Paying Fees On Your Investments

Post on: 26 Июнь, 2015 No Comment

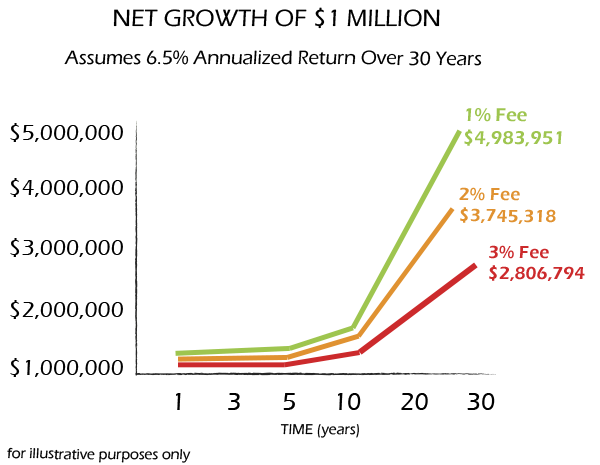

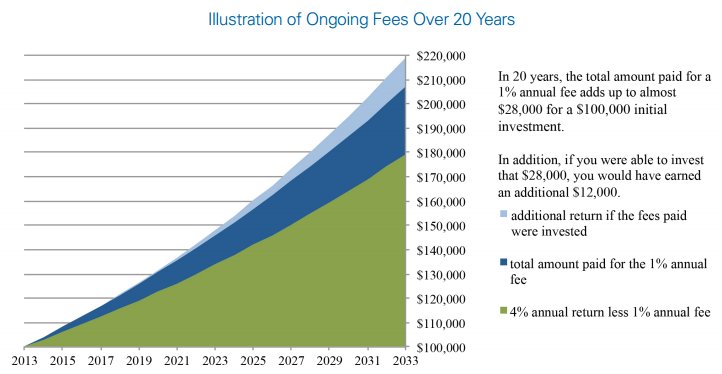

Most recently, I wrote an article highlighting some of my research showing that mutual fund fees do matter in investing. Mutual fund fees are only one type of fee that impact investors returns. In this article I would like to highlight some of the different types of fees that every investor should be aware of.

Mutual Fund Fees

When buying mutual funds, there are three key types of fees to be aware of:

1. Management Expense Ratios (MER) – Lot has been written on management expense ratios. They are one of the primary fees to be aware of when investing in a mutual fund. The Management Expense Ratio measures all of the fees and expenses associated with the fund. One of the expenses wrapped into the MER is the ‘trailer fee’ that goes to the financial advisor or broker as part of their ingoing compensation.

2. Front End Load In Canada, front-end loads are completely negotiable. In many cases you can pay as little as nothing to as high as 5%. This fee comes right off your investment. For example, if you are investing $10,000 and you pay a front-end fee of 2%, you will pay $200 for the purchase and $9800 will get invested. Paying a front-end fee means you have less money at work.

3. Back End Load or Deferred Sales Charge A back end load is different in that you do not have to pay anything up front. In the same example, you will have $10,000 invested and put to work. However, the mutual fund company has hooked you into a 6, 7 or 8 year time frame where if you leave their company before a certain time, you will have to pay a penalty for leaving early. The longer you stay with the fund company, the smaller the fee. Typically, you can still move your funds around within the same company without triggering fees. The theory is that back end loads promote long-term thinking.

A significant part of the front and/or back end loads go to the financial advisor or broker for compensation. Do it yourself investors also need to be careful. I’ve seen some investors who have bought mutual funds in their discount brokerage accounts choose the wrong versions of a mutual fund, where they buy a back end load fund instead of choosing the no load option or the front end load option.

Other Fees

Discretionary Fees – On some larger investment portfolios, financial advisors or brokers will promote the merits of a discretionary account. This annual fee is similar to a MER but it is negotiable depending on account size. This fee can also be potentially tax deductible on non-RRSP accounts. The investment industry is a scalable industry which means the more money you have to invest, the more you can negotiate the fees. Discretionary fees typically range between 1% and 1.5%. The big thing to be careful of is to watch the fees on the investments in the account. If you hold a mutual fund inside a discretionary account, you will be paying 2 sets of fees. Especially watch for double dipping where the broker is making money from the discretionary fee as well as the fees off the underlying investments inside the portfolio.

Self-Directed Fee – This fee only applies to RRSPs and is typically charged by the administrating financial institution. Self-Directed RRSPs allow investors to invest in a myriad of investments not restricted by the investments offered by one single company.

Trading Fees – Trading fees refer to the cost to buy and sell specific investments and/or securities within an investment account. Typically full service brokers will charge higher trading fees than discount brokers. If you are paying discretionary fees, you should not be paying trading costs. Watch how your trading fees affect smaller purchases. For example paying a $50 fee to buy a $1000 worth of stock is really a 5% fee. It might be more economical to buy no load mutual funds on smaller purchases.

There can be other fees like account closing fees, administrative fees, withdrawal fees, etc. Fees will differ from institution to institution so it is important that investors be aware! Know how much you are paying in fees. Never be afraid to ask what the fees are and how institutions and advisors get paid.