Mutual fund fees

Post on: 23 Июнь, 2015 No Comment

Fees reduce the return you get on your investment in a mutual fund. You may pay varying sales charges, other transaction fees and account fees depending on which funds you buy, how you buy them and what accounts you hold them in. You don’t pay fund expenses directly, but they affect you because they reduce the fund’s returns.

Types of fees and expenses

- Sales charges

- Other transaction fees

- Switch fees

- Short-term trading fees

- Redemption fees

- Account fees

- Registered plan fees

- Minimum account balance fees

- Fund expenses

The fees and expenses a fund pays are deducted from the fund’s assets before a fund’s returns are calculated and published.

- Management fees

- Operating expenses (or a fixed administration fee)

- Trailing commissions (paid from management fees)

- Trading costs

- Incentive or performance fees

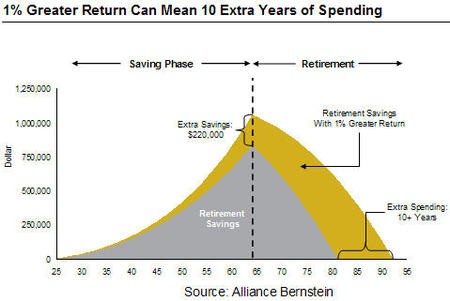

Carefully review the fees and expenses of any funds you are considering, even for no-load funds. Even small differences in fees can translate into large differences in returns over time. You can find information about fees in a mutual fund’s Fund Facts and in its simplified prospectus. By law, a mutual fund company must prepare and file these disclosure documents with the securities regulator. Beginning June 13, 2014, mutual fund companies are required to deliver Fund Facts within 2 days of buying a conventional mutual fund. The simplified prospectus for a mutual fund will continue to be available to investors upon request. Learn more about disclosure documents .

Top 3 costs

1. Sales charges

You may pay a sales charge when you buy or sell units or shares of a fund. These sales charges are also known as loads. Funds may be offered with a front-end load, back-end load, low load or no load. These sales charges are set by the mutual fund manufacturer.

If you have a fee-based account, you don’t pay a sales charge when you buy and sell funds. Instead, you pay a single client advisory fee (typically negotiated between 1% and 2%) every year to your advisor.

Find out which sales charge options are available for the funds you’re interested in. Funds may be offered with a front-end load, back-end load, low load or no load.

4 types of sales charges

- Front-end load or initial sales charge (ISC) – Some mutual funds charge a fee when you buy your units or shares. This is a percentage (up to 5%) of the amount that you are investing in the fund. The fee is paid to the investment firm that sells you the fund. You can negotiate this fee with your advisor.

- Back-end load or deferred sales charge (DSC) – Some funds charge a fee of up to 6% when you sell your units or shares. Here’s how it works:

- The longer you hold a fund with a DSC, the less you’ll be charged when you sell it. The fee declines every year according to a fixed schedule.

- If you hold it long enough (usually between 5 and 7 years), you won’t pay a fee when you sell your units or shares.

- Some fund companies may also let you take some of your money (usually 10%) out of the fund each year without charging you a fee.

- Your advisor’s firm receives commission (usually about 5%) up front from the mutual fund company when you buy the fund. Your advisor receives part of this commission. Any deferred sales charge you pay goes to the mutual fund company.

- Low load or low sales charge (LSC) – Low load funds charge a lower sales charge (up to 3%) when you buy your units or shares, and a lower redemption fee (up to 3%) when you sell them. You usually won’t have to pay a redemption fee if you hold your units or shares for at least 3 years.

- No load – A no load fund doesn’t charge a fee when you buy or sell its units or shares. A no load fund may not always be a better deal than a load fund. You should compare the MER and performance of each fund before you decide.

Understanding fund series and classes

Many mutual funds are offered in different series or classes, which are identified by a letter. This letter tells you about its fee structure and other features. There are no set rules about which letter goes with which fee structure, but here are a few general guidelines:

- Series A – Most investors buy Series A units or shares, which may have one or more sales charge options. MERs for this series are higher than Series F. That’s because investment firms that sell you the fund usually receive commissions and trailing commissions, which are costs to the fund.

- Series D – These have reduced trailing commissions and cater to investors who purchase them through the discount brokerage channel.

- Series F – Series F units or shares tend to be available only through an advisor, often through a fee-based account where you pay a single annual fee for services or through a fee-for-service plan. You negotiate and pay your fees directly to the advisor. Your fees are based on a percentage of the total assets the advisor manages for you. Mutual fund companies don’t pay any commission to the advisor since you’re already paying a fee. This keeps MERs lower than those for Series A units or shares.

- Series I – Series I units or shares are usually aimed at investors with a high net worth, of more than $500,000 to invest. But that amount can vary depending on the mutual fund company. Series I may also be aimed at institutional investors such as pension plans.

- Other series – Fund companies may assign any letter of the alphabet to a series of mutual funds with special conditions. They tend to offer these funds only to selected investors. For example, after various fund reorganizations and mergers, a mutual fund company created Class Y and Z series for investors who previously owned the funds involved.

2. Management fees and operating expenses (MER)

The fund’s management fee and operating expenses make up a fund’s management expense ratio or MER. They are paid by the fund, and are expressed as an annual percentage of the total value of the fund.

MERs can range from less than 1% to more than 3%. While you don’t pay these expenses directly, they affect you because they reduce the fund’s returns. This can add up over time.

The management fee paid to the fund management company includes:

- overseeing the fund,

- hiring a portfolio manager to make the investment decisions, and

- hiring other companies to assist in the administration of the fund.

Operating expenses include:

- bookkeeping and administrative fees

- marketing costs

- filings with the provincial securities commissions

- legal fees

- audit fees

- custodian fees

- GST/HST.

Before you buy a fund, check its MER and performance, and compare them to similar funds. The MER is charged whether or not the fund does well.

3. Trailing commissions

Most mutual funds pay a trailing commission (or trailer fee) each year to the company that sold you the fund. They pay this commission for as long as you hold the fund. The rate of the trailing commission is set by the fund manufacturer.

Here’s how it works:

- It’s paid out of the fund’s management fee, so it’s reflected in the fund’s MER.

- It typically ranges from 0.25% to 1.5% of the value of your investment each year.

- It is to pay for the services and advice the company and the advisor provide to you.

- The company may pay all or part of the commission to your financial advisor.