Protecting Your Portfolio Against Market Downturns

Post on: 27 Апрель, 2015 No Comment

7Eharbers/wp-content/uploads/2011/11/market-downturns1.jpg /% Whenever we encounter a period of unexpected stock market turbulence, the main thought on many clients’ minds is, “Can I achieve my investing objectives in these difficult economic times?” How we counsel these concerned clients is no real secret. Consideration of the client’s income needs, deep and broad portfolio diversification, the portfolio’s volatility characteristics and flexibility to adapt the portfolio as needed are all part of the conversation.

We’ve found that this targeted discussion is useful in dissipating emotional reactions to volatile markets or subpar economic conditions—reactions that can drive a portfolio seriously off course. A closer look at each of these four topics will give you a better idea of how we work with clients and our approach to portfolio development and management.

First, income needs. Future needs and objectives should guide the choices made for an investment portfolio. The question that must be asked and answered is: When will the portfolio need to provide income? Reassurance that the investment plan takes into account income needs and their timing goes a long way to help clients react to market movements and economic downturns logically rather than emotionally.

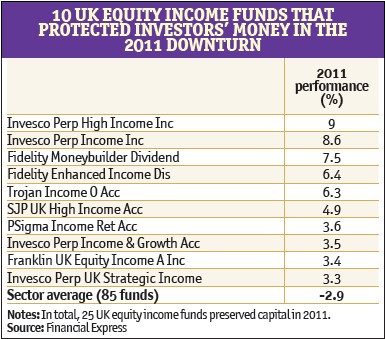

Second is portfolio diversification. When new clients are referred to us during volatile periods, the biggest problem we find on reviewing their portfolios is a lack of diversification. These portfolios almost always have too few managers employed, and all too often these managers are pursuing very similar strategies.

Because there are many different ways to approach investing for growth, we’re always looking for managers and strategies that complement each other. Achieving this mix often also resolves the third issue we review with clients: lowering volatility in growth portfolios.

What else do we do to protect clients’ portfolios? Read more

Finally, we consider the portfolio’s flexibility. The last few months have emphasized the importance of maintaining flexibility in a portfolio. No one can tell the future, and the backdrop for investing can—and often will—turn on a dime. So we look for managers who are willing to adapt their portfolios as conditions warrant. And we strive to access these managers in flexible formats, such as mutual funds or exchange-traded funds, allowing our clients a measure of flexibility.

It’s a fact of life that the unexpected often pops up at the least opportune time. Working to ensure that unexpected market or economic events don’t cause your investment portfolio to suffer unrecoverable losses is the cornerstone of our philosophical and practical approach to portfolio development and management. But that said, we are cautious to remind clients often that—despite our best efforts and thoughtful analyses—diversification and asset allocation strategies, regretfully, do not assure profit or protection against loss.

As always, don’t hesitate to call with questions. Our commitment to you includes the promise of a quick response to your phone calls.