Problems with Diversification Diversification Disadvantages

Post on: 15 Август, 2015 No Comment

The Case for a Concentrated Investment Portfolio

I’ll come straight out and say it — I have a lot of problems with diversification.

I’m also a big believer in having a concentrated portfolio, providing you’ve done your homework and chosen your investments with care.

The Drawbacks of Diversification

Gasp! Problems with diversification? A concentrated portfolio? Everyone knows you MUST diversify! How can you say such reckless and irresponsible things?

I’ve said a lot already elsewhere on this site about why I don’t like diversification, at least how diversification is often promoted by self-serving industries that provide products that may break up your investments into very small pieces but which don’t actually provide much protection or improve your results.

But to summarize the problems with diversification:

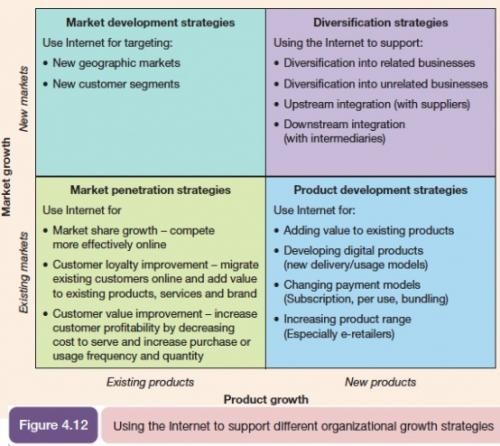

- Diversification often leads to diluted and mediocre investing. not quality investing — How is it smarter and safer to own little pieces of everything (or nearly everything) than it is to own fewer pieces of high quality, durable, consistently profitable, and consistently growing businesses?

- Diversification leads to inferior investment vehicles — most mutual fund managers underperform the stock market as a whole because of many structural disadvantages, including short term performance pressure, a trading vs. investing mindset, over diversification, and being subjected to the whims and emotions of undisciplined retail investors either piling more money in at market tops or pulling it all out at market bottoms.

- Diversification doesn’t actually provide that much protection — If you own 1 company and it blows up, you’re screwed. If you own 100 companies and 1 blows up, you barely even notice. But what happens when the entire economy blows up and you own 10 high quality companies and 90 mediocre ones? The 10 high quality businesses will eventually come back. But how sure can you be about the other 90?

- Diversification leads to low investing self esteem — when someone like John Bogle convinces you that individual stock picking is too risky and that the only sane way to invest is via index funds which he helped package and sell, the subtext of the message here is that you’re too stupid to invest on your own.

There are intelligent ways to diversify, even when it comes to option trading. but for many people, the number one rule of investing is to always be diversified.

For me, the number one rule of investing is to invest in individual high quality businesses (and number two is to pay as little for those investments as possible, either through rigorous value investing patience, or through strategic option strategies that produce value investing like results ).

The Advantages of a Concentrated Portfolio

A concentrated portfolio will mean different things to different people. I’m not saying you should limit yourself to owning just three or four stocks. But, in my experience, most self-directed long term investors max out at around 20 stocks, which I believe provides more than enough diversification if you choose intelligently.

To me, a concentrated portfolio, makes a lot of sense, as long as I take responsibility for the selection and timing of my investments:

- I know what I own — Selecting my own stocks means I can intelligently evaluate my investments at any time. If you own a mutual fund, you have little idea of what companies you’re actually invested in because a fund’s top holdings aren’t officially released until the following quarter and by that time, the fund manager may have already churned those holding for something else.

- I can focus on the long term — The mutual fund industry constantly churns stocks, and index investing focuses too heavily on the metric of market capitalization (share price) rather than the profound effects of compounding your income over time.

- I can focus on quality — I keep coming back to this. To me it’s insane to think you’re safer or better off by embracing a larger basket of mediocrity than a smaller basket of excellence. That’s like telling an entrepreneur that he or she shouldn’t put all their energies into a single business but rather that they would be better off starting up a large number of half-assed ventures.

Conventional Wisdom and Diversification

Beware conventional wisdom of all stripes — it’s usually a lazy, superficial, shorthand version of the real thing that, in my opinion, is almost always more wrong than right.

And when it comes to the stock market diversification mantra, you have to ask yourself who benefits from the need for diversification?

Just as fund managers and financial planners are compensated by how much money they manage rather than how well they manage it (as I pointed out in When Should You Sell Your Dividend Paying Stocks? ), it’s no surprise that those who clamor the loudest about the supposed advantages of diversification are those with products that provide broad diversification.

I will say this, however. I do believe there is a role for diversification and passive investing and — dare I say it? — perhaps even ETFs and mutual funds. But that role should be reserved for those who have zero interest or aptitude for managing their own investments.

Let’s face it — we all have areas in our life or activities where we are totally incompetent or that bore us to tears. Mine is hanging wallpaper or going with someone to shop for fabric. If you feel the same way about investing, then yes, outsourcing that to a trusted third party is the way to go.

But don’t expect above average results. And don’t expect the rest of us with genuine interest and commitment to tag along.