Online Brokerage Accounts

Post on: 27 Июнь, 2015 No Comment

Compare online brokerage accounts

To find the right brokerage account, you need to consider a few points. First, what kind of fees do they charge? Brokers usually charge a monthly fee as well as fees for trades (a trade is when you buy or sell an investment.) If you plan on making trades regularly (at least a few times per month), you should look for an account with lower fees for trades. On the other hand, if you don’t plan on trading often, look for an account with a lower monthly fee.

You also need to consider the minimum account balance needed to open an account. Some online brokers have no minimums while others can require several thousand dollars. Depending on how much money you have to invest, this could limit your choices.

Different brokers have different investment options. If there’s a particular kind of investment you want to make, for example you really want to buy stocks of small companies, make sure your online broker offers these investments.

Some online brokers also offer special promotions for new accounts. They might give you a number of free trades or give you a cash bonus for signing up. If the decision is close between a few companies, this can help you make up your mind.

Finally, check what kind of customer service you’ll receive with your online broker. Some companies only offer limited service, such as basic phone and/or email support to manage your account but not to give you advice. Others let you speak with financial advisors and have local offices where you can speak to someone in-person. Companies that offer more service are usually more expensive so you need to decide if this help is worth the extra cost.

Did you know?

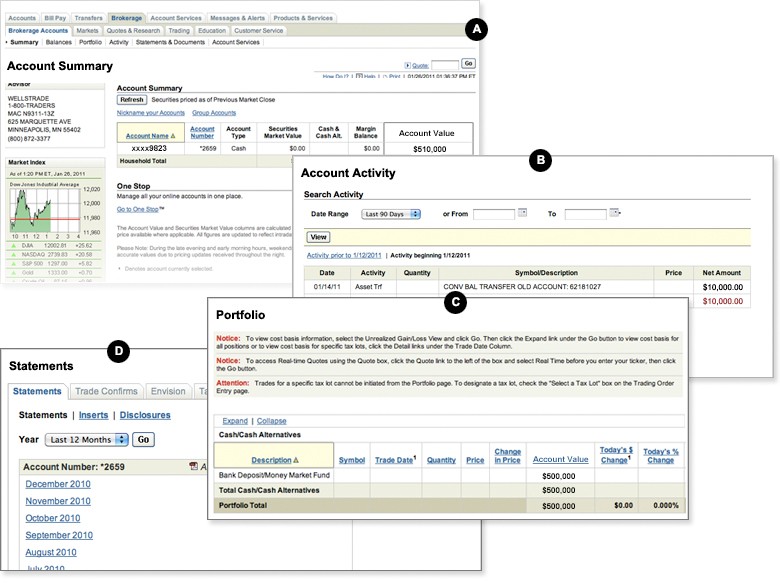

Brokerage accounts are investment accounts that let you buy and sell stocks, bonds, mutual funds, and other assets. In the past, you had to work with a traditional broker. This was a person who handled trades for you. If you wanted to buy or sell an investment, you had to contact your broker to make a trade. Online brokerage accounts let you manage your portfolio on the internet. You don’t have to deal with a live person to make investments and can do everything yourself.

Online brokerage accounts are much more affordable than traditional brokers. It only costs a few dollars to make a trade with an online brokerage account and the balance requirements to open an account are much smaller. You can also make trades more quickly with an online brokerage account. You just need to log in your online account and decide which investments to make.

On the other hand, online brokerage accounts have less support. You need to make your investment decisions yourself and you won’t have a professional investor helping you manage your portfolio. While some online brokers let you contact a financial advisor for support, the advisor won’t be actively watching your portfolio like a traditional broker.

Also, online brokerage accounts don’t have as many investment options. If you want to buy more specialized investments like international stocks or foreign currencies, you might have to work with a traditional broker.