Personal Capital Review The Good The Bad The Ugly

Post on: 28 Июнь, 2015 No Comment

Summary:

I write this Personal Capital review as a user. Ive used the service for roughly 2 years now and feel like its time to share my personal experience.

Personal Capital Background

More than 700,000 users are now using Personal Capital, and the company is now tracking more than $125 billion in assets on the online platform. Personal Capital is a Registered Investment Adviser (RIA ) with the SEC, and manages more than $1 Billion dollars in assets under management.

Bill Harris is the founder of Personal Capital. Harris is the former CEO of Intuit and PayPal. Bill and company raised $28 million in venture capital for Personal Capital at launch. Most employees have a background in finance and many hold the CFP ® (Certified Financial Planner) designation.

Here is a brief introduction by the CEO:

Personal Capital is best described as an account aggregator.” It exists to help you track and understand your financial accounts. After connecting your various accounts, including your mortgage, credit cards, bank accounts, investment accounts, and whatever else you may have, the free service will explain your situation and offer basic investment guidance.

It is similar to Mints online budgeting service, but much more comprehensive. If you have any investment information, Personal Capital picks up where Mint leaves off. It still allows users to track basic budgeting and spending, while providing substantially better functionality for tracking investments and introducing more advanced financial planning concepts, such as asset allocation, income tax planning, and tax loss harvesting.

How Personal Capital Works

After opening a free account, you must link your financial accounts to the online interface. This involves authorizing each account that you have from within Personal Capital. I found this to be extremely easy and efficient on the desktop version of the program. You simply click a small plus arrow, specify the type of account, and fill in the online credentials.

After linking accounts with Personal Capital . they remain linked until you unlink them or change any of the account information (change password, login info, etc.). Each day, your account information is automatically updated.

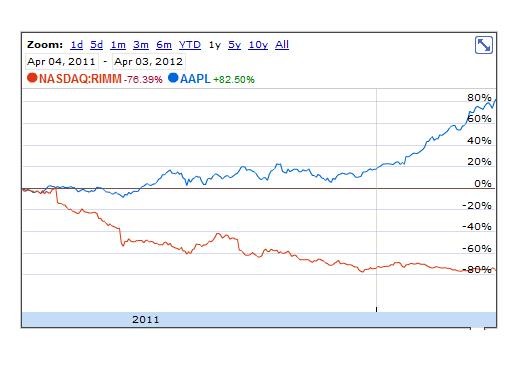

The site then aggregates all the information into a bright and colorful series of charts and graphs to help you make sense of your savings and investments, and to help you gauge your position against market performance.

The generated graphs include:

- Net Worth

- Account Balances

- Income Reports

- Spending Reports

- Asset Allocation

- Investment Returns

- Projected Investment Fees

Clicking on any of these allows you to zoom in for more information. For example, if you click income, you can see all of your sources of income. If you click spending, you can see what categories were involved, and where you spent the money. Its all very useful and intuitive.

Tracking Spending and Saving

Personal Capital offers a very good online interface to track all of your spending and account balances, and they continue to improve ease of use. I actually prefer the Personal Capital interface to Mints online interface.

You can track your spending down to the penny. Every credit card transaction. Every checking account. Every automated payment. They can all be viewed in your account dashboard. You can also get the details you need to analyze each purchase. You can categorize spending by date, merchant, and category.

Personal Capital also allows you to stay on track to pay bills and meet your budget. You can view the last payment made and past payments. You’ll also see upcoming bills that are due, the minimum payment due, and the total amount outstanding.

Much like the savings feature, you can also keep track of all income sources on your Personal Capital Dashboard. These different features all blend seamlessly for an excellent user experience.

Investment Checkup

Another thing worth mentioning is the Investment Checkup feature. You input a basic risk profile, answer when you want to retire, what income sources you predict, and a few other basic questions. It then spits out a pretty graph showing their recommended portfolio:

They then explain the historical returns and the risks associated with such a portfolio. You can compare it to your current account holdings and see the differences.

In addition, Personal capital will list the fees that you currently pay on your investments, and compare your returns to appropriate benchmarks. This is a nice touch that encourages investors to be aware of their portfolio and annual fees.

How They Make Money

The service Ive just talked about is completely free, but they have an additional optional asset management service.

Personal Capital is a registered financial advisor providing the free service to attract more affluent site users – particularly those with investable assets of at least $100,000. If a user has $100,000 or more, Personal Capital offers professional financial advice and the ability to work with a (real) financial advisor (who is often well trained and credentialed). Personal Capital gets its money by taking a percentage of the assets under management, or AUM.

The annual fees for their investment services are as follows:

- $0 – $1,000,000: 0.89%

- For clients that invest $1 Million or more:

- First $3 Million: 0.79%

- Next $2 Million: 0.69%

- Next $5 Million: 0.59%

- Over $10 Million: 0.49%

Please remember that these fees dont include any underlying investment expenses, such as ETF expenses. If Personal Capital invests all or part of your money in passive ETFs, you will pay another 0.1-0.2% on top of their investment management fees for a total fee amount.

Again, there is no obligation to pay for this service, and I choose not to do so. The reason is quite simple there are much cheaper alternatives on the market.

For example, Wealth Management firm Betterment will do it for 0.15% annually if you have $100,000 or more to invest. That includes advanced features like tax-loss harvesting. (Also see my review of Wealthfront)

Personal Capital Security

The security is very good. Personal Capital requires you to register each computer you use. They will send you either an E-mail or call your cell phone to register each device. Once your computer or smart phone is registered, you will not need to go through this process again.

Like most other reputable online sites, the site is encrypted and requires an account image and password as well. These are all great features.

There is another layer of security that is used when linking financial accounts to your Personal Capital account. You must sign in and verify the original online account in addition to your Personal Capital login. All of these features combine to leave you protected.

The Good

- Technology Personal Capital can be used on the computer, tablet, or smart phone. They have apps available and all integrate seamlessly. This makes it easy to check or track accounts on the go. The interface is very intuitive

- Ease of Use — Getting started and syncing accounts is incredibly easy with Personal Capital. Ive had no problems at all with functionality during my participation. In addition, the graphs and charts are very easy to read and understand.

- Comprehensive Service As I mentioned earlier in the Personal Capital review, this service allows you to bring together all of your account into one attractive online interface. This allows the tracking of spending and saving. It also allows investors to compare their investment holdings and better understand their overall asset allocation.

The Bad

- Investment Management Fees Their investment management service isnt horribly priced, but its a bit too high for me. Their website states that their stock portfolios have outperformed a basic Vanguard portfolio. It thats the case, good for them, but Id like to know what they are doing. For myself, Ill continue investing with Vanguard and Betterment . Remember that this service is optional, and is the equivalent of hiring a financial advisor or wealth management firm.

The Ugly

- Since ironing out the early bugs, there really isnt anything ugly remaining about the service. Its exceptional for a free tool.