Preqin Spotlights Hedge Fund Trends in New Report

Post on: 31 Март, 2015 No Comment

Research firm Preqin conducted a study of hedge fund managers and investors in late 2014, surveying their opinions of 2014 and assessing their outlooks for 2015. Sixty-three percent of hedge fund managers said they have a positive outlook on their industry, and 65% of investors said hedge funds met or exceeded their expectations in 2014 – despite hedge funds’ rather anemic gains for the year. The survey’s results are analyzed in great detail by Preqin’s Selina Sy in February 2015 Hedge Fund Spotlight . which also contains a great deal of additional content. The survey’s results are summarized below.

2014 Performance

The Passage to India Opportunity Fund posted gains of 225.21% in 2014, making it by far the top-performing hedge fund of the year. Two other funds – the venBio Select Fund and the Quan Technology Fund – are also highlighted by Ms. Sy as top performers, with respective gains of 73.54% and 70.96% for the year. Unfortunately, these top three performers are largely exceptions to what was generally a lackluster year for hedge funds.

Hedge fund performance, as measured by the Preqin All-Strategies Hedge Fund benchmark, saw its worst annual return since 2011, with gains of just 3.78%. Twenty-seven percent of hedge funds posted losses for the year, and the benchmark as a whole lost ground in six of twelve months. Only 18% of hedge funds in 2014 met or exceeded the benchmark’s 2013 returns of 12.25%.

2015 Allocations

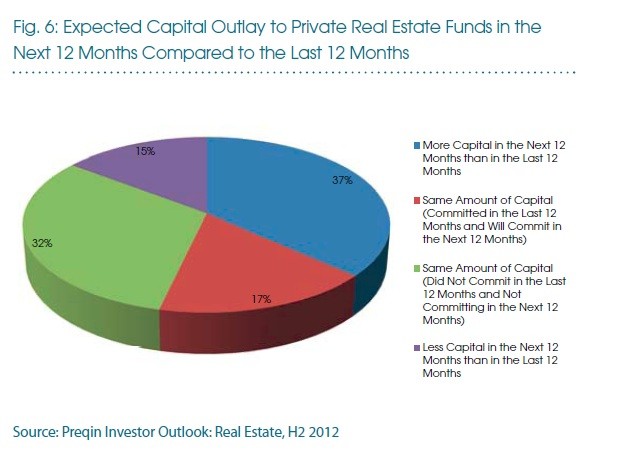

Despite lackluster performance in 2014, 65% of investors surveyed by Preqin said hedge funds met or exceeded their expectations for the year. This is because hedge funds are intended to “hedge” other investments by providing low correlation to traditional asset classes, and in this regard, hedge funds did their job in 2014. As a result, 26% of institutional investors said they planned to increase their hedge fund allocations in 2015, and 40% of investment consultants said they’ll recommend their clients increase their allocations. Details on allocations in 2015 are below:

2015 Projections

When asked about their outlook for 2015, hedge fund managers predicted that macro strategies will be the best performers of the year, with equity and event-driven strategies ranking just behind. Fund managers predicted credit strategies will be the worst performers.

Among investors, long short/equity strategies were the most sought after, with 49% of respondents citing them as their top choice.

Investors’ Concerns

Sixty-eight percent of investors said they’d like to see improvements in management fees, and 29% said they want more transparency. These demands are being stimulated by the availability of liquid alternative mutual funds and ETFs, both of which have lower fees and greater transparency than typical hedge funds, while pursuing similar or even identical strategies.

Managers’ Concerns

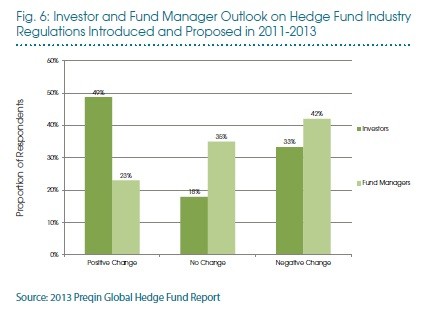

Managers’ concerns about regulation are growing, with 58% of fund managers and consultants saying regulation will cause negative consequences in 2015. In 2014, only 50% of managers and consultants thought regulation would have a negative impact; and in 2013, that number was just 42%. Thus, over the past two years, anti-regulatory sentiment has soared by 38%. Strangely, the proportion of managers and consultants that believe regulation will have a positive impact has also grown.

Conclusion

Preqin’s February 2015 Hedge Fund Spotlight contains a great deal of additional content. Along with the survey results, the newsletter also features an examination of the Preqin Investor Network’s activities, a list of the latest hedge fund benchmarks, articles about activist hedge funds and private wealth, a schedule of upcoming hedge fund conference around the world, and a look at notable fund managers and investors that have entered the hedge fund space over the past year.