Mutual Funds vs REITs

Post on: 5 Июнь, 2015 No Comment

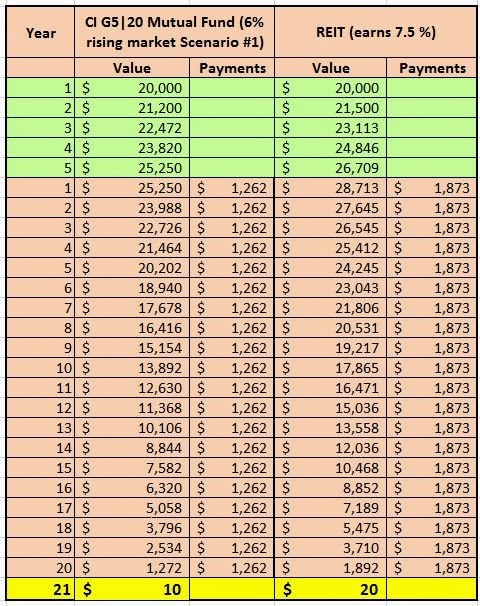

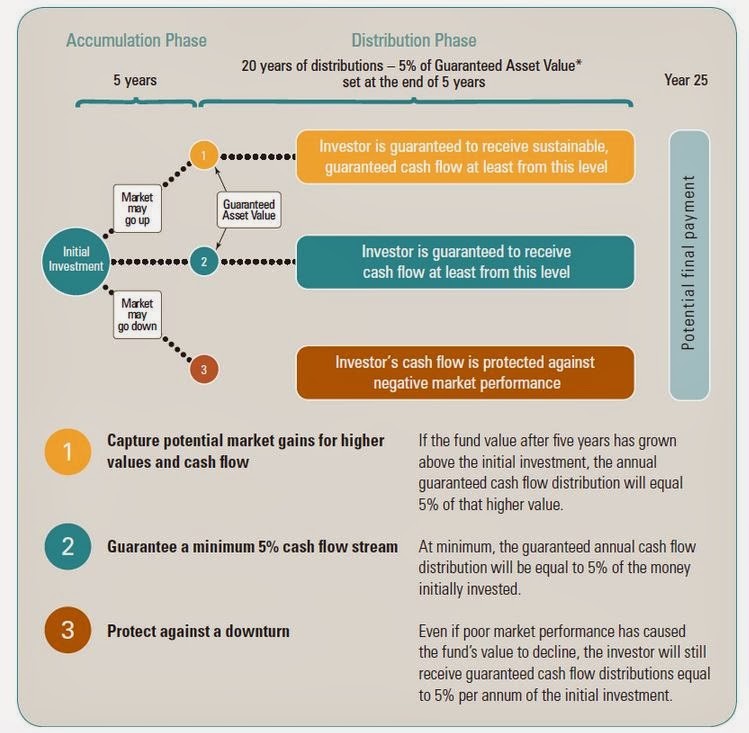

Placing money into the stock market is one way to build additional retirement income in the U.S. While most people are happy with standard mutual funds, some investors have recognized the benefits of various REIT accounts offered by brokerage firms. There are advantages to owning each type of account and this mutual funds vs REITs guide will help the common investor.

Mutual Funds Defined

A mutual fund by definition is a fund that is invested into by common shareholders through professionally managed accounts. These funds are the most common type tied to 401K and other retirement accounts. Soon to be retirees who are bulking up on pre-distribution funds for retirement often have major holdings spread out into multiple mutual funds.

Advantages of Mutual Funds

A professional manager or trustee is appointed to a mutual fund account through a brokerage firm. These accounts are professionally managed and can be spread out into various industries. It is this diversification in the market that has laid the foundation for investment wealth for missions of citizens.

It can be less expensive to buy into funds through brokers due to the low purchase price of most funds. This makes it easy to spread out the types of investing dollars that investors have each year. Common types of fund accounts include the following:

1. Index Funds

2. Stock Growth Funds

3. Money Market Funds

4. Regular Income Funds

REIT Funds Defined

Unlike a standard mutual account, a real estate investment trust is spread out into only real estate ventures. This includes commercial buildings, apartment complexes, rental facilities, hotels and other holdings in the housing industry. These funds are owned by companies or executive managers and there are many options for growth compared with a regular stock trading fund.

Advantages of REIT Funds

Like many investing types, public and private opportunities are offered to investors. One advantage that an REIT has over a regular account is the income distribution. While brokers and other insiders of a mutual fund receive portions of distributions, federal law guarantees that a minimum of 90 percent of the taxable income of an REIT is distributed to owners each year.

A dividend that is received through a real estate investment trust is usually taxed as standard income. Depending on business structures, a person could save money going with an REIT account versus a standard mutual fund. Tax professionals can often explain any disadvantages to owning a certain type of account. A person can test the waters in the housing industry from buying into a real estate traded fund.

Common types of REIT accounts include:

Buy Real Estate with REITs

An entry into the housing market for some people includes a partial ownership into a real estate venture through a real estate investment trust. These accounts can be setup quickly and used to buy percentages of different properties. Choosing which type of REIT or mutual fund is an important decision for any investor. Someone who does not want to invest into these types of accounts still has the option to buy turnkey real estate through companies like JWB online.