Nearly One Third of Actively Managed Funds Are Closet Indexers Finds New Study

Post on: 9 Апрель, 2015 No Comment

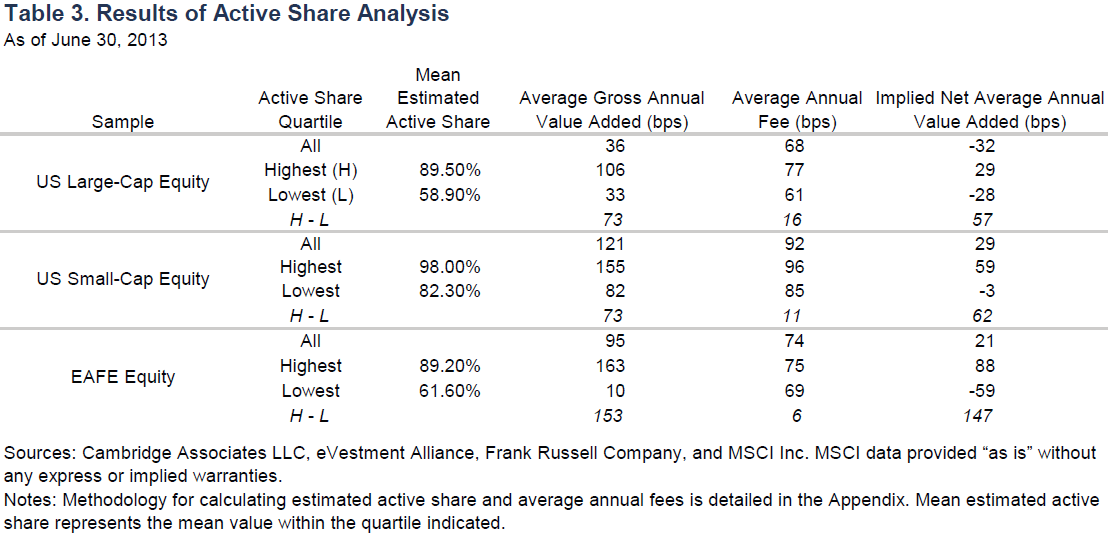

New Haven, Conn. August 21, 2006 – Finance professors at the Yale School of Management have devised a new method to measure the active management of mutual funds. This new measure, known as Active Share, reveals that nearly one third of the U.S. mutual fund industry is comprised of “closet indexers” – funds that claim to be actively managed but passively invest most of their assets in the benchmark index – while truly active funds account for only about a quarter of the market. Furthermore, Active Share significantly predicts fund returns, showing that only the most active funds outperform their benchmark indexes while all other active funds underperform after expenses.

“Many investors are paying high fees for the alleged benefits of active management, but they end up getting a mostly passive portfolio that hugs the benchmark index with only a small active part,” said professor Antti Petajisto, who created the Active Share measure with professor Martijn Cremers. Their study “How Active is Your Fund Manager? A New Measure That Predicts Performance ,” is available online.

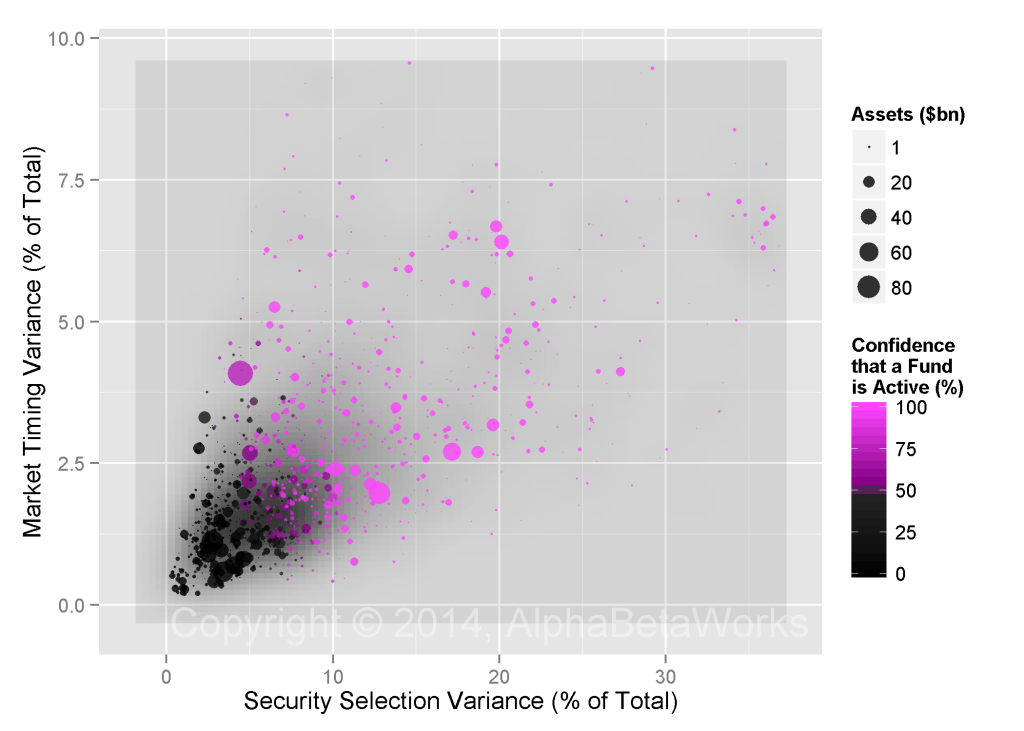

Active Share is the fraction of a fund’s portfolio holdings that deviate from the benchmark index. The Active Share of a mutual fund ranges from zero (pure index fund) to 100% (no overlap with the benchmark). Active management has traditionally been measured with tracking error, which measures the volatility of portfolio return relative to a benchmark index. Petajisto and Cremers’ method uses Active Share in conjunction with tracking error to give a comprehensive picture of how active a fund is on the dimensions of both holdings and returns.

This new method allows funds to be characterized by how much and what type of active management they practice. Funds with high Active Share and low tracking error are diversified stock pickers (e.g. T. Rowe Price Small Cap); low Active Share and high tracking error are factor bets (e.g. Investment Company of America); high Active Share and high tracking error are concentrated stock pickers (e.g. Fidelity Low Price); low Active Share and low tracking error are closet indexers (e.g. Fidelity Magellan); and zero Active Share and zero tracking error are pure index funds (e.g. Vanguard 500).

The study confirms the conventional wisdom that smaller funds are more actively managed, while a significant number of large funds, particularly those with more than $1 billion in assets, are closet indexers.

Looking at the evolution of active management over time, Petajisto and Cremers also find that closet indexing is a relatively new problem that is on the rise. Prior to the 1990s, most mutual fund assets were truly active; in recent years that fraction has dropped to 20-30%.

As measured with Active Share, active management predicts fund performance. Funds with the highest Active Share significantly outperform their benchmarks both before and after expenses and their returns are persistent from year to year. Funds with the lowest Active Share underperform after expenses.

“For investors, it seems the most attractive funds are those with the highest Active Share, smallest assets, and best one-year performance,” said Cremers. “Even when you factor in fees and transactions costs, funds with these characteristics outperform their benchmarks by about 6 percent per year.”

“If you want active management, make sure you get what you pay for,” cautioned Petajisto. “There are many funds in the closet, charging fees for very little active management.”