Money market funds needed cash during financial crisis Fed report says Business Updates

Post on: 16 Июнь, 2015 No Comment

By Beth Healy

Globe Staff | 08.13.12 | 4:21 PM

At least 21 money market mutual funds would have broken the buck, or fallen below a stable value of $1 per share during the financial crisis, if the firms that run them hadnt provided additional cash to support their value, the Federal Reserve Bank of Boston said in a report Monday.

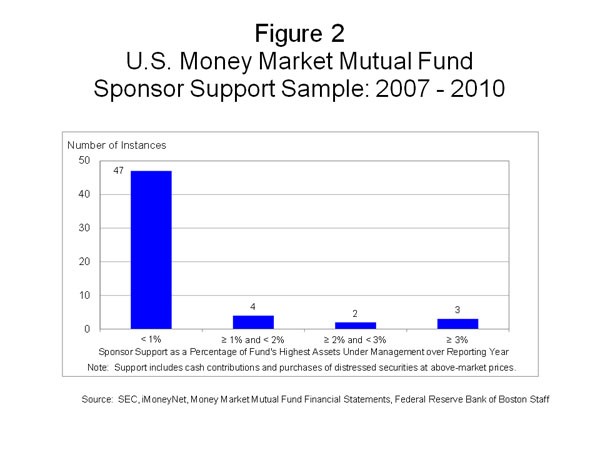

The Fed found that 78 money market funds in total received $4.4 billion in support from their sponsors. In some cases, the firms made cash contributions to the funds; in others, they bought securities from the funds at prices higher than fair market value. Many times, this assistance was just to ensure the funds safety during the financial crisis. But in 21 cases, if the companies did not provide additional support, the funds would have broken the cardinal rule of money marketsmaking sure investors looking for a safe haven dont lose money.

The Fed report said the support from the firms has served to obscure the credit risk taken by these funds. In other words, while investors look to money markets as the safest of vehicles, their managers are in fact making investment decisions that put the funds at risk. And in the event of market shocks like the Lehman failure, firms have varying abilities to provide large doses of support for their funds.

Advertisement — Continue Reading Below

Because investors in money markets count on the liquidity of the fundsthe ability to cash out on short noticethese investors are prone to run during a financial crisis, the Fed report concluded.

When a major money market fund, Reserve Primary Fund, broke the buck in September 2008, due to a large exposure to the failed Wall Street firm Lehman Brothers, it sparked a run on other funds. With many investors wanting to withdraw funds and keep their money in hand, numerous firms had to infuse their money market funds with cash to meet the demand. Only one other money market fund has actually broken the buck, besides the Reserve Primary Fund in 2008. It was the Community Bankers US Government Fun in 1994.

Firms that provided cash infusions to their funds according to the Fed included Columbia funds, then part of Bank of America Corp.; Dreyfus, which is part of Bank of New York Mellon Corp.; Charles Schwab & Co. and T. Rowe Price.

The report comes as US and international regulators deliberate whether money market funds need stricter rules. Boston-based Fidelity Investments, the nations largest manager of money markets, has been among those opposing greater regulations for the vehicle.

Fidelity, with manages $415 billion in money markets, argues that new rules already require more cash on hand by money markets, and are sufficient to have strengthened the system. Fidelity did not need to provide support its money market funds during this period, according to the Fed report.

But the Fed report called the current model concerning, given the credit risk thats still permitted in money markets, and the risk that some firms wont be able to bail out their funds in a pinch.

Boston Fed president Eric Rosengren has said he supports Securities and Exchange Commission chairwoman Mary Schapiros proposals to allow money market shares to fluctuate in value, or else to require firms to keep a capital cushion against losses. She also has proposed that firms impose fees on large institutional investors that want to sweep billions out the door all at once.

The authors of the new Fed study examined public records for 341 prime money market mutual funds.

Beth Healy can be reached at bhealy@globe.com .