Mutual fund structure

Post on: 17 Июль, 2015 No Comment

Mutual fund structure in the USA is governed by the Investment Company Act of 1940, [1] which sets the legal framework for four types of registered investment companies:

Contents

Structure

The Investment Company Act Of 1940 makes the following general requirements for investment companies:

- Requires that a fund must register with the SEC;

- Requires that a fund must offer information disclosure to investors in the form of a prospectus and statement of additional information and ongoing periodic reports;

- Regulates contract between the advisor and the fund. [3]

Open-end investment companies (mutual funds)

The open-end investment company (mutual fund) is distinguished by a number of characteristics, here given by the SEC:

- Investors purchase mutual fund shares from the fund itself (or through a broker for the fund), but are not able to purchase the shares from other investors on a secondary market, such as the New York Stock Exchange or Nasdaq Stock Market. The price investors pay for mutual fund shares is the fund’s approximate per share net asset value (NAV) plus any shareholder fees that the fund imposes at purchase (such as sales loads).

- Mutual fund shares are redeemable. This means that when mutual fund investors want to sell their fund shares, they sell them back to the fund (or to a broker acting for the fund) at their approximate per share NAV, minus any fees the fund imposes at that time (such as deferred sales loads or redemption fees).

- Mutual funds generally sell their shares on a continuous basis, although some funds will stop selling when, for example, they become too large.

- The investment portfolios of mutual funds typically are managed by separate entities known as investment advisers that are registered with the SEC. [4]

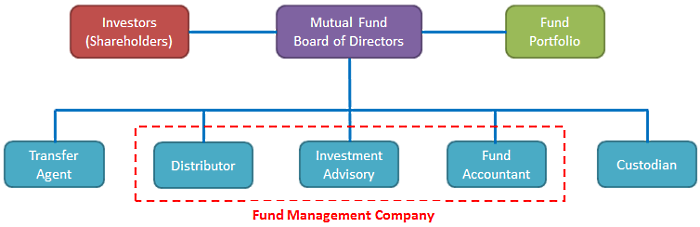

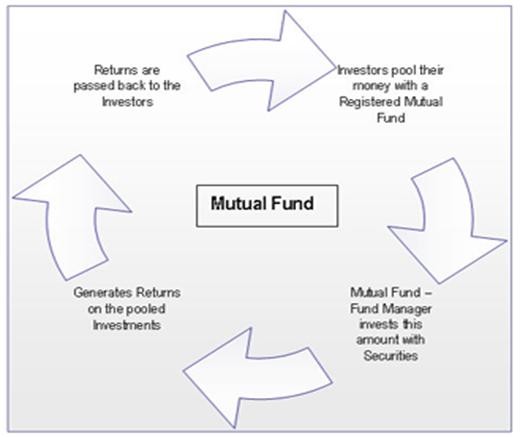

Basic structure

Distribution: load funds

Mutual funds sold by full service brokerages, banks, and commissioned advisors usually impose a sales charge on investors known as a sales load. The sales load may be paid upfront upon purchase, or deferred until an investor redeems fund shares; this deferred charge is often called a contingent deferred sales charge (CDSC). These sales charges are in addition to a fund’s expense ratio and any other transaction charges a fund may impose. Sales charges are usually labeled as different share classes of a fund, as follows:

- A-shares. A-shares impose a front end charge on initial investment. A fund issuing a-shares might impose a 5% load upon purchase; thus an investor committing a $10,000 investment to the fund would actually invest $9,500 in the fund with $500 going to the sales agent as a commissioned load. A-shares may also assess an additional 0.25% annual charge (known as a 12b-1 fee).

- B-shares. B-shares do not charge an upfront load. Instead the shares impose a back end redemption fee combined with a 1% annual charge (12b-1 fee).The redemption fee usually declines each year until it eventually reaches zero. The combination of the annual charge and the redemption fee assures that the full load is eventually paid. The exact rate at which these fees will decline will be disclosed in the fund’s prospectus. Ordinarily, b-shares convert to a-shares (and reduced 12b-1 charges) once the CDSC reaches zero.

- C-shares. C-shares do not charge an upfront load. C-shares are sold with a 1% CDSC for the first year, plus a 1% 12b-1 fee. The redemption fee is eliminated during year two. Unlike b-shares, c-shares never convert to a-shares; the investor pays the added 1% 12b-1 fee for as long as the fund is held. [5]

Distribution: no-load funds

A no-load mutual fund distributes its fund shares directly with an investor. Thus a no-load mutual fund does not employ the sales charge fees that load funds impose on shareholders. This is a distinct advantage for the do it yourself investor.

However a no-load fund may impose the following fees in addition to the expense ratio that all funds incur:

- Transaction fees. Mutual funds incur costs buying and selling securities for the fund (see Mutual funds: additional costs ). Some funds cover the costs associated with an individual investor’s transactions by imposing purchase fees and redemption fees directly on the investor at the time of the transactions to cover these costs. Unlike sales charges, these fees are usually paid back into the fund. A redemption fee may also be imposed as a means to deter short term market timing selling of a fund.

- Maintenance fees. Some funds may charge a separate maintenance fee for low balance fund accounts.

- 12b-1 fees. A no-load fund is permitted to charge a maximum 0.25% 12b-1 fee and still remain classified as a no-load fund. The main reason that a fund might impose a 0.25% is for purchasing access to a brokerage firm’s fund supermarket. The fee allows the brokerage to offer the fund as a No Transaction Fee fund in the supermarket.