Mutual Fund Owner s Guide

Post on: 13 Май, 2015 No Comment

Discussion Boards

It probably wasn’t very heartening to hear in our opener that the vast majority of mutual funds underperform the average return of the stock market. To add insult to injury, the chances are good that you own one of those underperforming mutual funds. Most Americans do. Oh, but wait, there’s more: Most 401(k) plans only let you invest in mutual funds. (We’re relentless, aren’t we?)

Chin up, Fools. There are some powerful forces in your corner, not the least of which is choice. Ultimately, you decide whether you will accept the substandard returns of your mutual fund or seek investing enlightenment and your right to market-matching returns.

Ahh, but how do you decide whether to stay or go? Remember that glossy binder you got when you signed up for your company’s 401(k) plan? Do you recall those quarterly mailings you’ve been getting from that mutual fund you invested in when you opened your IRA? (Hint: Check the bottom desk drawer or that file you labeled To Read Later.)

It’s hard to make yourself read those things as soon as they arrive (or ever, for that matter), but in all that paperwork lies some critical information. Every mutual fund issues a prospectus, which is written in the driest, most confusing, boring language possible. Somewhere in there it describes the fund’s investment policies and objectives, risks, costs (very important — that’s why we put it in bold), historical performance data, and various other legalese-encrusted tidbits. The prospectus, in essence, will describe the investment style of the fund.

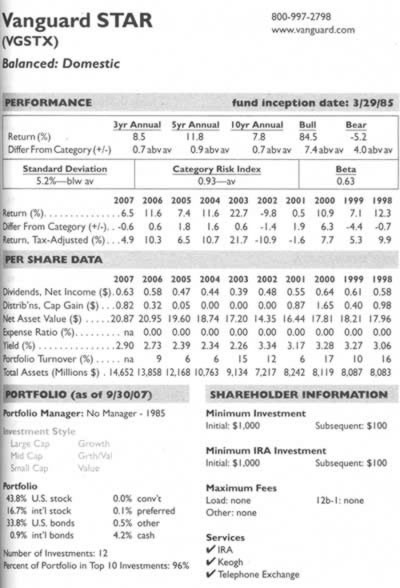

Nowadays, you can also find the essential information about mutual funds on various Internet sites. You can begin your research (once you’ve finished reading our little section) at Morningstar’s site, where you’ll find data and analysis on thousands of mutual funds.

Here are five specific things to look for in those quarterly and annual reports:

- Change in management. We spend a lot of words talking about how important the fund manager is, so make sure the manager you’ve chosen is still there. A change is inevitable at some point, of course, and it shouldn’t necessarily be a signal to sell. You need to be aware, however, of who is handling your money.

- Change in fees. This is another key element to watch. Mutual funds are not required to keep fees at the level at which you originally signed up. Your job as a fund shareholder is to make sure that your returns don’t suffer from fee creep.

- Change in style. If a fund renowned for buying slow-growth, high-dividend blue chips starts buying the latest wireless optical serving router start-up that just hit the market, sit up and take notice. Keep an eye on your fund’s holdings to make sure that they conform to what you think you bought — and to the label that the fund managers assigned it.

- A change in turnover. Keep a close eye on the turnover rate of any fund you own. If you want to or have to own mutual funds, look for funds with lower-than-average turnover rates — preferably no higher than 50% and hopefully much lower. For comparison, index fund turnover can be around 5% or lower.

- Change in performance. This is a tricky one. Occasional, or even somewhat frequent, underperformance is not unusual or unexpected for a good fund. Don’t bail on your funds just because they have a bad quarter, year, or even two years. Do track performance, though. If you start seeing poor five-year returns, then it may be time to start looking elsewhere.

When you see a fund make significant changes in any of these areas, it’s time to reassess your holding. That doesn’t mean that you sell automatically — some changes are for the better, or at least aren’t bad enough to suffer the ill effects of selling.

Make a pact with yourself to at the very least keep tabs on these five areas for the funds that you own. Heck, put a quarterly review date on your calendar. Make it as automatic as changing the oil in your car or putting a fresh box of baking soda in your fridge. When the red light on the dash goes on, or the stench of rotten broccoli overwhelms you, it may be too late. And so it goes for mutual fund investing.

The Perils of Selling

Unfortunately, selling a mutual fund can trigger a variety of costly events.

- If you hold the fund in a taxable account, you will have to pay capital gains taxes.

- Fund companies like to discourage selling, so some charge redemption fees or subject you to a back-end load.

- Even if you move your money to a different fund within the same mutual fund family (e.g. from one Fidelity fund to another), you will likely have to pay a sales commissions for your new fund.

Still, none of these things should discourage you from getting out of a real stinker. Just make sure you analyze all the costs before selling your funds. Here’s more on how to figure out whether it’s time to sell.

If you do decide to sell your fund, make sure that you aren’t stepping out of the frying pan and into the fire. Know what it takes to pick the best mutual funds.