Mountain Steps Investment Strategy Diversification (Diversify)

Post on: 2 Июнь, 2015 No Comment

Investment Strategy: Diversification (Diversify)

Diversification is one of the most basic investment strategies and one of the most easiest to implement. The idea is that you diversify the types of investments you have so you spread out the risk among them. You don’t put all your eggs in one basket, so to speak. If this sounds familiar it’s because in addition to being an investment strategy — diversification is a good general principle to live by. The Rule Of Threes is a form of diversification, but instead of diversifying your investments, you are diversifying your sources of food, water, shelter, and heat. Another area of life for diversification might be your skills — having a variety of skills might help you have more opportunities for a variety of careers or jobs if your current job disappears.

But with investing according to Investopedia.com :

What Does Diversification Mean?

A risk management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Diversification strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Therefore, the benefits of diversification will hold only if the securities in the portfolio are not perfectly correlated.

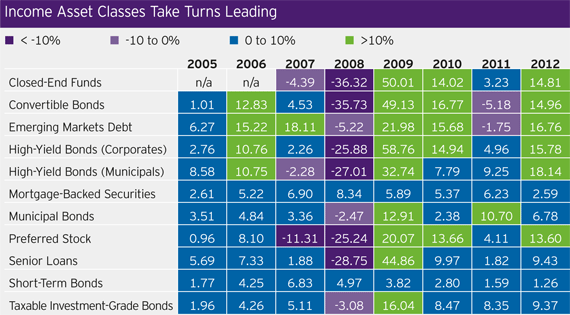

So — for investing instead of only having one or two types of investments you might have more than that. You might have investments in Cash, Stocks, Mutual Funds, Real Estate, Precious Metal. In in each category you might even diversify further — You might have Conservative Mutual Funds, Medium Mutual Funds, Aggressive Mutual Funds, Growth Mutual Funds. For Precious Metals you might diversify into Gold, Silver, Platinum, even into metals such as Copper or Aluminum. With these (For example Gold) you might diversify into Physical Bullion, Coins, ETF’s, Mining Stocks, GoldMoney, etc.

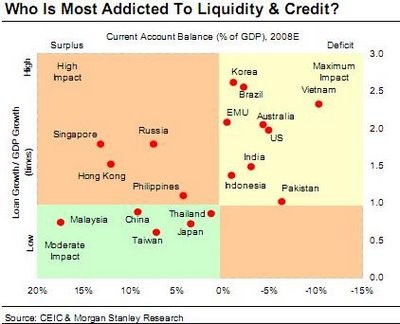

The idea is to spread the risk so you are not dependent on just one area. There are some real life examples of these dangers. The stock market is basically down by 50% from the high last year. And anyone who has a 401K plan is effected, regardless of whether they personally did any trading in the markets. If these people only had 401K plans and no other types of investments they are probably hurting pretty bad right now. People in Zimbabwe who only had cash and no other types of investments have literally seen their investment destroyed.

This brings up another point. Once you are diversified you may need to move investments around if you think one area is at risk of decreasing extensively. There are some people last year who felt a credit bubble was taking place and diverted or closed their 401K funds — they managed to protect their assets.

Lastly, any Financial Advisor who simply wants you to focus on one or two investments is putting you are at high risk. They should know better. You might want to consider finding a different advisor.

Short Term Goal: Understand about the investment strategy of Diversification and apply it to your life.