Passive funds v funds

Post on: 20 Апрель, 2015 No Comment

Are you looking to invest in some funds? If so, you have countless options, including securities that are either actively or passively managed.

When determining which of these categories suits you best or alternatively pursuing some strategies that blend the two it is best to know what options you have, as well as their respective costs and benefits.

Passive investing

Passively-managed funds are the less complicated of the two categories, as they track an index or a basket of assets. For example, investors who want quick exposure to blue-chip companies could purchase shares of a fund named SPDR S&P 500 ETF Trust, an exchange-traded fund that buys the stock of companies contained in the S&P 500 Index.

Alternatively, purchasing shares of PowerShares QQQ, previously known as the NASDAQ-100 Index Tracking Stock, would grant exposure to the shares of companies in this tech-heavy index. While these two ETFs let you invest in different types of firms, they also enable you to gain exposure and with little effort, at least compared to investing in the individual companies represented one by one.

Active investing

If you are looking for a more hands-on approach, you can potentially try your hand at selecting mutual funds, or alternatively work with a qualified professional like a financial advisor to pick out the right ones.

Mutual funds are different from passively-managed funds like ETFs and index funds because they are managed by a team of professionals that are paid to select securities based on predetermined investment objectives.

For those who can afford it, hedge funds provide an interesting alternative. Generally limited to investors that meet specific income and net wealth requirements, hedge funds engage in a wide range of investment activities that mutual funds cannot because of the way they are incorporated.

Market trends

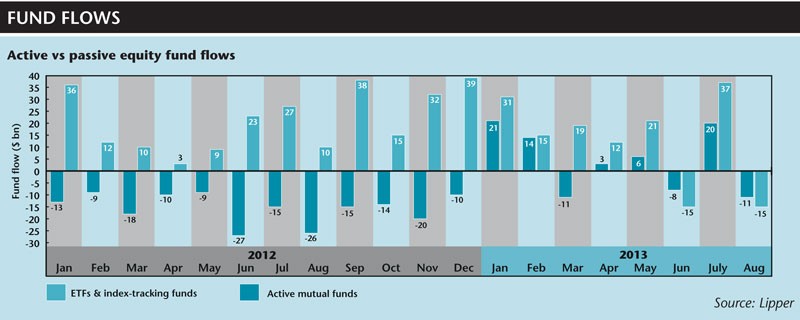

While these actively-managed funds may sound appealing, most of them have lagged the major stock market indices since the bull market began in 2009, CNN Money noted. Amid this situation, investors have been fleeing these more traditional investment vehicles and opting to put their assets into passively-managed funds.

Through the first 10 months of 2014, passive funds picked up almost $60 billion while active funds lost more than $80 billion, according to Morningstar figures reported on by the media outlet.

Separate data provided by global research firm XTF showed that at the time of report on Nov. 6, ETFs had enjoyed net inflows of $159.2 billion so far that year, according to CNBC. As a result, these investment vehicles now boast $1.92 trillion in assets under management. In contrast, mutual funds had lost 2.5 percent over the last 12 months, Investment Company Institute figures revealed.

These trends could continue, as Tom Lydon, president of Global Trends Investments and editor of ETFTrends.com, has predicted that global market participants will continue to opt for ETFs, which are generally managed actively instead of passively, the media outlet reported.

Advice from the Oracle of Omaha

If you are considering active or passive management, it is worth keeping in mind that legendary investor Warren Buffett advocates the latter. He is well-known for buying stakes in companies where he sees a strong value, and then watching those interests grow over time.

The shareholder letter that Buffett wrote last year illustrates the value he sees in using passively-managed financial instruments, as the Oracle of Omaha revealed in this document that he has advised his estate's trustee to put 90 percent of his wife's assets into an S&P 500 Index fund, CNN Money reported. When making this decision, Buffett stated that the long-term results from this policy will be superior to those attained by most investors.

Many have noted that if an a market participant bought an ETF representing the index in March 2009 and held it until now, doing so would yield returns of roughly 200 percent.

While these returns would give any investor cause to be interested, Wall Street has been pushing to get even better results by creating what are referred to as smart beta funds, according to CNN Money. These investment vehicles are similar to passively-managed securities, but built a basket of assets based on specific variables such as dividends, valuation or volatility.

If you are considering these financial instruments, keep in mind that they carry higher fees than passively-managed ETFs, the media outlet reported. Even though they are more expensive than indexing, Jeff Weniger at BMO Global Asset Management stated that smart beta funds are like active management with lower costs.

Smart beta works There's all kinds of strategies out there that are beautiful, he told the news source.

When forming any sort of investment strategy, market participants must first determine their investment objectives, time horizon and risk profile, and then follow this up by implementing an effective strategy that will help them achieve these goals.

If they are more interested in short-term results, stock trading may be more appropriate. However, if they are trying to create wealth over a more drawn-out period, building a portfolio of passively-managed securities may be a far better approach.