Portfolio Analysis Tools

Post on: 6 Май, 2015 No Comment

Socially Responsible Investing and

Modern Portfolio Theory

You need to take two passes over your portfolio. First, a socially responsible investing (SRI) portfolio analysis, and second, a modern portfolio theory (MPT) portfolio analysis.

To find out if your trustee is doing a good job maintaining your assets, you need to ask, at a minimum:

- Is your trustee (or are you) using Modern Portfolio Theory? This means independent asset classes that respond differently to potential future scenarios.

- Is your portfolio well diversified across sectors, and within sectors?

- Is your portfolio appropriately globally distributed. Including across the spectrum of established markets, emerging markets, and frontier markets.

- How socially responsible are your investments?

Socially Responsible Portfolio Analysis

This is easy. Ask the following: if each company in your portfolio was unsupervised for 50 years, and could do anything they wanted, what would the world be like? Would you want your grandchildren eating (only) that company’s food, using (all of) their products, living next door to their factories, and having a home built on top of a dump filled with their used products? Would you want to work for that company for 30 years in any country they sell, manufacture or outsource? i.e. would you work for 30 years on the assembly line at Foxconn in China, manufacturing Apple’s Iphones? (Read the New York Times stories and the This American Life podcasts (and subsequent controversy and retraction) on Apple and Foxconn. At the end of the This American Life retraction podcast there is an exchange between the NYT reporter and Ira Glass, that asks important ethical questions. This would be a great subject high school curriculum on journalism, ethics, and the future.

Big Bank’s Portfolio Analysis

Banks are taking out ads offering to analyze your portfolio. That is ironic, given the recent spate of lawsuits against the big players for lack of diversification (see court references below). But you can do this analysis yourself, it is not rocket science. You just have to follow modern portfolio theory (MPT). MPT is the result of smart, conscientious investment theorists following the great depression. They wanted to figure out how to not let that happen again.

Basically you need a low-to-no-leverage portfolio (no borrowing to buy; that’s what got the investment banks in trouble in the 2008 collapse). And you need to have 4 or 5 asset classes (not including cash), that are as completely independent as possible—two asset classes, stocks and bands, are not enough. Independent means uncorrelated, so if stocks go down, government bonds won’t. The stability of bonds is only iron-clad true if you hold actual bonds and not mutual funds of bonds. This is not so convenient for banks—but you should insist on it; why increase your risk just so that the bank’s investment manager has more time to take longer lunches? And this assumes no sovereign default, which in some countries, including the US is now a real possibility.

Examples of potentially independent asset classes are: stocks, bonds, cash, tangible or real assets (i.e. oil and gas pipelines, forests, agricultural land, gold, artwork, antiques, etc), annuities, so called market neutral hedge funds, private equity, real estate. Then you can diversify within each asset class (i.e. not a single homogenous bond fund, for example not 50% of your portfolio in a fund of Hawaii Muni bonds). Not all assets are appropriate for trusts (antiques are probably not liquid enough for a small portfolio). Look at how Yale manages its portfolio to see cutting-edge, well-diversified investments. Although one should also examine how socially responsible they are.

The cutting edge of Modern Portfolio Theory (MPT)

The most recent approach in MPT portfolio analysis is to ask how would your portfolio behave in all potential future scenarios: inflation, deflation, long-term stagflation, specific asset depreciation, collapse of the dollar, bonds going down, bonds going up, US stocks down, Asian stocks down, natural disasters (insurance companies collapsing), what if the US market has seen its prime and another country or set of countries will now take off and the US will never recover, collapse of the housing market (it could never happen, right?), housing prices continuing to go up so no one can afford to buy a house, oil goes up, oil becomes irrelevant (new energy technology invented), and so on. In this light, a portfolio is like machine with many interacting parts. You can liken it to a car with independent suspension—all these parts fit together but allow an isolated absorption and response to bumps and potholes.

But portfolio analysis is not enough, a portfolio does need to be watched. Read Too Big to Fail. about the leaders of the banking and investment communities during the 2008 bank and stock market collapse. You won’t hear any of the leaders concerned about the banks’ clients’ trust portfolios. My family had two trusts (with two of the world’s leading banks) during that time and nothing was done to protect the trusts. But the leaders of the banks, according to the book, really understood the seriousness of what was happening (just read the opening pages), and went to extreme lengths to protect their bank’s well being and their own careers.

Choose your trustees and investment managers carefully.

Ask yourself if your trust is making as much as the bank. Ask yourself if you are getting the kind of bonuses the bank’s leaders are. Ask yourself if this is an industry you want to support (see the podcasts on the Guerrilla Guide to Trust Planning Page ). Ask the bank if it knows anything about socially responsible investing and will consider it in your trust (JPMorgan Chase will not; BNP Paribas/First Hawaiian Bank kept a huge percentage of a trust in tobacco at a time when responsible people were divesting from tobacco). Ask questions.

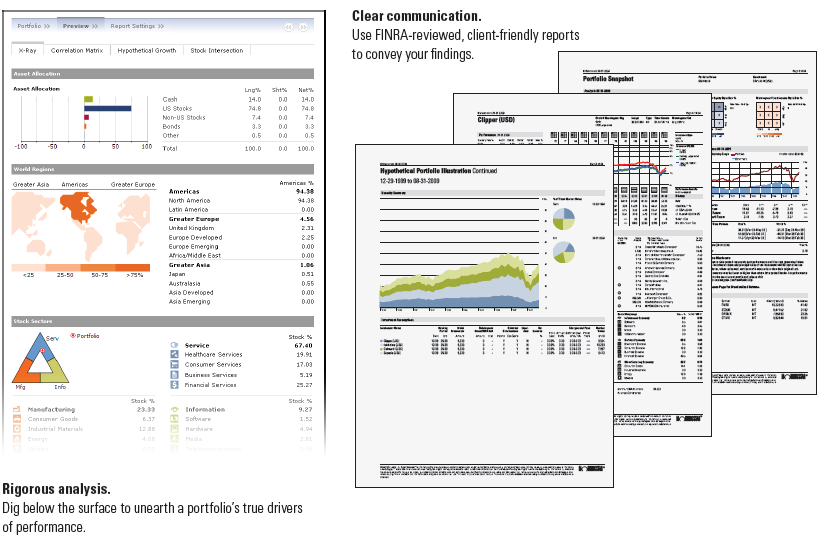

If you would like, I can take a look at your portfolio and give you a quick reality check. I cannot advise on investments, but I can try to help you understand the need for diversification and why socially responsible investments are so important. I am especially eager to educate people on the need to find life-supporting investments. Your decisions on how you use your wealth really is creating the future of the next generation. If you want a more thorough analysis of your portfolio, there are plenty of companies (including probably your brokerage house) that will use their portfolio analysis software programs, taking into account your goals, your age, etc.

Portfolio Analysis Tools and Resources