Mutual Fund Cost Calculator

Post on: 17 Июнь, 2015 No Comment

About the Mutual Fund Calculator

Contents

Q1. What is the Mutual Fund Cost Calculator?

Q2. Why has the SEC created this program?

Q3. What is included in total costs?

Q4. What costs are not included in the Cost Calculator?

Q5. How do you access the Cost Calculator?

Q6. What kind of computer or other equipment do you need?

Q7. Where do I get the information to enter into the Cost Calculator?

Q8. Where can I find definitions of unfamiliar terms used in the calculator?

Q9. Can the Cost Calculator download information directly from any mutual funds or mutual fund rating agencies?

Q10. Does the Cost Calculator cost anything to use?

Q11. Who can I contact with questions?

Q12. Where can I get more information about mutual funds and fees?

Q13. The fee table of my fund has two numbers for operating expenses. Which should I use?

Q14. I don’t remember which class I invested in. How can I find out?

Q1. What is the Mutual Fund Cost Calculator?

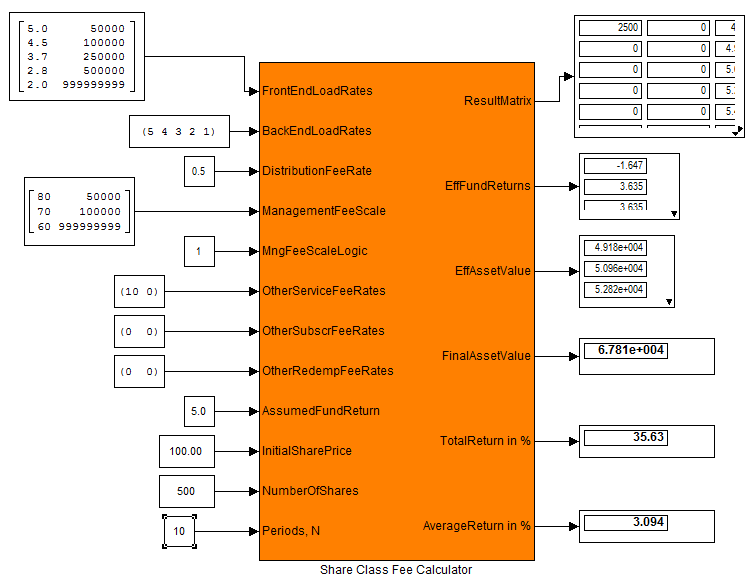

A1. The SEC’s Mutual Fund Cost Calculator is an easy-to-use computer program that allows investors to compare the total costs of owning different mutual funds. It also provides definitions for terms that users will come across while investing in mutual funds.

Q2. Why has the SEC created this program?

A2. The Cost Calculator serves two primary purposes. First, it enables investors to compare the cost of owning funds before buying them. Second, it clearly demonstrates the effect that fees have on foregone earnings and total costs.

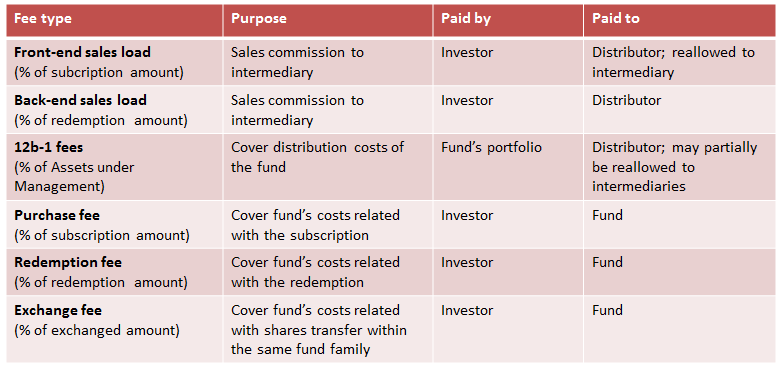

Q3. What is included in total costs?

A3. Total costs is the sum of the fees paid plus the foregone earnings. Fees include payments made when the account is opened or closed as well as operating expenses. Once these fees are paid to the fund company rather than being invested in the fund, an investor foregoes earnings. Therefore, the higher the fees, the higher foregone earnings there will be.

Q4. What costs are not included in the Cost Calculator?

A4. This program does not include all fees that you may be charged (for example, exchange fees, or account maintenance fees). These fees, however, are relatively small. In addition, deferred sales charges (discussed later in the Cost Calculator) are based on the lesser of the initial investment or the values of the investment at redemption, but some funds may base the charge solely on the initial investment.