Money Market Mutual Funds Proposed Changes

Post on: 3 Июнь, 2015 No Comment

A Little Background

Money market funds are mutual funds that hold very liquid, short-term investments. They provide an alternative to bank deposits for individual investors, although unlike bank deposits, they are not insured by the Federal Deposit Insurance Corporation. They also serve as a source of financing for financial institutions and the capital markets, since the money funds invest in commercial paper, Treasury bills, and various short-term instruments issued by banks and others.

Money market mutual funds are highly popular with very risk-averse individual investors because they aim to hold the net asset value (NAV) of their shares steady, that is, at $1.00 per money market fund share. Over the years, the money funds have rarely failed to maintain stable NAVs. Should a money fund fail to do so, it is said to “break the buck”.

To be sure, the money funds are required to reprice their shares when the market value of the securities held by the fund declines sufficiently to cause each fund share to fall to less than $0.995. In practice, when a money fund appeared likely to break the buck in the past, its mutual fund parent company has almost always come to the rescue.

However, there have been a few exceptions, notably in September, 2008, when Lehman Brothers filed for bankruptcy. A sizable money fund, The Reserve Primary Fund, held $785 million of Lehman’s debt. Reserve’s money fund shareholders, fearing losses, rushed to redeem their shares. The Lehman debt represented only about 1% of the fund’s assets, but Reserve wasn’t able to absorb the loss and it didn’t have a rescuer, so the Securities and Exchange Commission (SEC) stepped in, suspending redemptions of the fund to allow it to be liquidated in an orderly manner.

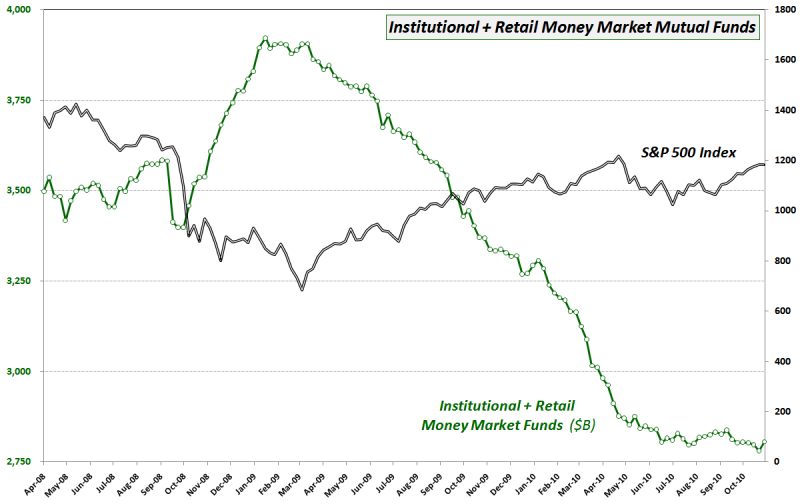

To stop runs on the money funds and make the funding markets more liquid, the U.S. Treasury and Federal Reserve launched temporary initiatives in the fall of 2008 to guarantee the value of participating money funds and make credit available to banks to support their purchases of high-quality commercial paper from the money funds. Following the expiration of these programs, the SEC took additional measures to strengthen the money funds.

While the above measures have helped, various government entities feel that the money funds are still structurally vulnerable to runs. In its Proposed Recommendations Regarding Money Market Mutual Fund Reform. the Financial Stability Oversight Council (FSOC), an organization created by the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act to monitor risks in the financial system, enumerates some of the industry’s weaknesses.

For one, the money funds tend to attract very risk-averse investors who are prone to redeem their shares at the first hint of a possible decline in the value of the securities held by the money fund. Moreover, those that redeem their shares early on, the “first movers”, are able to redeem their shares “at the customary stable share price of $1.00, rather than at a price that reflects the reduced market value of the securities held by the MMF”. Those who aren’t as quick to redeem their shares incur losses. This first mover advantage tends to destabilize the money funds.

In addition, the FSOC also warns that “MMFs are highly interconnected with the rest of the financial system and can transmit stress throughout the system because of their role as intermediaries, as significant investors in the short-term funding markets, as potential recipients of economic support from the financial institutions that sponsor them, and as important providers of cash-management services”. The money fund industry is also concentrated, with a small number of money funds accounting for a significant portion of the industry’s assets. Moreover, the FSOC notes that, as of September 30, 2012, “three large U.S. banks provided liquidity or credit support for approximately $100 billion of securities held by MMFs”.

Reform Recommendations in a Nutshell

The FSOC first proposes that money funds switch from a NAV fixed at $1.00 a share to a floating NAV based on the value of securities in the fund’s portfolio, similar to other types of mutual funds. The goal is to reduce the likelihood that investors might rush to redeem their shares “when faced with the prospect of even modest losses”.

The second recommendation would require the money funds to maintain a buffer of up to 1% of a fund’s assets to absorb daily changes in the value of securities in the fund’s portfolio. Investors with large fund balances might also face some delays in redeeming their fund shares. The idea is to strengthen the money fund’s ability to withstand day-to-day fluctuations in the value of the fund’s underlying assets. The redemption delays aim to reduce the likelihood of large redemptions when a fund is under stress.

An alternative proposal is that the funds maintain a 3% NAV buffer based on the riskiness of the securities held in the fund’s portfolio, with no buffer for assets viewed as risk-free (cash and Treasury securities), 2.25% for very liquid assets, and 3% for all other assets.

More Questions Than Answers

The FSOC has asked the money funds to comment on its recommendations, and is currently reviewing their responses to questions regarding the likely impact of the changes. There’s a lot of debate for and against the FSOC’s recommendations.

The funds fear a floating NAV would make them considerably less attractive to investors, particularly to conservative individuals who make up a large portion of their holders. Or would the increased regulation make money fund investors feel safer? The FSOC wonders whether adopting a floating NAV might make investors less sensitive to changes in market values. Would it make them more willing to bear occasional losses? If not, where would investors shift their investments and how would this affect the stability of the financial system?

Would requiring the money funds to maintain NAV buffers significantly raise their costs, in turn reducing returns to money fund investors? Who would bear these costs: the fund sponsors, financial intermediaries, or individual investors?

Some funds claim that all money funds are being painted with the same brush, and that only the riskier funds, those that hold bank and financial institution securities, should have to comply with the proposed restrictions. But since all money funds are vulnerable to possible runs, should all be subject to the recommendations?

The above are only some of the questions under discussion by the FSOC and the money fund industry. Overall, the money funds are not happy, and some big money fund companies are challenging the FSOC’s authority to recommend changes to the industry, which in the United States is regulated by the SEC. Consequently, decisions on the recommendations, which could alter the shape of the money fund industry, may not be known for some months.

At the time of this article’s writing, the author did not have positions in any of the companies mentioned.