Mutual Fund Fact Sheet

Post on: 9 Август, 2015 No Comment

Identification

Mutual funds are large pools of capital created by combining the investments of a number of individuals. The money is invested in a portfolio of securities based on the strategies and goals of the particular fund, with investment decisions made by a professional fund manager. The price of shares in a mutual fund is determined by dividing the net asset value (NAV) of the fund by the number of shares outstanding.

Expense Ratio

A mutual fund’s operating expenses, including management salaries and administrative costs, are summarized by the expense ratio. The expense ratio is the percentage of a fund’s assets that go toward covering these costs each year. Transaction costs—fees for buying shares of a stock, for example—are not included in the expense ratio. Some funds do include some or all of their marketing costs as a 12b-1 fee. For the investor, comparing the expense ratio is a good tool to assess how well the fund is managed compared with its earnings performance.

Loads

In addition to the expense ratio, some mutual funds charge loads. A load is a sales commission paid to brokers or financial advisers for promoting the fund. The load is paid out of the money you invest, up-front when you buy shares or later when you liquidate your investment. According to Michael Weiss, CFA (The Lowdown on No-Load Mutual Funds) the evidence shows returns on load funds are no better than for no-load funds, if as good.

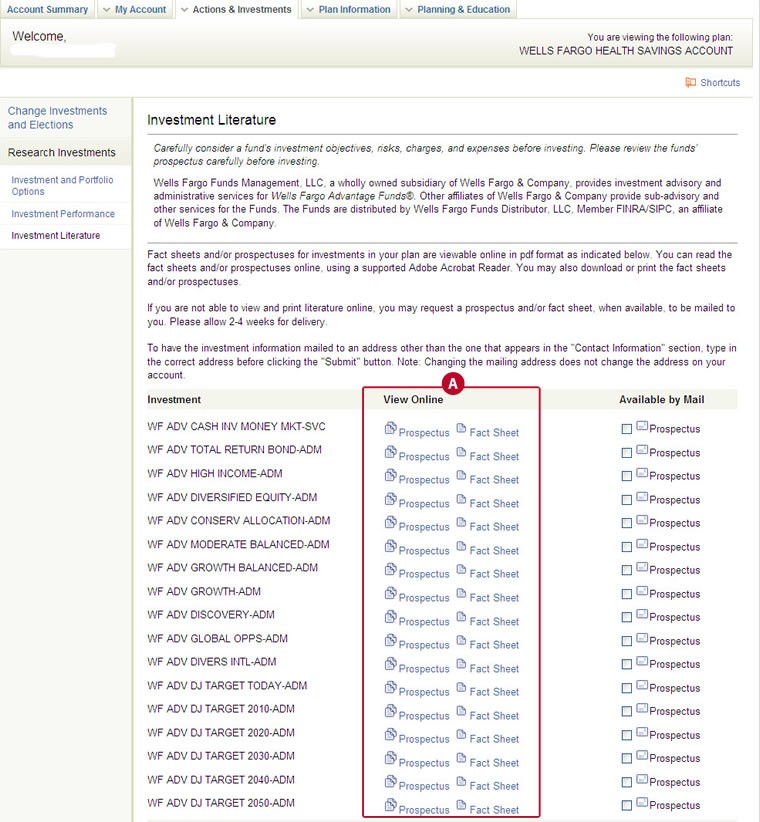

Prospectus

Any investor considering investing in a mutual fund should obtain and read the fund prospectus. This document is required by the Securities and Exchange Commission and discloses details of the funds operation. The prospectus includes the fund’s performance history for the past 10 years, all fees (including the expense ratio and loads) and information about the fund manager and investing philosophy. The prospectus is usually available for download on the fund’s website. If not, you can contact your broker or the fund, and request a copy.

Money Market Funds

References

Resources

More Like This

How to Calculate Mutual Funds

S&P 500 Index Fund Vs. Mutual Funds

What Is Good for Joint Pain?

You May Also Like

Other People Are Reading. The Best Mutual Funds for Retired People; Safe Investments for Seniors; Print this article; Certificates of Deposit.

You can find mutual fund fact sheets at the website of independent research firm Morningstar, or at individual mutual fund company websites.

A mutual fund's fact sheet often contains information on risk versus return as represented by four statistics: alpha, beta, standard deviation and.

Mutual fund companies are subject to a variety of regulations that cover the activities of the investment company and the securities held.

Are ETFs Closed or Open Mutual Funds? ETF Guide; DIA ETF Fact Sheet; Comments You May Also Like. ETF Definition. ETF is.

A balance sheet hedge is the denomination of assets or liabilities designed to reduce or eliminate the. Hedge funds pool funds.