Play Market Games Have Fun Learning How to Trade Stock

Post on: 5 Май, 2015 No Comment

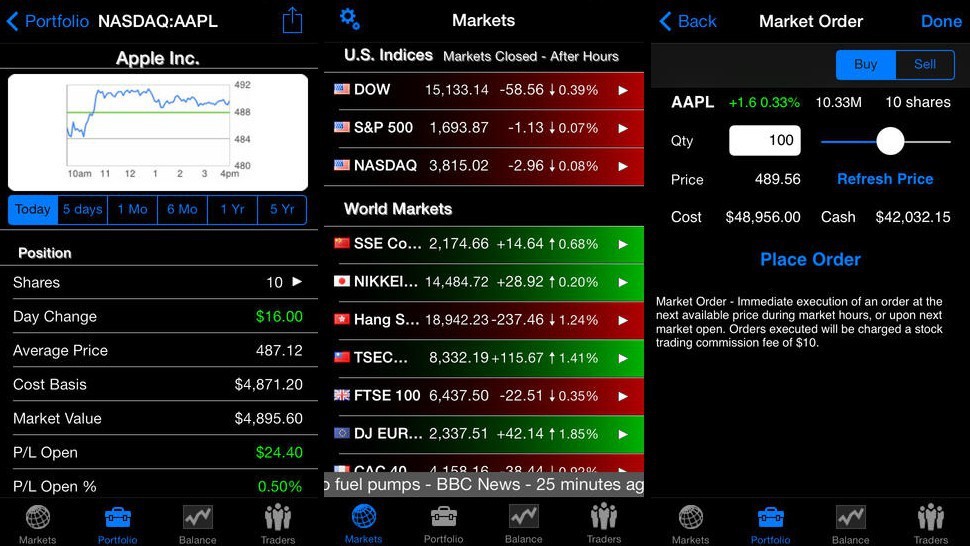

How well do you know the stock market? Test your stock market IQ for free today!

Once you know the basics, head over to our partner, WallStreetSurvivor. and play stock games. You could win iPads, Amazon gift cards and cash prizes!

What is the Dow Jones or the DJIA?

The Dow Jones Industrial Average (often referred to as the Dow) is an averaged number representing the values of 30 U.S. blue-chip stocks. The DJIA is the most well-known market indicator in the world and was created in 1896 by Dow Jones & Company, which is actually a publicly-traded company (DJ) on the New York Stock Exchange (NYSE). They produce many important business publications including The Wall Street Journal, Barrons, and several stock indexes.

What is the Nasdaq?

The NASDAQ refers to two different things. First is the largest electronic stock market in the U.S. — the National Association of Securities Dealers Automated Quotation System. Second is the popular stock index called the NASDAQ Composite Index. It measures all domestic and international stocks listed on The NASDAQ, which number over 3,000. It was started in 1971 and is now one of the most important stock indexes.

What is the Big Board?

The Big Board is another name for the New York Stock Exchange.

What is the S&P 500?

The S&P 500 is a stock index published by Standard & Poors. It measures 500 U.S. stocks that are supposed to be representative of the overall stock market. It was created in 1957.

What determines a stocks price?

There are many factors that play into a stocks price. Overall, though, the price is determined by investors perceptions of what the stock is worth.

What is insider trading?

Insider trading occurs (1) when an insider to a company, such as an officer or someone who owns a large percentage of the company, trades the companys stock. This is legal and acceptable, as long as that person is not trading based upon non-public company information.

What penalties can you risk taking on?

How much money do I need to get started?

What is the Bid price? What is the Ask price?

You are not guaranteed to get these prices because the market fluctuates constantly and prices change quickly. Also, if you buy (or sell) shares of a low-volume stock, you run the risk of affecting the price due to excess demand (or supply).

Will somebody always buy my stocks when I sell them?

What is day trading?

Day trading is the process of buying and selling the same stock during one day. Professional day traders commonly trade many times per day. Learn More .

When is the market open?

U.S. markets are usually open 9:30am-4:00pm Eastern time, except on holidays.

How much return can I expect?

Historically, the market has advanced roughly 10% per year. Of course this rate fluctuates constantly. For instance, it may grow up 30% one year, then fall 20% the next year.

How do I know which stocks to buy?

That is a great question. With over 8,000 different stocks to choose from, it can be overwhelming to pick some possible winners.

Many people simply buy stocks that are recommended to them by their brokerages, their friends, or experts from TV, magazines, and newspapers.

Some people buy stocks from companies they think are big, stable, and successful. This may seem like a safe route, but there are no guarantees.

Other people buy stocks based on rumors that the price will rise/fall sharply soon.

Many experienced traders watch financial news on TV, read the relevant newspaper stories, and investigate companies that are in the news. They also use technical indicators, which are numbers or graphs which may help indicate whether a stock will rise, fall, or stay the same.

A few people will randomly pick stock symbols by throwing a dart at a newspaper, which is a risky game to play in multiple ways.

It’s a good idea to practice buying and selling on a play market first though.

What is a mutual fund?

A mutual fund is a fund created by an investment company which combines money from many investors and invests it in a group of stocks, bonds, or other investment vehicles. The investment company actively manages the portfolio to meet a desired goal, such as long-term growth or steady dividends. One major benefit is diversification. Many mutual funds also charge a fee when someone buys or sells shares.

When someone buys shares of a mutual fund, they are not directly buying shares of the underlying companies. Instead, they are entitled to a proportional amount of the funds profits, which are usually distributed two or three times per year.

What is a mutual funds N.A.V.?

The Net Asset Value (NAV) is the current price of a mutual fund. which is calculated at the end of each business day. It is the total value of the funds assets minus its liabilities and divided by the total number of shares outstanding. It is similar to a stocks closing price for the day.

What is a 401(k) plan?

A 401(k) is a type of personal pension plan that is offered by many employers. Employees contribute part of their salary (before taxes) and employers commonly match part of the contribution. The bulk of the plan is usually invested in mutual funds .