Pros and Cons of Investing in Targetdate Funds

Post on: 17 Август, 2015 No Comment

Pros and Cons of Investing in Target-date Funds

Did You Know?

According to a CNBC report by Shelly K. Schwartz, Quirk &. Associates, an asset management consulting firm has predicted that target-date funds will attribute to almost half of the projected $7.7 trillion in US-defined contribution assets by the year 2020.

Target-date funds are a collection of various funds and asset allocation mix for an individual portfolio. They’re extremely popular among investors, especially for planning their retirements. The date in the target-date funds implies to the retirement date of the investor or a date where he declines making contribution to the funds. It doesn’t mean that the investor will get the money on the date. The fund continues to work for the person in retirement. Target-date funds are touted to be as the most low-maintenance retirement funds. As one approaches the age of retirement, it’s advisable that he doesn’t invest his money in aggressive and volatile investments. Thats exactly why many people prefer to go with target-date funds as they become more and more conservative once the retirement year starts approaching. However, many people still doubt whether it’s good or bad to invest in such funds. Here are a few pros and cons which you should be aware of.

PROS

Easy Availability

In 2006, the Pension Protection Act signed by President Bush helped employers to implement these funds as a default option for 401(k). Hence, many major employers today offer their employees target-date funds as a part of their 401(k) package. Apart from your employers, you can also get such fund options from your brokers, banks, mutual fund managers, insurance companies. Trusts.

Increased Transparency

The SEC and labour department have proposed certain regulations regarding the target funds’. Investment and fee, which will add a lot of transparency for the investors.

Lower Fees

According to a CNBC report, the consumer is growing increasingly aware about the returns on the investment. Lawmakers are forcing fund companies to be transparent about their fees. This has led many companies to lower their fees.

Penny Stock Symbol Program Penny Stock Prophet Review

Portfolio Management

Target-date funds include a number of investments and asset allocation, which the company provides based on your target date. This helps simplify the complexity of owning a mix portfolio and managing it successfully over a period of time. Even if you’re not adept at managing your portfolio, you need not worry as the target-date fund will do it for you.

Rebalancing

Once you opt for a target-dated fund, the company will rebalance your portfolio from time to time. This will involve selling and buying new investments from time to time. It requires an investor to have better judgement and to be non-emotional to sell the well-performing investments and buy the ones that aren’t doing well. However, with target-date funds, this problem will be taken care of. Also, they automatically rebalance to become more conservative as the date of retirement approaches.

Helps Avoid Mistakes

Many people commit mistakes in the asset allocation of their portfolios. For example, working youngsters often attribute all the money to investments that offer fixed income investments, while people who are on the verge of retirement allocate most of their money to investment in equity. This is exactly what target-date funds avoid. They’ve strategically planned asset classes based on your age and contribution, which provide better asset allocation.

CONS

Not a Diversified Portfolio

Your company may be either too aggressive or too conservative. Know about the funds and asset classes that are going to be a part of your portfolio. What you need is a portfolio that’s the right mix of investments, which will include equity, stocks, derivatives, bonds, closed-end funds, commodities, ETFs, mutual funds. Real estate. Your portfolio needs to span multiple investment vehicles.

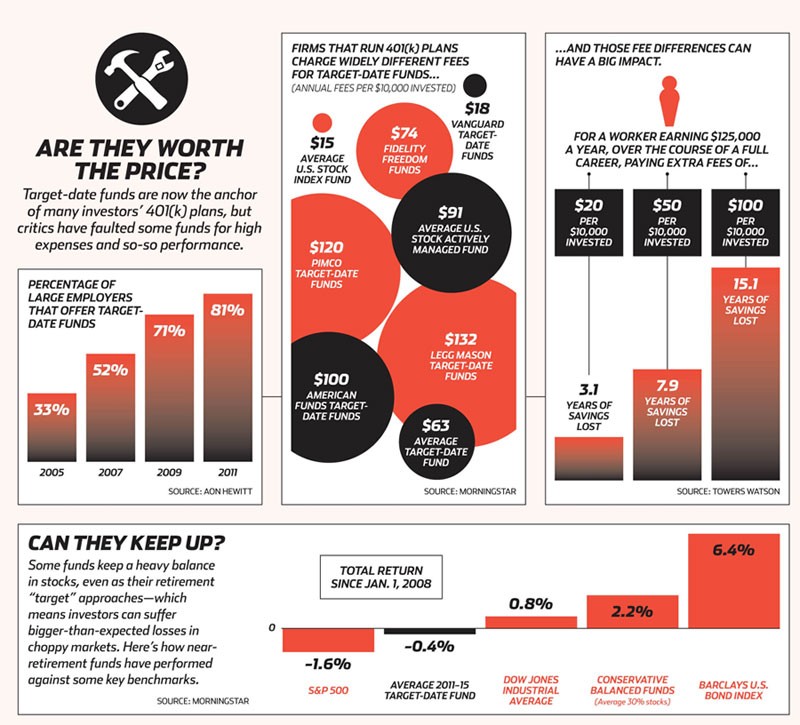

High Fees

The last thing you’d want to do is invest in funds which tag along a huge expense in terms of fees. Forget the returns, you’ll have to spend your hard-earned money in the payment of fees. You must conduct an expense ratio analysis to know whether you’ll actually be able to afford the impending fees. According to a report in marketwatch.com, human resources consultant Tower Watson has quoted that an increase of fees of $50 for every $10,000 of target-date fund may cause an investor to lose 8 years worth of retirement savings throughout his career.

One Size Fits All

They don’t necessarily offer customization based on individual investment needs. This is perhaps one of its greatest drawbacks. They’re too general and lack the personalisation required based on the individual preferences of the investor.

Flexibility

One of the key cons is that they lack flexibility. If you go with a target-date fund in your 401(K), which is sponsored by your employer, you’ve no choice but to settle for funds it comes with. They may not necessarily match up with your portfolio or the amount of risk you’re willing to take.

Impossible to Draw Comparisons

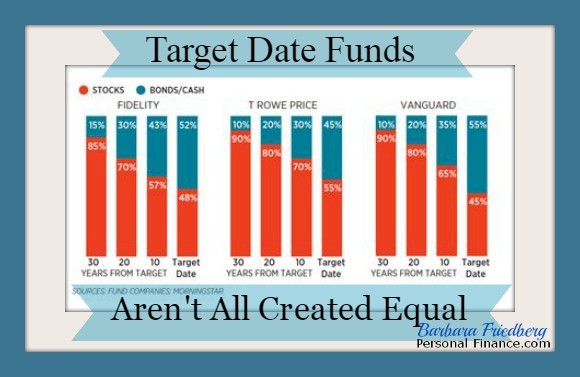

There are several target funds in the market. However, all of them may differ in their asset mix, fees, risk tolerance levels, etc. This makes it very difficult for a layman to draw comparisons between them to come up with a common yardstick to measure the performance of these funds.

Volatile Nature

If your target-date fund is maturing during your retirement year (say 2040), who knows if it’ll be a bullish market and you’ll gain better in that year. It may also happen that it can be a bearish market and you may not get returns as expected. During the financial crisis of 2007-08, it was found that target-date funds weren’t conservatively positioned. This led to a lot of volatility.

No Frequent Rebalance

it’s often said that target funds may rebalance your portfolio every 4 –. 5 years, i.e. not too often. You may lose out on the benefits of capitalizing on the target funds when the market conditions are right.

Outliving Savings

If your portfolio is too conservative right from the beginning of your career, you may not get higher returns on the same because you’re taking lower risks. This means that you may not get good returns on your investment. This means that you may run the risk of outliving your savings.

Some Tips

Buy your target fund from a broker instead of your employer sponsored 401(k) plan. This will allow you to find a fund that’ll suit your needs and your risk tolerance limit. Remember, looking at the performance of a target-date fund may not be the right yardstick to measure its effectiveness. At the time of retirement, you’d rather prefer to go for a target fund that provides stability, rather than aggressive performance. Study the portfolio that a company offers to the current retirees. This will give you an idea as to how your portfolio will look. Go for a target fund that provides the right asset allocation rather than opting for one which undertakes maximum risk to give better returns. Try to choose a company that offers fewer assets that are volatile. Search for companies that offer low fees and have index funds. Go for a fund that’ll match with your risk tolerance. You must know the glide path”. Of your target-date funds.

Try to avoid a fund that’s too conservative in its approach and decides to invest a major portion of your money in bonds as this can be a risky bet. Dont forget to review the growth of your funds on a periodic basis.