Private equity

Post on: 16 Март, 2015 No Comment

At HSBC we have a particular approach to private equity investing. We focus on strategies in which we have the highest conviction, selecting what we consider to be the ‘best-in-class’ managers, who in our opinion should be able to reward you for the illiquidity associated with private equity.

HSBCs private equity investment philosophy

Private equity investing should always deliver an illiquidity premium when compared against public equity market investing. Our investment-led process has been refined to focus on high-conviction private equity strategies with risk-return profiles that have rewarded illiquidity in the past, and where we believe that a supply and demand imbalance between the need for investment and available capital will persist in the future.

To deliver an illiquidity premium we are focused on what we believe to be best-in-class investments, giving you choice on how to access Private Equity and how involved you want to be in the investment decisions.

Key strengths in private equity investing

Private equity strategy selection

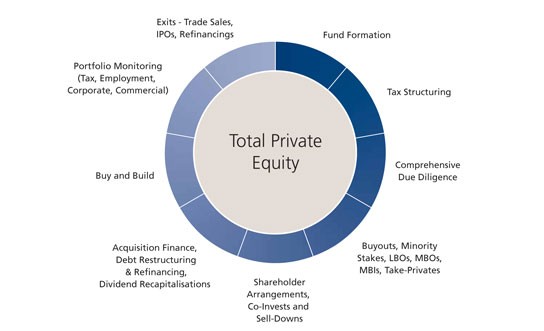

We focus on investing in strategies where there is a genuine need for private capital and which we believe can compensate for the illiquidity associated with private equity investing. We have the depth of knowledge and are also able to dedicate significant time into screening the manager universe in these four areas to ensure access to best-in-class managers globally.

Manager sourcing and selection

Manager selection skills are so important in private equity, given the gulf in performance between the best and worst funds. Our teams manager selection process is founded on a wealth of experience, strong industry knowledge and a comprehensive due diligence process. This process, combined with our sector expertise, facilitates the identification and selection of what we consider to be the best and most appropriate managers.

Exclusive investments

Our teams expertise in their core areas of conviction often means we are able to gain access to exclusive, institutional-quality opportunities with leading private equity groups. We are then able to deliver these opportunities to our clients in a variety of ways according to their needs and desire for involvement.

HSBCs private equity client solutions

We always focus on ensuring we deliver the most appropriate investment, in the most appropriate manner. We understand that different clients want different levels of involvement; therefore we offer a range of solutions from standalone funds to customised mandates, as well as access to proprietary secondary deals and direct co-investments for our family office and institutional clients.

Alternative Investments

%img src=/

/media/images/pbpws10/content/infographic/retina_altinv_diagram_defaultgrey.png?h=183&w=564 /% %img src=/

/media/images/pbpws10/content/infographic/retina_altinv_diagram_1yellow.png?h=183&w=564 /% %img src=/

/media/images/pbpws10/content/infographic/retina_altinv_diagram_2aqua.png?h=183&w=564 /% %img src=/

/media/images/pbpws10/content/infographic/retina_altinv_diagram_3green.png?h=183&w=564 /%

Funds

Club Deals & Co-investments