Mutual Fund Expense Ratio Mutual Fund Fees

Post on: 28 Март, 2015 No Comment

What is a mutual fund expense ratio? Learning about the various mutual fund fees

Is it better to make more money or spend less? Of course, both practices help grow your wealth. For investors, finding a balance between making more and spending less can be a challenge. Sometimes, saving money today can cost you money down the road.

How can you be confident that you are getting the value and quality you need with your mutual fund investments? Learning about the various fees and expenses associated with mutual funds will help you better determine whether a fund is worth its cost.

What you actually get

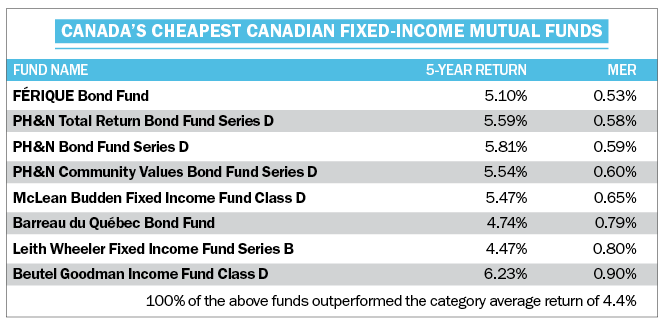

When choosing a fund, consider the actual return once all the expenses have been paid. For example, if your fund makes five percent this year and charges you two percent in management fees, your actual return is only three percent. Sometimes it is difficult to decipher what youre being charged. For instance, rather than charging upfront commissions, some mutual fund companies also take operating expenses directly from the funds assets. Though it may be labeled differently, its still a fee.

Because fund companies have no legal limit on their expenses, competition plays an important role in keeping prices in check. Still, with no set structure and the fact that some funds perform better than others, it can be difficult to see where to get the most value for your dollar. Keep and review your fund performance reports, making sure to understand what fees you are paying and what your investments are paying.

Operating expenses

Each fund has its own unique operating expenses. Index funds and exchange-traded funds (ETFs) will usually have lower expense ratios than an actively managed mutual fund. But remember, lower expenses dont automatically mean a better return. The right actively managed fund may be worth the extra cost.

The types of expenses are numerous: marketing and distribution expenses (12b-1 fees), investment advisory fees, brokerage fees, legal fees, accounting fees and so on. One common expense is trading costs. Through buying and selling, a fund manager has the potential to incur significant trading costs on your behalf. While it can be important to adjust positions based on market conditions, unnecessary or frequent trading is a concern.

Choosing a fund

You want to look for funds that have low operating expenses, but not without also considering their performance. Compare multiple yearly returns for the last ten years. Be sure to include the various fees and expenses in your calculations. Small differences in cost grow large with time.

The manager of a fund can be as important as the funds holdings. How frequently are a funds holdings bought and sold? Remember, more activity incurs more fees. Find a good balance. Does the funds manager have a history of investing money successfully? What is the managers investing style and theory? Is it risky or conservative?

It is important to understand a funds expenses as well as its potential. Gaining the necessary knowledge may seem overwhelming at times. Your financial future is importantyou should know what youre paying for and what youre getting back. Engaging an investment advisor can help answer specific questions and make certain you are on the right path.

What to do next

- Keep and regularly review your fund performance reports.

- You are paying for operating costs with your investmentsmake sure you understand what they are.

- When selecting an investment, be sure to include the various fees and expenses in your calculations.

- Engage an investment advisor who can answer your questions and work with you to determine your specific investment path.