, the average balanced fund lost 28%, according to Morningstar.

Woohoo! Where can I get me some of that stuff.

Let me let you in on a little secret…

Let me let you in on a little secret.

One of the many advantages of a properly structured Bank On Yourself-type policy is that you can borrow the equity in your policy, use it to invest elsewhere, and your money in the policy continues growing as though you hadnt touched a dime of it! (Note – not all companies offer this feature.)

I explain exactly how and why this happens on pages 68-69 of my best-selling book .

So, if you found a great investment, you could borrow money from your policy to put into that investment.

Result: You could be receiving the 7 – 8% after-tax equivalent return I talked about at the beginning of this post… PLUS the return of the investment you put the money into!

This allows you to have your money working for you in two ways at the same time!

Chapters 8 and 11 of my book give real-life examples of people doing just that, from the Arizona couple using the money in their Bank On Yourself policy to fund a horse breeding business, to the surgeon who used his equity to purchase shares in a very profitable surgical center.

The bottom line is that the rate of return on a Bank On Yourself policy will put just about any traditional investment to shame, and it will do that without the risk or volatility of stocks, real estate, gold, commodities and other investments.

Havent we learned that return of our money is at least as important as the return on our money?

Financial security comes from knowing you have a solid financial foundation and that you have a nice chunk of your savings in a plan that only goes in one direction – UP.

So, if you havent started to Bank On Yourself, why not find out what it could do for you and your family?

Take the first step now by requesting your free Analysis. You have nothing to lose and everything to gain.

1. Stock markets real return? Paltry, by Anthony Mirhaydari, MSN Money, February 1, 2010

2. “Bonds Why Bother?” by Robert Arnott, Journal of Indexes. May/June 2009 Issue

3. DALBAR’s 2012 Quantitative Analysis of Investor Behavior