Nine Reasons To Just Say No To Managed Futures

Post on: 6 Апрель, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Welcome to the wild west of managed futures. Even before the highly publicized fiascoes at Peregrine and MF Global we wondered why anyone might want a managed futures account. Our position has always been we wouldn’t touch them with a ten foot pole.

The sales pitch: “During periods of great future uncertainty”, though “future certainty” is an oxymoron so I’ll translate that for you, “during periods of investor anxiety about the markets, you should consider managed futures, which offer attractive returns in bull and bear markets as well as reduces risk by providing diversification.”

Sounds fantastic, I’ll take 2 please. Unfortunately, it’s not really that simple. It is time we take a closer look at the common myths about managed futures and why I recommend you just say no.

Myth #1: Managed Futures is an asset class

First thing to realize is “managed futures” is just an investment in future contracts, i.e. derivatives, being managed. It could be a strategy focused solely on precious metals or it might include every commodity, all the currencies, and all the capital markets. Additionally, a strategy can be long, short or long & short. A strategy could be based on an automated, rules-tracking process to “trend” to a specific benchmark or open to wherever the commodity trading advisor’s (CTA) “gut intuition” wants to go. The number of iterations is endless.

The core issue with this myth is that managed futures is actually a wide variety of investment strategies, not an asset class and that is a very important distinction. Past performance data on asset classes can be analyzed to create some basis for future expectations. Unrestrained, eclectic investment strategies don’t.

Myth # 2: Managed Futures have had attractive returns.

Remembering that managed futures refers to a multitude of strategies, recognizing that most are private programs and understanding that most of the managed futures benchmark returns are suspect due to the many reporting biases, how can anyone really know if the returns have been attractive to the investors?

Fortunately there are over 31 publically traded mutual funds that we can look to for more verifiable performance data yet most haven’t been around for very long. Thirteen of the thirty one were started in 2011 and only five funds have a three year track record. Arguably the granddaddy of publically traded managed futures is the Guggenheim Managed Futures Strategy H (RYMFX), a mutual fund which began trading in late 2007 and today has roughly $1.9 billion in assets. The fund invests substantially all of its net assets in commodity, currency and financial-linked instruments whose performance is expected to correspond to that of the S&P Diversified Trends Indicator.

The fund manager (Guggenheim) charges

2% in fees per year. Given the complexity of the fund and SEC exemption (see #8), it isn’t possible to identify if there are or are not any additional underlying expenses such as fees to commodity trading advisors (CTA) which usually average an additional 2% plus

20% incentive fees on the gains. These are eye-popping expenses to me but pretty typical for managed futures.

So with RYMFX as our proxy for managed futures, how attractive has the performance been?

If attractive returns are relative, Table #1 does show that Managed Futures (RYMFX) were very attractive in 2008 relative to the S&P500 (SPY) but no more attractive than the 1-3 year Treasury (SHY) and compared to the 20+ Treasury (TLT), managed futures were not so attractive. Since 2008 the relative attraction amongst the group continues to change, but the point here is that in relative perspective to more traditional and much lower cost options, managed futures really haven’t been all that attractive.

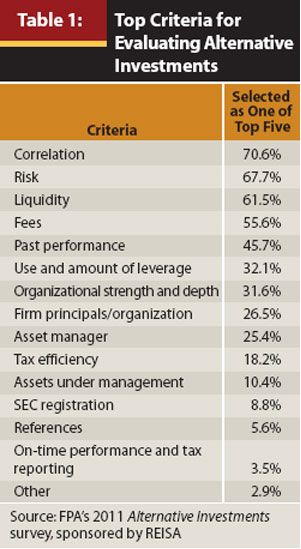

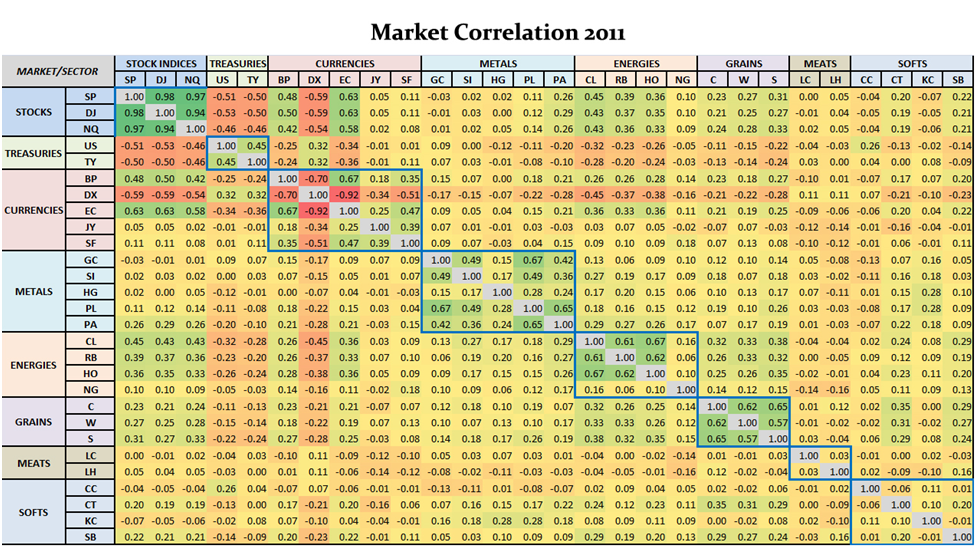

Myth #3: Managed Futures reduce risk and improve diversification because they might be negatively or non-correlated.