Passive v Bond Funds Which Option is Better for You

Post on: 9 Апрель, 2015 No Comment

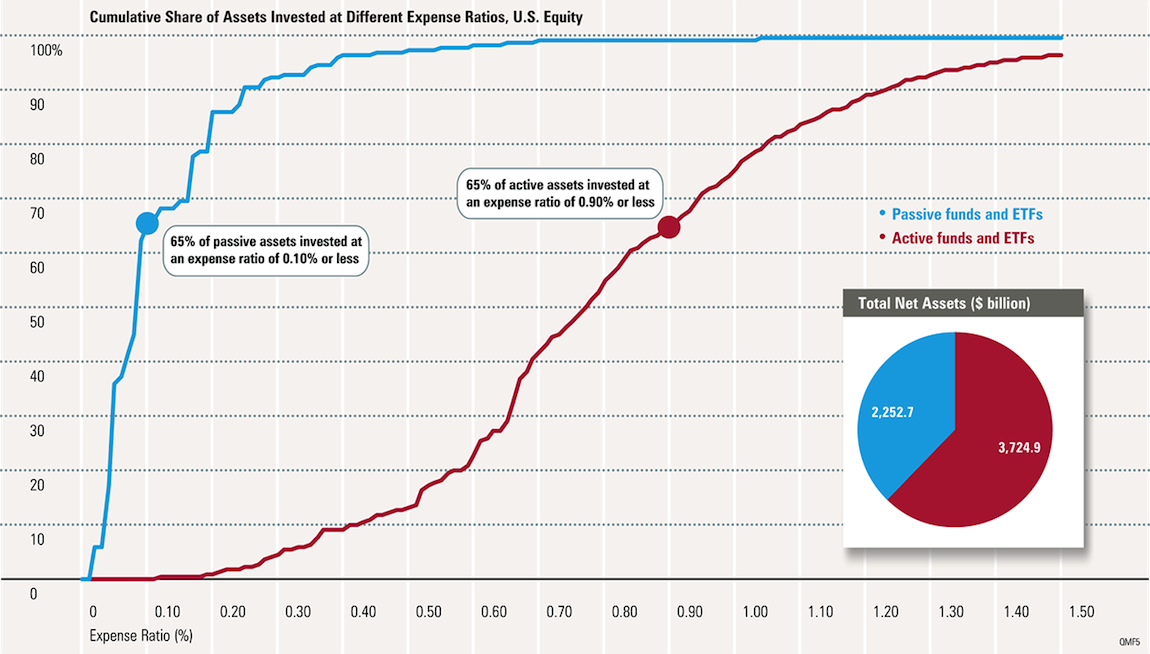

Passively managed bond funds have the goal of exactly mirroring the performance of specified index. The job of those involved in managing passive funds is to replicate the performance of the index, by matching the holdings of the fund with the type of bonds and maturities held the index. For this reason they are also known as “Index Funds.” Passively managed funds tend to have very low annual expense ratios. as their portfolios have minimal turnover (reducing trading costs) and they don’t need to heavily research individual investments.

Two popular examples of passively managed bond funds are the Vanguard Total Bond Market Index Mutual Fund (VBMFX) and the Barclays Aggregate Bond Fund ETF (NYSE: AGG). Both fund’s have the goal of tracking the Barclays Capital Aggregate Bond Index. (see our ratings of these and other funds here)

Actively Managed Bond Funds

The goal of an actively traded bond fund is to outperform a specified index, while holding similar type securities. Essentially, they have a more concentrated portfolio than an index. They expect the securities that they hold to do better than the overall index. To find these “investment winners”, they do lots of research.

Actively Managed Mutual Funds and ETFs tend to have higher annual expense ratios, as they need to employ strategists and researchers to analyze individual securities. Additionally, the portfolios tend to have higher turnover, which adds to trading costs.

Two popular examples of Actively Managed Bond Funds are the PIMCO Total Return Fund (PTTRX) which is the largest mutual fund in the world, and the PIMCO BOND ETF which is the ETF version of the Total Return Fund.

Which is better?

Most Actively Managed Bond Funds Underperform Their Indexes

In a Vanguard Report titled, “Debunking Some Misconceptions About Indexing ”, there is some great data about relative performance. In the overwhelming majority of cases, actively managed funds underperform the indexes they track when looking at a 15 year period of time. The gap in performance is particularly bad for growth stock funds. For example, 97% of actively traded mutual funds that invested in mid-sized companies with capital growth as their goal, underperformed their index. Half of these funds trailed their index by 3.75% or more.

The Numbers Are Less Bad For Bond Funds

70% of actively managed Intermediate Government Bond Funds and 89% of actively managed Intermediate Corporate Bond Funds failed to outperform their indexes. Half of the intermediate corporate funds trailed their indexes by 0.83% or more. However, this number shrinks to 0.27% for intermediate corporate funds.

Most actively traded funds are likely to have performance that trails the performance index that they have a goal of beating. If you happen pick an actively managed fund which is in the middle of the pack in terms of performance for bonds, the performance is likely to provide annual returns which trail the index by a quarter to a full percent. This compares to passively managed funds which should trail their index by the amount of their annual expense ratio, which is generally around a third of percent.

The Vanguard Report Does Not Mention That The Average Return For Actively and Passively Mentioned Funds Are About The Same.

The Vanguard Report focuses on the median return. The return level which divides the top half and bottom half of funds. By this measure, passively managed funds and ETFs look like a far better investment. However, the story is very different when you look at average returns. Adding up all the returns and dividing by the number of funds. By this measure, actively and passively managed funds perform about the same including fees.

What does this mean? It means that the top performing actively traded funds do really, really well, compensating for under performance of the majority of actively traded funds. If you pick the right fund, you can greatly outperform the benchmark. However, picking which actively traded funds will be winners and losers is a complicated as choosing individual bonds for a portfolio.

What’s the Bottom Line

Most bond investors will come out ahead by investing in a passively managed fund.

Want to learn how to generate more income from your portfolio so you can live better? Get our free guide to income investing here .