Mutual Funds Annuities by Annuity Advantage

Post on: 17 Апрель, 2015 No Comment

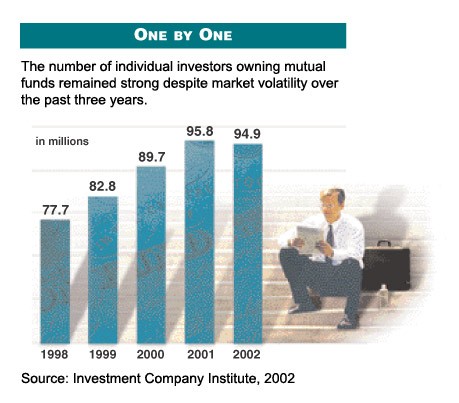

The United States is the mutual fund capital of the world. Roughly half of the world’s $18 trillion in mutual fund assets is parked right here at home. 1

Saving for retirement is far and away the most common reason for owning mutual funds, with 92% of mutual fund investors listing it as their top investment goal. 2

If you are concerned about how you will reach your long-term financial goals, you might want to consider the benefits of mutual fund ownership.

A mutual fund pools money from investors and builds a portfolio consistent with the fund’s stated goals. Although there are thousands of mutual funds on the market – with goals ranging from preservation of capital to current income to long-term growth – most funds share some common characteristics. Note that funds seeking to achieve higher rates of return also involve a greater degree of risk.

Two characteristics in particular make mutual funds a natural choice for investors who prefer a long-term, buy-and-hold strategy.

Professional management: Actively managed funds employ professional investment advisors who research, select, and supervise fund assets, buying and selling in an attempt to generate investment returns that meet the fund’s objectives. When you purchase shares in a mutual fund, to some extent you are also buying the expertise of the fund manager and the fund management company.

Diversification: When you buy even one share in a mutual fund, you may actually be a part owner of dozens or perhaps hundreds of securities. Diversification is an essential component in a long-term investment strategy. Although diversification does not guarantee against loss, it does help limit exposure to losing investments and may give your portfolio more opportunities to participate in winning investments. It is a method to help manage investment risk.

Mutual fund shares fluctuate with market conditions and, when redeemed, may be worth more or less than their original cost.

Mutual funds are sold only by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1–2) Investment Company Institute, 2006