NAV financial definition of NAV

Post on: 16 Март, 2015 No Comment

Net Asset Value

In stocks and businesses, an expression of the underlying value of the company. That is, it is a statement of the value of the company’s assets minus the value of its liabilities. One way of thinking about the net asset value is that it is the underlying value of a company, not the value dictated by the supply and demand of shares or its market capitalization. It is also called the book value.

NAV

Net asset value (NAV).

The NAV is the dollar value of one share of a fund. It’s calculated by totaling the value of all the fund’s holdings plus money awaiting investment, subtracting operating expenses, and dividing by the number of outstanding shares.

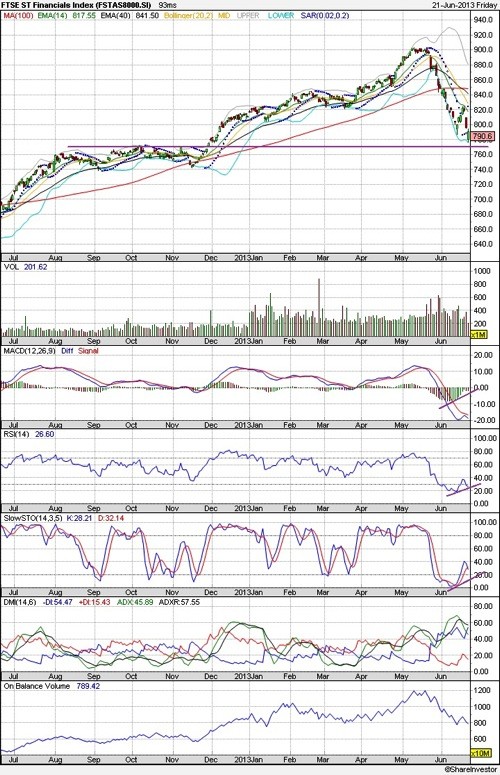

A fund’s NAV changes regularly, though day-to-day variations are usually small.

The NAV is the price per share an open-end mutual fund pays when you redeem, or sell back, your shares. With no-load mutual funds, the NAV and the offering price, or what you pay to buy a share, are the same. With front-load funds, the offering price is the sum of the NAV and the sales charge per share and is sometimes known as the maximum offering price (MOP).

The NAV of an exchange traded fund (ETF) or a closed-end mutual fund may be higher or lower than the market price of a share of the fund. With an ETF, though, the difference is usually quite small because of a unique mechanism that allows institutional investors to buy or redeem large blocks of shares at the NAV with in-kind baskets of the fund’s stocks.

Net Asset Value (NAV)

What Does Net Asset Value (NAV) Mean?

A mutual fund’s price per share or an exchange-traded fund’s (ETF) price per share; in both cases, the per-share dollar amount of the fund is derived by dividing the total value of all the securities in its portfolio, minus any liabilities, by the number of fund shares outstanding. In terms of corporate valuations, the value of assets minus liabilities equals net asset value (NAV), or book value.

Investopedia explains Net Asset Value (NAV)

In the context of mutual funds, NAV per share is computed once a day, based on the closing market prices of the securities in a fund’s portfolio. All mutual fund buy and sell orders are processed at the NAV of the trade date. However, investors must wait until the next day to get the trade price, which means that many mutual funds are priced just once a day, after the market closes. Mutual funds pay out virtually all of their income and capital gains. As a result, changes in NAV are just one measure of a mutual fund’s performance; total return, which includes gains and distributions, is a more comprehensive measure. Because ETFs and closed-end funds trade like stocks, their shares trade at market value throughout the trading day, which means that at any particular time they can be trading at a premium (above NAV) or a discount (below NAV).