Mutual Funds to Invest in Brazil Russia India China BRIC

Post on: 6 Май, 2015 No Comment

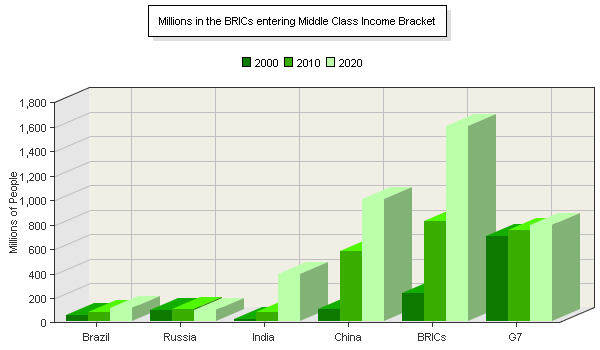

Brazil, Russia, India and China are the dominant emerging countries in the world, and as a whole, the future growth of the world economy depends on these countries continuing on their growth path. Needless to add, mutual funds, hedge funds, ETFs, indexes, future, options and a host of other investing instruments have now mushroomed to take advantage of the rapid growth in these economies. Many companies that operate in these countries have listed their stocks in the New York Stock Exchange as well, in search of a wider pool of investors and investment dollars.

The average investor can take the path of investing in individual securities, but this limits the number of companies one can safely and easily invest in. It is far better to put money into actual mutual funds that specialize in emerging economies with a specific focus on the BRIC nations of Brazil, Russia, India and China.

Wall Street Journal recently reported that Franklin Templeton Investments. HSBC Asset Management. Deutsche Asset Management and Schroders Investment Management are among the fund companies that recently began offering BRIC funds to investors in Europe and Asia, and to U.S. high-net-worth individuals. Nikko Asset Management has launched a BRIC fund in Japan.

As you may note, these funds are not available to the average investor in the US — but if you are a high net-worth individual then you can take advantage of these funds. There are other options however, such as the American Century Emerging Markets and Managers Emerging Market Equity that invest in all of the BRIC nations as well as other emerging economies.

Another method to invest is to simply buy the ETFs that track the stock market indexes in these countries. For example you could purchase the MSCI Brazil Index fund (EWZ), and the MSCI India ETF, or the upcoming Market Vectors Russia ETF (produced by Van Eck), and the MSCI China (HKD) or very broadly, simply the MSCI Emerging Markets Index ETF (EEM). Also, take a closer look at all the closed funds that operate in these countries. Funds such as India Fund, India Growth Fund, China Fund, Greater China Fund, Brazil Fund and Brazil Equity Fund, and Templeton Russia Fund will give you the exposure and diversification you need.

Last but not the least is funds that are based in those countries — local companies that primarily cater to the domestic population. There are several very savvy fund managers that operate in each of these countries, and who are intimately familiar with the local conditions and now have developed a reasonably strong track record. Not all of them have facilities to accept and disburse funds abroad, but either directly, or through banking institutions, you should be able to access these funds. Alternatively, your broker should be able to place orders in those countries directly and give you access to not only these mutual funds, but to a large range of individual companies in these countries.

As with any asset allocation methodology, make sure that investments in the BRIC countries make up a fixed, small percentage of your overall portfolio. Many of these nations are experiencing serious, sustained growth for the first time in many years — and are yet to face all the usual obstacles of business cycles, social moods that may swing from pro-business to anti-business, protectionism and currency upheavals. While the returns are wonderful, always take some money off the table each time you make a serious profit in any of these investments. As mentioned above, event risks are above average in these economies and countries.

Happy investing in the BRIC countries!