Mutual Fund Expense Ratios & 12b1 Fees How Much Attention Should They Get

Post on: 25 Июнь, 2015 No Comment

There has been a lot of media hoopla about expense ratios. Many financial advisors and journal articles have focused on the expense ratios in mutual funds. 401k plan trustees are cautioned to shop for low expense ratios as part of their fiduciary responsibility to their plan participants.

After more than twenty years in the investment advisory business, I am still amazed by the amount of emphasis individual investors and 401k plan trustees put on a mutual fund’s expense ratio. Almost every individual or plan trustee I have met, not only asks about expense ratios, but focuses on them, as one of their main criteria for selection of mutual funds.

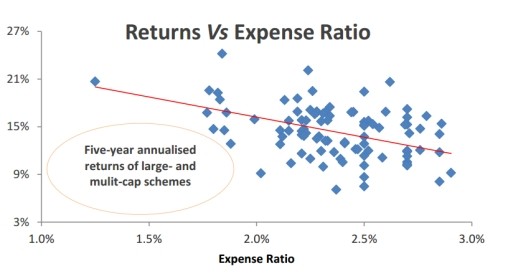

Has the focus on expense ratios caused the public to lose focus of more critical financial measures, such as performance? I believe that all the media and advisor focus that has been given to expense ratios has inadvertently caused a misplaced emphasis by the public. Putting the value of expense ratios in context with other financial measures is critical when performing an analysis to select mutual funds.

In order to better understand the place of an expense ratio, lets look at what it is and where it fits in an analysis. Then, we will take a brief look at some standard measures that should be the main focus of your analysis.

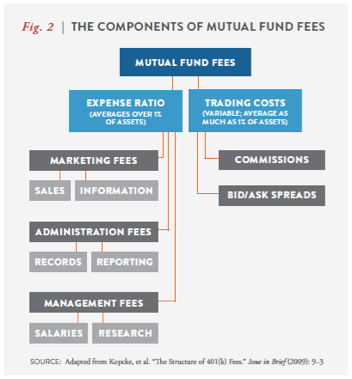

What is an expense ratio in a mutual fund? Morningstar, Inc. defines expense ratio as, the percentage of a fund’s assets paid for operating expenses and management fees, including 12b-1, administrative fees, and all other asset-based costs incurred by the fund, except brokerage costs. Sales charges are not included in the expense ratio. The expense ratio is useful because it shows the actual amount that a fund takes out of its assets each year to cover its expenses.

A 12b-1 fee is the maximum annual charge deducted from fund assets to pay for distribution and marketing costs. 12b-1 fees are usually set on a percentage basis in the range of .25% to 1.00% of assets per year but occasionally it is a flat amount. All 12b-1 fees are something of a hidden charge, because they are taken out of the NAV (Net Asset Value). 12b-1 fees are included in the expense ratio.

Fund expenses are reflected in the funds NAV. NAV is the value of a fund after all costs, divided by the total number of outstanding shares. Simply put, the NAV is the fund’s share price or what the fund is worth per share on any given day. A fund’s performance is based on the changes in its NAV from period to period. So, a fund’s performance takes into account the expense ratio and the 12b-1 fees but not sales charges.

12b-1 fees are included in the expense ratio and the expense ratio is included in a fund’s performance. It is important to understand that a mutual fund’s performance numbers include 12b-1 fees and the expense ratio and are not costs that reduce the published performance numbers. It should be apparent that performance is more critical than the expense ratio because the expense ratio is merely a part of the calculation for performance.

Then, why is there so much discussion about the expense ratio? The expense ratio shows you how much a fund takes out of its assets each year to cover its expenses. Tracking a fund’s expense ratio over time can provide an indication of whether the fund’s expenses are trending higher or lower. Smaller funds and international funds usually have a higher expense ratio than larger funds. Since costs are more controllable than performance it is a natural place to look for improvement in a fund. Also, the lower the costs of a fund the less a fund manager needs to overcome with the fund’s performance. Unfortunately, the assumption often is that lower costs should mean better performance. It would, IF everything else was equal, but it is not. Therefore we need to look at other factors like the Standard Measures.

By comparing the expense ratio of various fund’s of the same kind to one another, you can determine which funds have higher expenses. Higher expenses may indicate that a fund manager needs to take more risk to achieve an equivalent performance than a fund with lower costs, especially in bond funds. These factors may explain a fund with a high expense ratio that has higher risk or under performance. The expense ratio should be used to help identify the cost trends of a fund. The expense ratio could alert you to the possibility of a fund taking higher risk than a comparable fund with a lower expense ratio in order to attain the same performance, but it should not be a major factor in the decision making process.

Although performance is an important factor in the evaluation of a fund, comparing performance of a fund to another fund in the same asset class without looking at the risk taken by each of the fund’s to achieve their respective performances could be just as misleading as placing too much emphasis on the expense ratio.

To illustrate how focusing on the expense ratios could lead to a poor investment decision, let’s look at the information from two fund’s in the same asset class. The information in the example came from Morningstar data dated April 30, 2004: Investment Option #1 — Vanguard Growth Index Adm

Investment Option #2 — American Funds Amcap R4

Both are large cap growth fund’s with a 5 Star Rating, the highest Morningstar rating.

Vanguard Growth Index Adm has an expense ratio of .15% per year.

American Funds Amcap R4 expense ratio is .81% per year.

Vanguard Growth Index Adm has no 12b-1 fees incorporated in its expense ratio while the American Fund Amcap R4 fund has .25% per year of 12b-1 fees as part of its .81% expense ratio.

On the surface it appears that the Vanguard Growth Index Adm fund would be a better buy for the large cap growth asset class because they are both 5 star rated and the Vanguard Growth Index Adm’s expense ratio is significantly less than the American Funds Amcap R4 fund.

But, by looking further at some Standard Measures like Standard Deviation, Beta, Alpha, Sharpe Ratio, R-squared and finally the Mean (average) Return over 3, 5, and 10 years, the picture looks a lot different.

Standard Deviation is a measurement of dispersion about an average, which, for a mutual fund depicts how widely the returns varied over a certain period of time. When a fund has a high standard deviation, the predicted range of performance is wide, implying greater volatility. Standard Deviation is appropriate for measuring risk if it is for a fund that is the investors only holding.

Beta is a measure of a fund’s sensitivity to market movements. It is a relationship of a fund’s movement vs. an index it is associated with. Beta is particularly appropriate when used to measure risk of a combined portfolio of mutual funds, i.e. a Beta of .85 indicates that the fund’s excess return is expected to perform 15% worse than the market’s excess return during up markets and 15% better during down markets.

Alpha is a measure of the difference between a fund’s actual return and its expected performance, given its level of risk as measured by Beta. It represents value added or subtracted by a fund or portfolio manager. Higher R-squared lends more credibility to the Alpha score.

Sharpe Ratio is a risk-adjusted measure. The higher the Sharpe ratio, the better the fund’s historical risk-adjusted performance. The Sharpe Ratio can be used to compare two fund’s directly on how much risk a fund had to bear to earn excess return over the risk-free rate.

R-squared reflects the percentage of a fund’s movements that can be explained by movements in its benchmarks index. An R-squared of 100 indicates that all movements of a fund can be explained by movements in the index. R-squared can be used to ascertain the significance of a particular Beta. Generally, higher R-squared, numbers closer to 100, will indicate a more reliable Beta figure.

The comparison of the two funds for the past 3 years is as follows: