Peertopeer lending Banking without banks; By offering both borrowers and lenders a better deal

Post on: 16 Март, 2015 No Comment

Peer-to-peer lending: Banking without banks; By offering both borrowers and lenders a better deal, websites that put the two together are challenging retail banks

SAVERS have never had a worse deal but for most borrowers, credit is scarce and costly. That seeming paradox attracts new businesses free of the bad balance sheets, high costs and dreadful reputations which burden most conventional banks.

Foremost among the newcomers are peer-to-peer (P2P) lending platforms, which match borrowers and lenders directly, usually via online auctions. The loans issued often comprise many tiny slivers from different lenders. Some P2P platforms slice, dice and package the loans; others allow lenders to pick them. Either way, the result is a strikingly better deal for both sides. Zopa, a British P2P platform, offers 4.9% to lenders (most bank accounts pay nothing) and typically charges 5.6% on a personal loan (which is competitive with the rates most banks charge).

Elsewhere, returns (and risks) are higher. IsePankur, which lends to more than 60,000 people in four euro-zone countries, pays its lenders (who include your correspondent) a stonking 21.45% average net return (after a 3% default rate). Its typical borrowers do not flinch at rates of up to 28%: they are refinancing far costlier credit-card debt and doorstep loans.

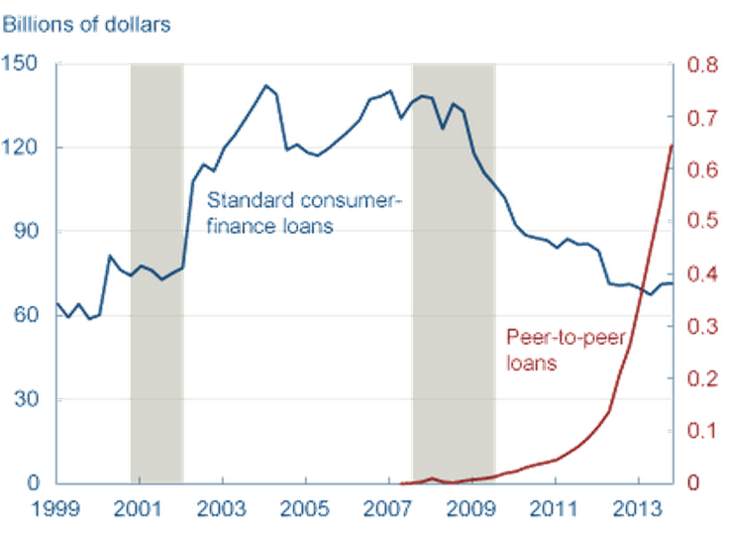

Peer-to-peer lending is growing fast in many countries. In Britain, loan volumes are doubling every six months. They have just passed the £1 billion mark ($1.7 billion), though this is tiny against the country’s £1.2 trillion in retail deposits. In America, the two largest P2P lenders, Lending Club and Prosper, have 98% of the market. They issued $2.4 billion in loans in 2013, up from $871m in 2012. The minnows are doing even better, though they are growing from a much lower base.

Neil Bindoff of PwC, a professional-services firm, speaks of a “perfect storm” supporting P2P’s growth. Interest rates are close to zero, the public is fed up with banks, costs are low (one third of a typical bank’s, according to Renaud Laplanche of Lending Club), and e-commerce is becoming part of daily life. People use the internet for peer-to-peer telephony (Skype) and shopping (eBay), so why not loans?

Awareness is still low—a survey by pwc found only 15% of Britons claimed to have heard of the big P2P firms such as Zopa, Funding Circle and RateSetter; 98% had heard of the main banks. Another hurdle in Britain is that P2P is not fully regulated; that will change on April 1st. The Financial Conduct Authority will issue the new rules imminently. In America, people saving for retirement can apply tax breaks to their loans, and offset their losses against profits. Britain’s P2P industry is awaiting a decision to extend tax-free savings schemes to its lenders.

Regulation to the rescue

Regulation should help forestall a big worry: that an ill-run platform might collapse, taking investors’ money with it. At a conference organised by the P2P Finance Association, a trade body, this week, executives were worried about the risks of a “Bitcoin-style bust” that could rattle confidence in the nascent industry. New rules are likely to insist that P2P businesses ringfence unlent funds gathered from savers and arrange for third parties to manage outstanding loans if they cease trading.

Other big questions abound. One is insurance. Funds placed with P2P lenders are not covered by the state-backed guarantees that protect retail deposits in banks. Some platforms offer something of a substitute. Zopa and most other British companies have started “provision funds”, which aim (but do not promise) to make good on loans that sour. These smooth the risk for lenders, but blunt the original P2P concept. So too does insurance: Ron Suber of Prosper, America’s second-biggest lender, says “deep actuarial conversations” are going on with outsiders who would like to help lenders provide for the risk that their borrower defaults, dies, or loses his job. Purists fear such arrangements could recreate the moral hazard that has plagued conventional banking.

The boom in cross-border P2P raises tricky legal questions. The European Commission has yet to get to grips with the industry. National rules often determine how credit is issued and debts are collected. But they offer little help when the money comes from hundreds of lenders in dozens of countries. Yield-chasing foreigners, private and institutional, are investing heavily in the American market.

Only a third of the money coming to Lending Club is now from retail investors: the rest (the fastest-growing slice) comes from rich people and institutions. Should such big investors get a better deal—such as getting their pick of the best loans on offer? In Britain, Giles Andrews of Zopa regards the idea as anathema: all savers should be treated equally. Some others think big lenders will eventually dominate P2P.

P2P also ends the dangerous mismatch between short-term deposits and long-term loans inherent in conventional banking—but generally by locking lenders in for the loan’s duration. A secondary market in P2P loans is developing fast. This allows investors to get their money back if they need it, usually by selling the loans at a discount. But rules vary: some platforms will buy back the loans; others just hold an auction.

P2P is not complicated: success largely depends on marketing oomph, the quality of the algorithms used to screen borrowers and ease of use (P2P platforms are scrambling to develop apps for smartphones and tablets). P2P may attract big outsiders, such as banks, or internet companies which already have lots of data about their customers and (like Facebook) are good at connecting them. Google last year led a $125m investment in Lending Club, valuing it at $1.55 billion. It might well want more.