Mutual Fund Basics

Post on: 24 Апрель, 2015 No Comment

Mutual Fund Basics

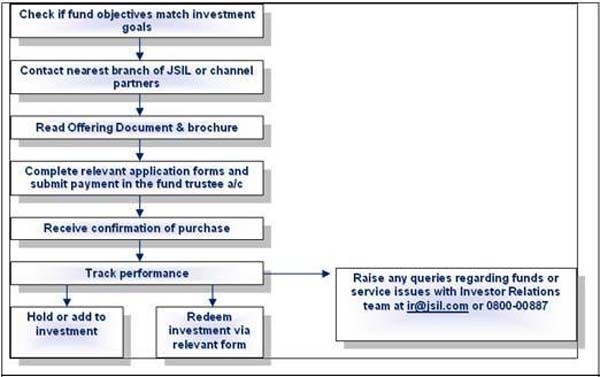

Buying Mutual Funds

Fund shares may be purchased on any business day, which is any day the New York Stock Exchange is open for business and normally ends at 4 p.m. New York time. Generally, the Exchange is closed on weekends and national holidays. The share price you pay will depend on when Nuveen receives your order. Orders received before the close of trading on a business day will receive that day’s closing share price, otherwise you will receive the next business day’s price.

Through a Financial Advisor

You may buy shares through your financial advisor, who can handle all the details for you, including opening a new account. Financial advisors can also help you review your financial needs and formulate long-term investment goals and objectives. In addition, financial advisors generally can help you develop a customized financial plan, select investments and monitor and review your portfolio on an ongoing basis to help assure your investments continue to meet your needs as circumstances change. Financial advisors are paid for ongoing investment advice and services either from fund sales charges and fees or by charging you a separate fee in lieu of a sales charge. If you do not have a financial advisor, call (800) 257-8787 and Nuveen can refer you to one in your area.

Investment Minimums

The minimum initial investment is $3,000 ($2,500 for a Traditional/Roth IRA account; $2,000 for an Education IRA account; $100 through systematic investment plan accounts) and may be lower for accounts opened through certain fee-based programs. Subsequent investments must be in amounts of $100 or more. The funds reserve the right to reject purchase orders and to waive or increase the minimum investment requirements.

Systematic investing allows you to make regular investments through automatic deductions from your bank account, directly from your paycheck or from exchanging shares from another mutual fund account (simply complete the appropriate application). The minimum automatic deduction is $100 per month. There is no charge to participate in each fund’s systematic investment plan. You can stop the deductions at any time by notifying your fund in writing. To do this, simply complete the appropriate section of the account application form or submit an Account Update Form.

From Your Bank Account

You can make systematic investments of $100 or more per month by authorizing us to draw preauthorized checks on your bank account.

You can make systematic investments by authorizing Nuveen to exchange shares from one Nuveen mutual fund account into another identically registered Nuveen account of the same share class. One of the benefits of systematic investing is dollar cost averaging.

Because you regularly invest a fixed amount of money over a period of years regardless of the share price, you buy more shares when the price is low and fewer shares when the price is high. As a result, the average share price you pay should be less than the average share price of fund shares over the same period. To be effective, dollar cost averaging requires that you invest over a long period of time and does not assure that you will profit.