Mutual Funds

Post on: 7 Май, 2015 No Comment

Information Navigation

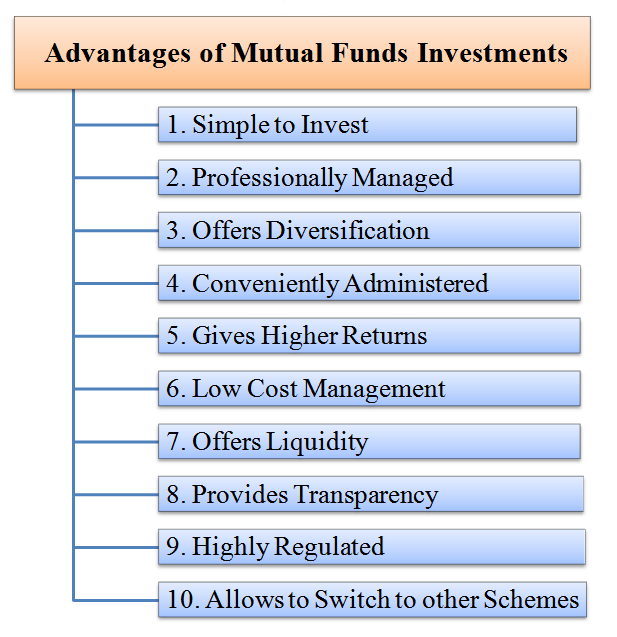

Professionally managed, diversified portfolios designed to help cushion one’s investment from sudden swings in a single security’s value. Stock mutual funds invest solely in stocks and, depending on the objective of the fund, may invest from conservative to aggressive seeking capital appreciation. Bond mutual funds may specialize in a particular kind of bond or a combination of several. Most bond funds are designed to produce current income for shareholders. Some mutual funds, known as balanced mutual funds, may contain a combination of stocks and bonds in the portfolio for additional diversification.

Through U.S. Bancorp Investments, Inc. you have access to hundreds of mutual funds, so you are sure to find the mutual funds that fit your needs.

Receive expert help or invest on your own

For expert guidance with choosing the right mutual funds for you, contact a financial professional. or invest on your own through U.S. Bancorp Investments, Inc. Discount Brokerage account.

Mutual funds come in many varieties. While mutual funds can help you minimize risk through diversification and allow you to benefit from the expertise of the professional fund manager, the possibility of loss cannot be eliminated. Investors need to assess their tolerance for risk before they decide which fund would be appropriate for them.

The types of investments that a mutual fund holds, its investment goals, the fees charged, and information about who manages and advises the fund are described in a prospectus. You should receive and review a prospectus before investing.

U.S. Bancorp Investments, Inc. (USBI) routinely receives compensation for the sale of financial products, including mutual funds, variable annuities, and fixed annuities. The compensation provided to USBI depends upon the product and may include a sales charge or commission.

Financial Product Compensation

The most well known type of compensation is transaction based compensation called a sales charge or commission that is paid by you. This sales charge may be paid at the time of purchase and is called a front-end sales charge. In other instances the product sponsor pays the sales charge or commission to USBI and your investment professional at the time of your purchase, but does not collect the charge from you unless you sell your investment within a specified number of years after your purchase. This type of charge is called a contingent deferred sales charge (CDSC) or surrender charge. The product sponsor may also collect higher annual operating expenses from the net assets of your investment and pay a portion to USBI. USBI may continue to receive compensation in the form of a trailer after your original transaction, which may be received periodically during the time frame in which you hold your investment.

USBI, in turn, pays a portion of the compensation it receives to your investment professional. The product sponsor typically discusses this compensation in the prospectus or contract, which is delivered around the time of your investment.

Financial Contributions from Product Partners to USBI

Many financial products are made available in the marketplace. To assist our clients in choosing the product that is right for them, USBI utilizes a formal due diligence process to evaluate firms who offer a broad array of financial products, selecting only those matching our required criteria and who strive to deliver the highest customer service and satisfaction. Following this due diligence process, our investment professionals make recommendations only from among this wide-range of approved products based upon the specific investment objectives of their clients.

USBI has entered into agreements through which certain firms (our approved Product Partners) provide financial contributions to USBI which are used to support the marketing of their products, training of our investment professionals about their products, and for other purposes. These financial contributions may include revenue-sharing arrangements from the Product Partner that may provide: (1) an annual, lump-sum payment; (2) a payment of up to .0025 based upon the total amount of your purchase; (3) a payment of up to .001 per year based upon the daily average balance of funds held in your account.

Product Partners may also reimburse USBI for expenses incurred during training and educational conferences and seminars, and for providing client accounting and administrative services for USBI’s client accounts holding the products of the Product Partner. In addition, investment professionals may receive promotional items, meals or entertainment or other non-cash compensation from the Product Partners.

All of the above-referenced financial contributions are in addition to any sales charges disclosed in the fee tables found in the prospectuses and statements of additional information for the mutual fund or in your annuity or insurance contract.

In exchange for sharing revenue, these approved Product Partners are provided enhanced access to USBI’s distribution network and greater opportunities to participate in marketing and training functions. Investment professionals do not, however, receive any portion of, or any additional compensation as a result of these revenue and cost sharing arrangements. It is important to note that not all product sponsors approved by USBI make financial contributions to USBI.

Potential Conflicts of Interest from Financial Contributions

A potential conflict of interest exists where USBI and your investment professional is paid more in financial contributions if you purchase one type of product instead of another. A potential conflict of interest may also exist if one Product Partner provides more in financial contributions over another. USBI is committed to serving our client’s interests first, so we have adopted policies reasonably designed to control and limit these potential conflicts of interest. These policies require investment professionals to recommend products and services based only on their appropriateness in meeting your investment goals. They prohibit the payment of any portion of revenue or cost sharing fees directly to investment professionals. In addition, revenue-sharing payments must be made by the distributor or the product sponsor by wire transfer or check, and are prohibited from being accepted in the form of direct or indirect investment portfolio trading commissions of the product sponsor.

Important Information about Revenue Sharing Arrangements

U.S. Bancorp Investments (USBI) routinely receives compensation for the sale of financial products, including mutual funds, unit investment trusts (UITs), variable and fixed annuities, and variable and fixed life insurance. The compensation provided to USBI depends upon the product. In addition to sales loads, 12b-1 fees, networking and processing fees, USBI receives mutual fund support fees, which are sometimes referred to as revenue sharing payments, from the advisers or distributors of mutual funds that have access to USBI’s investment professionals, as described below. Similarly, in addition to the commissions paid to USBI in connection with the sales of annuities and life insurance, USBI receives support fees from certain insurance companies or distributors. Again, these insurance companies and distributors (if applicable) have access to USBI’s investment professionals, as described below.

Financial Revenue Sharing from Product Partners to USBI

Many financial products are made available in the marketplace. To assist our clients in choosing the product that is right for them, USBI utilizes a formal due diligence process to evaluate firms who offer a broad array of financial products, selecting only those matching our required criteria. Following this due diligence process, our investment professionals make recommendations from among this wide range of approved products based upon the specific investment objectives, risk tolerances, and time horizons of their clients and subject to broker-dealer suitability requirements.

USBI has entered into agreements through which certain firms (our Product Partners) provide financial contributions to USBI which are used to support the marketing of their products, training of our investment professionals, and for other purposes. Product Partners may also reimburse USBI for expenses incurred during training and educational conferences and seminars, and for providing client accounting and administrative services for USBI’s client accounts holding the products of the Product Partner. In addition, USBI employees, including investment professionals, may receive promotional items, meals or entertainment, or other non-cash compensation from the Product Partners.

In exchange for sharing revenue, these Product Partners are provided enhanced access to USBI’s distribution network and greater opportunities to participate in marketing and training functions. Investment professionals do not, however, receive any portion of, or any additional cash compensation as a result of these revenue and cost sharing arrangements. It is important to note that not all product providers approved by USBI make financial contributions to USBI.

All of the above-referenced financial contributions are in addition to any sales charges or commissions that may be disclosed in the fee tables found in the prospectuses and statements of additional information for the mutual fund or in your annuity or insurance contract.

Mutual Funds — Revenue Sharing Payments

Financial contributions from USBI Mutual Fund Product Partners may include revenue-sharing arrangements. The revenue sharing payments made to USBI by a Mutual Fund Product Partner may consist of: (1) an annual, lump-sum payment; (2) a percentage of the total amount of mutual fund sales made by USBI for that fund family (mutual fund sales-based fee); and/or (3) a percentage of the total net assets of the mutual fund shares of that fund family held by USBI customers (mutual fund asset-based fee).

The amount and type of revenue sharing payments received from a Mutual Fund Product Partner may vary and is subject to negotiation. Revenue sharing payments are generally in the following amounts:

Mutual Fund Sales-Based Fee

Up to 0.25% (paid quarterly) on sales of mutual fund shares (e.g. $25 per $10,000 purchase).