OPEC s No to Oil Production Cut Dents Crude Prices 3 Energy Funds to Dump Mutual Fund

Post on: 5 Апрель, 2015 No Comment

The price of West Texas Intermediate (WTI) crude had slumped on Black Friday to the lowest mark since Sep 2009. The plunge came after the international cartel of oil producers — Organization of the Petroleum Exporting Countries (OPEC) — decided against an oil production cut on Thanksgiving Day.

Amid the soft oil pricing scenario, most investors were expecting an output cut from OPEC as the move could have arrested declining crude prices. However, in a meeting at the Austrian capital of Vienna, the OPEC members formed a consensus to keep their production target at 30 million barrels per day, as was decided in Dec 2011. This eventually dragged oil prices further; resulting in WTI crude falling over 10% to settle at $66.15 per barrel last Friday.

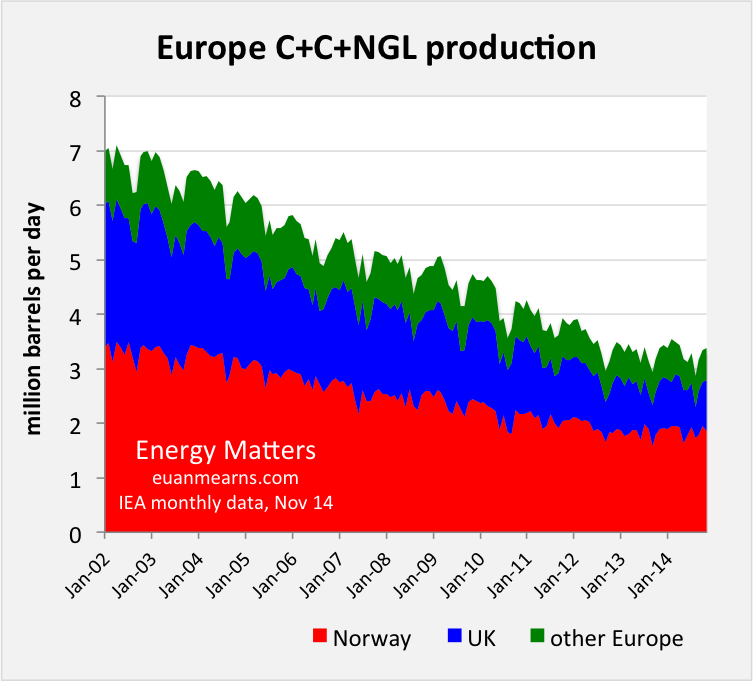

Eventually, the drastic fall in crude prices dragged energy shares significantly lower. In fact, this is not new as the crude prices have been moving south for some months now. Plentiful North American shale supplies in the face of lackluster demand expectations, sluggish growth in China and the prevailing economic concerns in the European economy had been affecting crude price.

Also, stronger U.S. dollar impacted the demand for greenback-priced crude as it is now expensive for importers to buy oil. A stronger greenback creates a vicious circle for oil price by making imports cheaper at a time when bearish inventory data are creating demand worries.

OPEC’s Conclusion after the Vienna Meeting

The OPEC members finalized that their decision against production cut is not meant to affect the economy. The members — that account for almost 40% of the gross global crude production, as per the U.S. Energy Information Administration (EIA) − believe that oil producers will be able to generate a decent income even at such low crude prices. Furthermore, they can invest out of savings to meet future demand.

Saudi Arabia, which holds the top spot in terms of total production among the 12 OPEC members, had already taken its stand against a production cut and had announced it publicly before the meeting in Vienna.

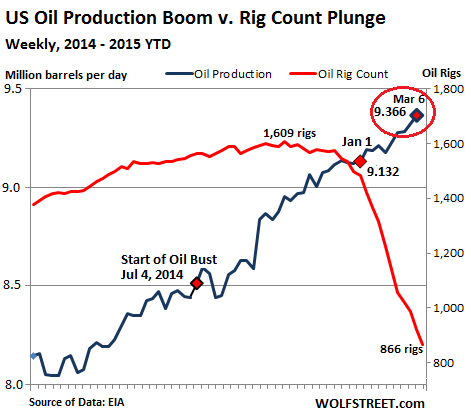

The decision might be a strategic move by Saudi Arabia to win an edge over U.S. shale producers. This is because shale oil, which has been witnessing large-scale production in the U.S over the last few years, is relatively expensive. Moreover, the life span of a shale oil well is considerably short and production from these wells is also comparatively tougher sans a regular flow of investment.

Hence, with the recent fall in crude prices it will be difficult for U.S. shale producers to garner sufficient earnings to sustain in the industry.

3 Energy Funds to Dump Now

The business of energy firms is positively correlated to crude prices as many generate revenues by selling crude to refiners and downstream players. Hence, with oil prices nose-diving, it will be difficult for the energy firms, more particularly those related to exploration and production, to earn sufficient cash flow for shareholders. Subsequently, the energy mutual funds will be adversely affected.

Here we will suggest 3 energy funds that carry either a Zacks Mutual Fund Rank #4 (Sell) or Zacks Mutual Fund Rank #5 (Strong Sell) as we expect the funds to underperform its peers in the future.

Remember, the goal of the Zacks Mutual Fund Rank is to guide investors to identify potential winners and losers. Unlike most of the fund-rating systems, the Zacks Mutual Fund Rank is not just focused on past performance, but the likely future success of the fund.

The funds have negative returns over the past 4 weeks and year to date. These funds also carry sales load and have higher expense ratio.

Rydex Series Trust Energy Services A (RYESX) seeks growth of capital. The fund invests a majority of its assets in equities of small to mid-cap Energy Services Companies that are domestically traded. It also invests in derivatives. The fund may also buy American Depositary Receipts for exposure to non-Us energy companies.

RYESX currently carries a Zacks Mutual Fund Rank #4 (Sell). The fund has lost 17.2% over the last 4 weeks and is down 27.8% year to date.

The fund has an annual expense ratio of 1.62% as compared to category average of 1.53%. The fund has a max front end sales load of 4.75%, which however is lower than category average of 5.24%.

Top holdings of the fund include Schlumberger NV (SLB), Halliburton Co (XO) and National Oilwell Varco Inc (NOV).

BlackRock Energy & Resources Investor B (SSGPX) invests a lion’s share of its assets in equities of global energy and natural resources companies. It also invests in companies belonging to utilities sector. The fund mostly focuses on small-cap firms. The non-diversified company invests without limit across the globe and usually in at least three countries.

SSGPX currently carries a Zacks Mutual Fund Rank #4 (Sell). The fund has lost 14.1% over the last 4 weeks and is down 24.2% year to date.

The fund has an annual expense ratio of 2.1% as compared to category average of 1.53%. The fund has a max deferred sales load of 4.50%, higher than category average of 2.27%.

Top holdings of the fund include Helmerich & Payne Inc (HP), Southwestern Energy Co (SWN) and Cabot Oil & Gas Corp Class A (COG).

Saratoga Energy & Basic Materials C (SEPCX) seeks capital appreciation over the long term. It invests a majority of its assets in domestic and non-US energy and basic materials companies by using Standard & Poor’s classification system to identify securities from this sector. The fund invests in companies of all sizes. Adverse market situations may also lead to investments in investment grade debt securities, which could result in the fund not meeting investment objective.

SEPCX currently carries a Zacks Mutual Fund Rank #5 (Strong Sell). The fund has lost 9.1% over the last 4 weeks and is down 20% year to date.

The fund has an annual expense ratio of 3.61% as compared to category average of 1.47%. The fund has a max deferred sales load of 1%, as compared to category average of 1.89%.

Top holdings of the fund include Kinder Morgan, Inc. (KMI), Exxon Mobil Corporation (XOM) and Suncor Energy Inc (SU).

About Zacks Mutual Fund Rank

By applying the Zacks Rank to mutual funds, investors can find funds that not only outpaced the market in the past but are also expected to outperform going forward. Learn more about the Zacks Mutual Fund Rank in our  Mutual Fund Center.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report