Mutual Funds Costs Mutual Fund Loads

Post on: 16 Март, 2015 No Comment

Mutual fund sales charges, also called loads, are one of the things that a Fool should never pay when purchasing a mutual fund. If you’re reading this, you’re certainly able to pick mutual funds that will provide better net returns than if you pay somebody else to pick them for you.

Mutual funds come in two broad categories. Those that have a sales charge and those that do not. Those that have a sales charge are called load funds and those that do not are called no-load funds. When a broker recommends a fund for one of her clients to buy, that fund will be in all probability a load fund, and the load, or sales charge, is pocketed by the broker and/or other middlemen as payment for the service of helping you pick a good fund.

You should be aware that there is no real difference historically between the performance of load funds and no-load funds in terms of year-to-year performance. In fact, according to the latest survey by the mutual fund data analyzer Morningstar, even excluding the drag on returns if the load were included in the calculation, no-load funds actually have a superior record to load funds over the last 3-year and 5-year periods.

Let us repeat that. Funds that impose no cost to purchase have outperformed those that brokers pay themselves to find for their clients.

The simplest load to understand is the front-end load. Nothing too complicated about this one — the day that you buy the mutual fund, you pay a sales fee, usually around 5%, and somewhere between 3% and 8.5%. Nothing confusing about this arrangement at all. You immediately lose a big chunk o’ your money.

Because it is so obvious that the arrangement of giving 5% of your money away for nothing in return is such a lousy deal, mutual fund companies have begun to realize that people just won’t fall for the front-load scheme forever. Something trickier is needed, and thus loads are now not always made explicit to the purchaser. Aside from the front-end load is the ominous sounding contingent deferred sales load (CDSL) or back-end load. This is a real masterpiece of the mutual fund industry. State-of-the-art deception (though we certainly expect to see something else come along at some point). The only purpose of a back-end load appears to be to confuse shareholders and make them think they are buying a no-load fund when they are not. A CDSL is simply a full load in disguise, but it takes a little explaining, so bear with us. You are going to be confused until we show you a little chart — a chart, by the way that won’t be in your mutual fund prospectus.

Usually, funds that charge CDSLs are called class B shares, and often after the end of five years will convert into class A shares. A CDSL is a full sales load that is charged over time. Instead of imposing a 5% sales fee up front, a fund will eliminate the front-end load entirely but impose an exit fee of 5% if a shareholder leaves the fund in the first year. This exit fee will decrease each year by 1%; however, at the same time the fund is charging a yearly 12b-1 marketing fee of 1% each year.

Sound confusing? It’s supposed to. The sales pitch is that there is no sales charge if you hold onto the fund for six years. But is that true?

Here’s a chart that helps explain what is happening a bit better.

Has this all confused you enough?Well, as we said, that’s what the mutual fund industry would prefer. But if you’re Foolish, you’ll never make any investment if you don’t understand the fees involved — so don’t buy any class B shares of any mutual fund.

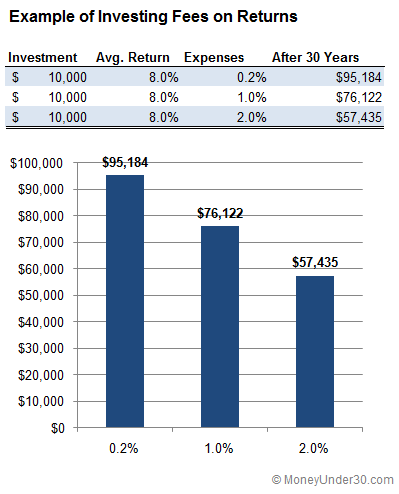

One final load you should be aware of is the level load. This type of load, often designated as class C shares, usually charges a straight 1% in 12b-1 fees each and every year you own the shares. Though there is either no up-front load or a very small one (around 1%), because 1% is taken away in fees each and every year, the level load ends up being the most expensive type of load of all for a long-term shareholder. It’s the load that keeps on keeping on — siphoning away your money year after year after year after year after.

Bottom line — the only thing that you really need to know and remember about mutual fund loads is that you don’t ever have to pay any. Everything that a broker could ever find for you in a load fund, you can find for yourself, and find much better, by doing a little research or asking questions on the Mutual Funds and Index Funds message boards here in Fooldom.

For more on Fools’ efforts to make sales loads and other fees more clear to investors, check out David Gardner’s testimony before the U.S. House Commerce Subcommittee on Finance and Hazardous Materials.