Mutual Fund Fees Expense Ratios Loads and Share Classes

Post on: 10 Июнь, 2015 No Comment

By Jeremy Vohwinkle 8 Comments

Mutual funds are one of the most common investment tools for the average investor. Youll find them in your 401(k) plan, in your IRA, and everywhere in-between. Mutual funds are popular for good reason. They provide instant diversification without requiring a lot of money. Instead of having to pick all of the individual stocks you want to own and buy them yourself, you can simply purchase a share of a mutual or index fund and automatically get pieces of all the underlying companies. If youve recently rolled your 401k into an IRA you may have done so for other reasons, but reducing fees is the greatest benefit of this strategy.

Like anything, this convenience comes at a cost. Whether youre investing in an actively managed mutual fund or an index fund, it costs money to run these investments. Some funds charge up-front fees and recurring expenses, others charge a back-end fee, and some just charge a regular recurring fee. It can get confusing for a new investor but with a little help you can learn how to spot what type of fees youll be paying and how to minimize those fees. After all, the less you pay in fees the greater your overall returns will be.

Load vs. No-Load

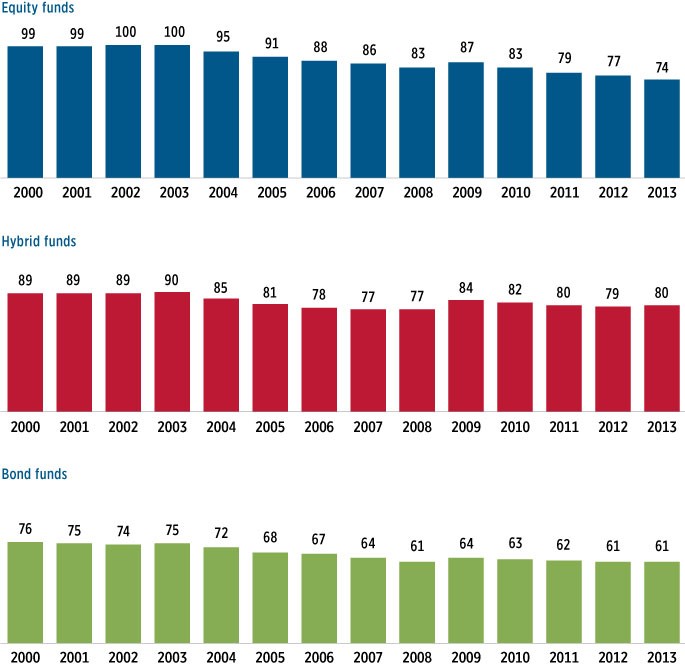

A load is one of the most important fees to watch out for. A load just means its an expense in addition to the underlying fund expenses. Typically these come in the form of front-end loads, often sold my financial advisers or brokers who work on commission. You pay the load up-front when you purchase the shares. Loads can vary greatly between fund companies, how much money youre investing, and more. But it isnt uncommon to see equity funds with a front load as high as 5.75%. To put that into perspective, if you wanted to invest $10,000 in ABC fund with a 5.75% load, youd immediately lose $575 to the front-load fee. Ouch! And thats in addition to the recurring annual expenses that may run higher than 1%.

The good news is that you dont have to use loaded funds. While nobody will stop you from purchasing shares in a fund with a front-load, youre typically going to be presented these funds by someone in the financial industry who works on commission. Thats because most of that load is a salespersons commission. So if you think about it, its no wonder they might try to steer you to a fund with a high load since they are going to instantly put a few hundred bucks in their own pocket. So you have to ask yourself whether the advice they gave you was worth that fee. In most cases, probably not. A fee-only financial planner wont steer you into loaded funds since they arent earning a commission based on how much money you invest and where, and instead earn money by charging you for the advice they provide.

What about if youre investing on your own? Obviously, you want to stay far away from front-load funds if youre investing on your own. Theres no need to throw money away to a one-time fee just for purchasing the fund. So, how do you spot funds with fees? Morningstar is my favorite tool for this task. It packages all of the important information on an easy to use page that highlights everything from return, fees, yield, and more. Here is an example of using Morningstar to pull a quote on the Franklin Income Fund (FKINX):

You can easily see the front load listed on the first page. This fund has a 4.25% front load. If you had typed in a no-load fund it would show 0.00%.

Stick to No-Load Funds

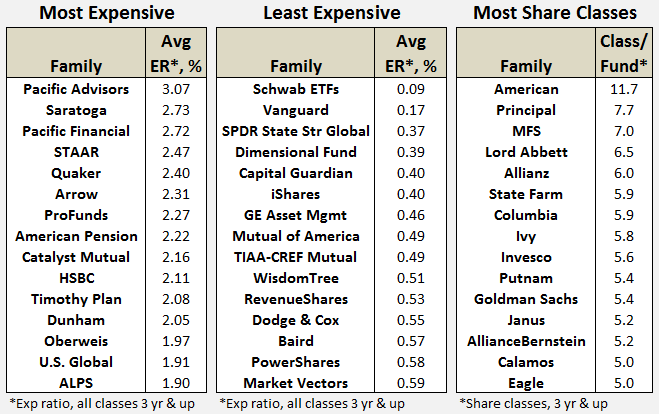

Its probably quite obvious, but you should stick to no-load funds. Theres almost never a situation where its worth losing a few percentage points off each investment just by investing in a load fund. Not sure where to start with no-load funds? While there are many options available youll probably end up with one of the four main no-load fund providers: Vanguard. T. Rowe Price. Fidelity. and Schwab .

If youre looking for a more comprehensive search, Ill again have to refer you to Morningstar and their Fund Screener. Here, you can easily select to only search no-load funds and then further narrow down your search by other criteria. Youll probably be amazed at how many no-load funds there actually are to choose from.

Expense Ratios

Youve found a no-load fund so that means youre all set, right? Not so fast. Loads are only one of the fees to look out for. While not all funds have loads, all funds do have expenses. These expenses are expressed in the form of an expense ratio. This makes it easy to compare apples to apples when looking at multiple funds since the fee is shown as a percentage. Looking at the example above with the Franklin Income Fund youll see the expense ratio is 0.62%. That means if you had $10,000 invested in this fund for a year it would essentially cost you about $62.

Unlike a front load you dont see this expense deducted directly from your account. Instead, the expenses are built into the funds overall return. So if you pull up your account statement and it shows that your fund had a 4.3% return, that is your net return after expenses already. You wont have a quarterly or annual fee deducted from your account. Thats why these expenses can be tricky because they are almost hidden and people dont really consider the effect they have on returns.

So, make sure youre also looking at a funds expense ratio before making an investment. The lower the expense the better. If youre looking for the absolute lowest fees you should probably stick to index funds. Since these arent actively managed and simply track an index they can keep costs down. This means youre looking at usually only 0.10-0.25% expense ratios on index funds. Once you get into actively managed funds its a different story. You might find one fund charging 0.3% and another charging 1.3%, which can make a huge difference.

Share Classes

While this wont apply to most of you simply investing in no-load funds, it is important to be aware of the different fund classes in the event you find yourself talking to a financial advisor or otherwise who might bring them up. While not as common today as they were, there are three main types of share classes. Each share class invests in the same assets, but the difference lies in how the load is applied.

- Class A Your standard front-end load funds as discussed above.

- Class B Deferred sales load. No up-front load, but if you sell prior a predetermined holding period youre charged a back-end load.

- Class C A fixed load applied every year.

Thankfully, class B and C shares are heading the way of the dinosaurs, but that doesnt mean they arent still used by some financial salesmen. They are often used to encourage an investment where they can still earn a commission by putting you into something that doesnt appear to have a big front load like A shares. While none of these loaded share classes are good, you most certainly want to stay away from B and C.

In addition to these primary share classes you may also stumble across other odd share classes in your research. You might see something like R shares or Z shares. These are typically special share classes offered by a fund company to be used in employer-sponsored retirement plans, sold by advisors, or to institutions. You may not be eligible to invest in these classes, so make sure you check the details and investment requirements.

Recap

As you can see, understanding the fees associated with your funds isnt all that difficult, but you can probably also see how its easy to underestimate the impact the fees can actually have on your returns. An expense ratio of 0.6% might not sound like much, but when youre talking about tens or hundreds of thousands of dollars over 30+ years that can significantly eat away at your return. And with the different share classes, loads, and no-load funds available you can see how some people, namely commission brokers, will steer you into a fund that could end up costing you.

Hopefully now that youre armed with the basics you can make sure youre getting the most out of your funds, both with new purchases and existing holdings. Now would be a good time to dig into the details of your current investments and see how much they are costing you. If it seems high, you can always use something like Morningstar to explore your other options. And if youre currently invested in expensive funds it might be time to look for alternatives. You can always open a free account at a low-cost broker such as TradeKing and start investing in low-cost index funds.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D80&r=R /%

My name is Jeremy Vohwinkle, and I’ve spent a number of years working in the finance industry providing financial advice to regular investors and those participating in employer-sponsored retirement plans.