Portfolio Asset Allocation

Post on: 24 Июнь, 2015 No Comment

Note: Step 7 is one of the most complicated steps in the Portfolio Design process. It is not a quick read, and it will involve you doing some math. There is no black and white answer to this step as it is different for everyone. The asset allocation one person decides will be unique to that persons own financial circumstances. So be prepared to do some work in this step!

Note: In the section Single Asset vs Multi Asset Portfolios. we have provided a more detailed and specific discussion about finding an asset allocation (Bonds, Common Shares, Domestic and International) that strikes the optimal balance between minimizing a portfolio’s volatility and maximizing a portfolio’s rate of return. The support for this discussion is drawn from Russell Investments investment data. Russell Investments has been tracking investment portfolios with differing asset allocations for decades and the company shares its data with investors annually.

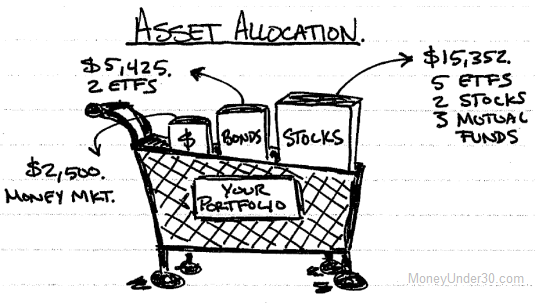

Generally, in the investment world, asset allocation is a phrase used to describe the amount of money invested in different investments or asset categories. And generally it is recommended that when it comes to asset allocation. dont put all your eggs in one basket. So before we actually begin Step 7 lets first describe what asset allocation is.

When discussing asset allocation, there are actually two levels of allocation to consider, as outlined below:

- between investment types

- between account types

Asset allocation between investment types

Let’s say you have $100,000 in savings and these moneys are invested as follows: $50,000 invested in bonds, $25,000 invested in mutual funds, and $25,000 held as a cash balance. How you divided your money is called your asset allocation .

Note: A persons asset allocation can be expressed in dollar amounts or in percentage terms. If the above example asset allocation were expressed in percentage terms, then your $100,000 in savings would have an asset allocation of 50% invested in bonds, 25% invested in mutual funds, and 25% invested as cash.

Three basic investment types

Individual investments are typically assigned to one of three basic asset categories: Cash/Cash Equivalents, Fixed Income. and Growth. In general, for an individual investment to be assigned to one of the three basic asset categories, each investment must possess certain investment characteristics and features, for example:

- Cash or Cash Equivalents: For an investment to be classified as Cash or as Cash Equivalen t, the savings are held as a cash balance in an account or it provides a high level of safety for the capital amount, pays a reasonable income while invested, and it can be sold easily at any time or the investment has a very short-term maturity. At maturity, the issuer guarantees to return the investors capital upon the maturity date.

- Fixed Income: For an investment to be categorized as Fixed Income. the investment should have a set maturity where the investors invested capital will be returned to them and the investments should have a set, regular annual income. The investments market value is typically influenced by the credit rating of the issuer, the current interest rate environment and the investment’s liquidity. Fixed Income investments do benefit from the issuers profitability or investors enthusiasm for the issuers industry or sector. In some cases, as with preferred shares, the investment may be missing a maturity date, but its individual features and the markets valuation of the investment is closer aligned to a Fixed Income investment than it is to a Growth or Cash Equivalent investment. As a result, it is classified as Fixed Income for asset allocation purposes.

- Growth: For an investment to be categorized as Growth. the investment will not have a maturity date where the investors capital is returned to them. There is no issuer guarantees on the monies invested. The market value of the investment will fluctuate dependent upon the issuers profitability, the economic and investment environment and the popularity of the issuers industry with investors. The investment will not pay an enforceable income payment to the investor. The investment may or may not pay an annual income, but the payment is at the discretion of the issuer and, as such, the investments annual income payments can be increased or decreased at the issuers discretion.

Note: The most common asset or investment categories are listed and grouped below: