Mutual Funds Ultrashort but Long on Choices

Post on: 8 Октябрь, 2015 No Comment

By Carole Gould

Published: February 19, 1995

BECAUSE ultrashort-term bond funds occupy a niche squarely between money-market funds and short-term bond funds, you might think they are fairly simple investments.

Not so.

Some ultrashort funds own only Treasury securities; some own junk bonds, too. Ultrashort usually means less than a year, but it can mean several years. Some invest abroad; others stick to the United States. Some pay dividends; others don’t.

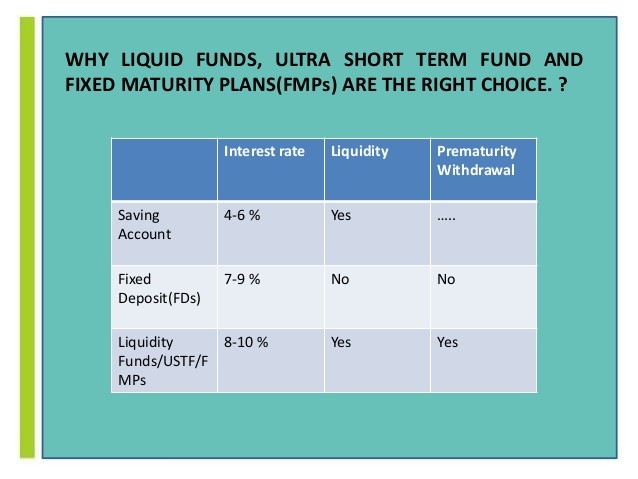

While nearly all the share prices of the 15 ultrashort funds fell last year, their high incomes propped up their total returns. The ultrashorts gained 3.1 percent, on average, according to Lipper Analytical Services, compared with losses in short-term government and high-quality corporate bond funds.

Ultrashorts were a way for the fund industry to appeal to bank customers, by offering an investment whose price did not vary much but whose yield was higher than that on certificates of deposit.

As yields fell in 1992 and 1993, the funds became more popular. The number of funds nearly doubled from 1990 through 1994.

And after a year like 1994, when prices tumbled, you’d expect strong growth from mutual fund investors who are looking for less downside risk in their bond funds, said Jeffrey R. Kelley, editorial manager of Morningstar Mutual Funds.

Like money market funds, the share prices of ultrashorts are mostly stable. Of course, you forfeit any gains from share price movements. As a group, the funds returned 30.1 percent for the five years ended 1994, compared with 36.0 percent for short-term bond funds, Lipper said. This makes most ultrashorts better choices for those more concerned with income than with long-term gains.

Yet the funds can respond quickly to rising interest rates because they own short-term paper. The group typically owns a mix of Treasury, government agency securities, corporates and investment-grade commercial paper with an average weighted maturity of 90 days to a year.

That’s why the ultrashorts held up so well last year. Their 3.1 percent gain compares with losses of 1.65 percent in short-term government funds and 0.4 percent in short-term high-quality corporate funds.

Yields were pretty good, too. The ultrashorts yielded 3.95 percent, on average, last year. That compares with 3.59 percent for money market funds and 5.21 percent for short-term government funds, Lipper said.

But share prices of ultrashorts are not fixed at $1 like money market funds. They vary with the value of their holdings like any other type of bond fund.

In fact, while the hefty yields were enough to create positive total returns, the share prices of most ultrashorts fell last year.

Strong Advantage, by far the largest fund in the group, began 1994 with a share price of $10.19 and closed the year at $9.98. Hotchkiss & Wiley Short-Term Investment Grade lost 1.85 percent of its principal, and Neuberger & Berman Ultra Short Bond Fund lost 1.66 percent.

Only two funds managed to increase their share prices in 1994. Eaton Vance Government Short-Term Treasury gained 3.49 percent using an accounting technique that lets the fund accumulate earnings instead of paying dividends to shareholders. And Permanent Portfolio Treasury’s price rose 2.3 percent using a similar tactic.

In fact, Neuberger’s price has dropped almost steadily since its 1986 inception.

As a result, it’s important for people not to confuse ultrashorts with money market funds, Mr. Kelley said.

The risk-reward equation that applies to any bond fund also applies to ultrashorts.

The Hotchkiss fund, last year’s best performer among all taxable bond funds, with a total return of 4.4 percent, earned its top billing partly by holding short-term corporate issues as well as derivative securities designed to profit from rising interest rates.

Strong owns lower-credit paper — 18 percent is in junk issues — so its good performance came mostly from higher income. It yielded 5.52 percent in 1994.

By contrast, Neuberger & Berman Ultra Short Bond mandates a minimum credit quality of A but averages AAA, said its manager, Theresa Havell. And Permanent Portfolio owns mostly short-term Treasury notes, virtually eliminating credit risk.

Does it pay to skim the higher yields off an ultrashort that owns junk?

Bond prices typically move because of shifts in interest rates. But in a real flight to quality that causes a credit crunch like there was in 1990 there won’t be a market even for the shortest junk, Mr. Kelley said.

What about overseas investments? Pacifica Asset Preservation buys foreign issues; Neuberger & Berman won’t.

And some funds have longer average weighted maturities then one year. Strong can go as high as six years; Neuberger, two. The moral: don’t judge ultrashort funds by their yields because their risk levels range all over the lot. Check a fund’s total return. And read its prospectus to find out where it can invest and its shareholder report to see where it does invest, Mr. Kelley said.

Graph showing total assets of ultrashort bond funds from 1989 to 1994. (Source: Morningstar Inc.)