Mutual Fund Investing The benefits for individual investors

Post on: 21 Июль, 2015 No Comment

Mutual fund investing offers many compelling benefits to individual investors. People from all walks of life, and even some institutional investors, have over $9 trillion invested in 8,000 U.S. stock and bond funds. The same features that make mutual funds appealing to these investors will serve you well, too.

Mutual funds provide the following benefits:

- Automatic diversification at various levels.

- Access to financial markets worldwide.

- Access to all major asset classes.

- A broad selection of fund types.

- A diversity of investing styles.

- Professional management.

- Elimination of the need for individuals to perform detailed and ongoing securities analysis.

- The option of making automatic investments and withdrawals.

- Many funds can be purchased with small initial and subsequent investments.

- No transaction fees if you pick the right place to open your account.

- No sales commissions if you choose no-load mutual funds or invest through a retirement plan that offers no-load funds.

Mutual fund investing eliminates the need for individual investors, such as you, to perform detailed securities analysis and make it possible for individuals to own broadly diversified portfolios of professionally managed assets with a minimal initial investment. Better investment diversification is available for larger, but still relatively small, portfolios.

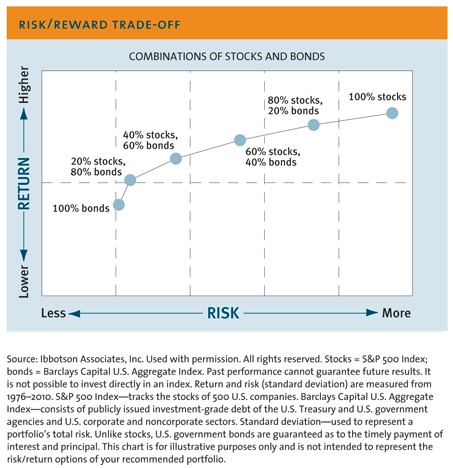

It’s hard to overemphasize the benefits of diversification. First, diversification is analogous to not putting all of your eggs in one basket. The greater your diversification within and across asset classes, the lower your risk. Next, diversification is how you achieve asset allocation, which accounts for over 90% of your success as an investor. Finally, there’s portfolio efficiency, which is the optimization of your asset allocation. These factors are covered in depth elsewhere on this site.

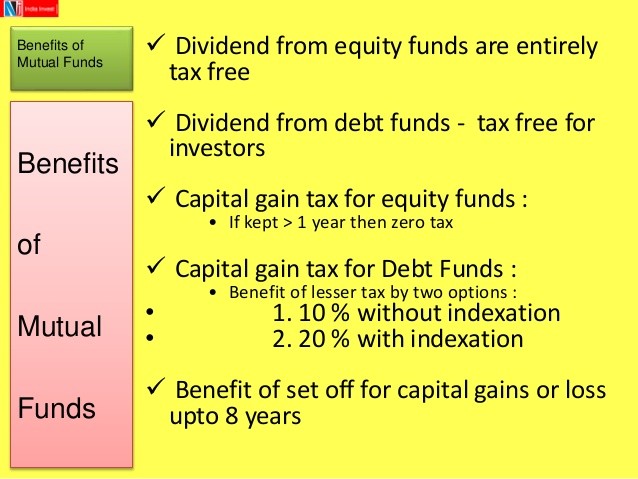

The benefits of professional management and comprehensive securities analysis come at a relatively small cost, as the cost is shared by thousands of shareholders. These services are covered by the annual management fees paid to the fund companies and are on average about the same as the standard 1% fee charged by most investment advisors. By carefully selecting actively managed funds and/or using index funds, you can keep this cost below 1%.

Automatic diversification is provided within the mutual funds’ respective categories by virtue of the fact that they tend to hold the shares of many different companies within their categories. This diversification virtually eliminates company-specific risk. However, there are a few funds that deliberately concentrate their investments in a relatively small number of companies. These funds necessarily have to be fairly small and they clearly state in their prospectuses that they employ this investing strategy. If you do your homework you shouldn’t accidentally end up with one of these funds in your portfolio. You may, however, decide that you’d like to own one or more of these concentrated funds. After all, Warren Buffett has done quite well with this strategy.

Mutual funds cover virtually all of the major asset classes, investing styles and every financial market in the developed and developing world. This is what really makes it possible for you to enjoy the same degree of diversification as the institutional investors and have a good shot at constructing a relatively efficient portfolio.

Depending on where you establish your account, you may not incur any transaction fees when you buy and sell shares. And, if you restrict your investments to no-load mutual funds, you will not incur any sales charges, which means 100% of your investable funds will be invested, rather than a portion being diverted to sales commissions. (Those of you who purchase mutual funds through a 401k or other employer-sponsored retirement plan may not pay a sales commission on funds that are sold with a load outside the plans. This is a good question for your plan sponsor.)

Mutual funds transaction expenses are merely a fraction of what one would pay a broker for an actively traded portfolio of individual securities. However, you’ll never see the transaction fees racked up by the buying and selling activity done by fund managers, it simply reduces the net asset value of the funds and thus your return. Fortunately, the transaction fees paid by mutual funds are minuscule compared to that which individuals have to pay, thanks to economies of scale.

Finally, mutual fund investing can be initiated with a relatively small initial investment, depending on which funds you choose to invest in. And even smaller minimums are required for IRAs. These minimums can be as low as $250 and $100, respectively.

In reality, you’ll be very limited in your selection if you try to achieve broad diversification with only a few thousand dollars to invest. A good strategy when you are just starting out is to get as much diversification as possible by constructing a portfolio of index funds.

Those of you who don’t have hundreds of thousands or millions of dollars to invest can achieve broad diversification for $50,000 or so, and adequate diversification for much less. Once your nest egg builds to be $100,000 or so, you can enjoy the level of diversification that institutional investors are accustomed to. Even if you do have substantial wealth, mutual funds are usually your best choice as an investment vehicle.

With all of these benefits, there is no need for you to even consider individual securities. That issue is discussed in Mutual Funds vs Stocks & Bonds .

1 2 3 4 5 6 7 8 9 10 11

Section Intro Next Section