Momentum Strategy CXO Advisory

Post on: 31 Март, 2015 No Comment

As elaborated in What Works Best?. a strategic allocation involving perhaps five to ten equally weighted asset classes available via low-fee exchange-traded funds (ETF) or mutual funds, with periodic rebalancing, is a simple way for individual investors to harvest uncorrelated volatility over the long term. For investors seeking an active (tactical) edge, there is evidence supporting exploitation of intermediate-term momentum of these asset class proxies. Holding a few top-performing funds (rather than just the top fund) combines continuous diversification and momentum.

For the set of strategies described here, we allocate at the end of each month all funds to the top one (Top 1 ), the equally weighted top two (EW Top 2 ) or the equally weighted top three (EW Top 3 ) asset class ETFs from a set of nine, based on total return over the past five months.

Supporting research includes (items may at times be unavailable for a few days during updates):

- Simple Asset Class ETF Momentum Strategy investigates systematic rotation to a proxy for the best-performing asset class.

- Alternative Asset Class ETF Momentum Allocations test portfolios of multiple high-performing asset class proxies.

- Simple Asset Class ETF Momentum Strategy Robustness/Sensitivity Tests investigates the optimal historical ranking interval for asset class performance.

- Simple Asset Class Momentum Strategy Applied to Mutual Funds repeats tests in the above three items on a set of mutual funds that are reasonably similar to the ETF universe used in them, but with a somewhat longer history .

- Effects of Execution Delay on Simple Asset Class ETF Momentum Strategy looks at effects of delaying action on changes in the winner for up to 21 trading days.

- Asset Class Momentum Faster During Bear Markets? focuses on performance of the strategy during equity bear markets.

- Simple Asset Class ETF Momentum Strategy Universe Sensitivity and Simple Asset Class ETF Momentum Strategy Universe Enhancers? explore what kind of assets contribute effectively to a relative momentum set.

- Simple Asset Class ETF Momentum Strategy vs. Luck examines how the strategy stacks up against pure luck.

- Weekly or Monthly Asset Class ETF Momentum? examines whether weekly rotation signals outperform monthly signals.

- Optimal Monthly Cycle for Simple Asset Class ETF Momentum Strategy? investigates whether using a monthly cycle other than end-of-month to determine the winning asset improves basic strategy performance.

- Simple Asset Class ETF Maximum Momentum Strategy tests an alternative approach that that measures ETF returns from the lowest daily close within the momentum measurement interval rather than the monthly close at the beginning of the momentum measurement interval.

- Simple Asset Class Leveraged ETF Momentum Strategy investigates whether using leveraged versions of asset class proxies improves strategy performance.

- Simple Asset Class ETF Momentum Strategy with SHY Return Filter tests the effectiveness of substituting a relatively short duration U.S. Treasury notes fund for any winner with a lower past return than that fund.

- Add Stop-loss to Asset Class Momentum Strategy? tests whether adding an intra-month stop-loss rule to the strategy improves performance.

- Add Stop-gain to Asset Class Momentum Strategy? tests whether adding an intra-month stop-gain rule to the strategy improves performance

- Sticky Winner Asset Class ETF Momentum Strategy tests whether limiting the trading of the strategy by holding the winner until it drops out of the top three is effective.

- Buffered Winner Asset Class ETF Momentum Strategy tests whether limiting the trading of the strategy by continuing to hold a past winner until it loses to a new winner by a significant margin is effective.

- Limited-choice Asset Class Momentum Strategy tests whether limiting choices of assets to equity-like (other) asset classes during U.S. bull (bear) markets is effective.

- Asset Class Momentum vs. 10-month SMA for U.S. Stocks compares performances of the two strategies.

- Combining Sector and Asset Class ETF Momentum adds nine sectors to the mix of asset choices.

- Asset Class ETF Momentum Winner Performance by Calendar Month quantifies average strategy performance by calendar month.

- Simple Asset Class ETF Momentum Strategy as Diversifier tests whether the strategy is a good diversifier of the U.S. stock market.

- Model Momentum Strategy Adjustment documents a September 2012 change in specifications for the tracked strategy.

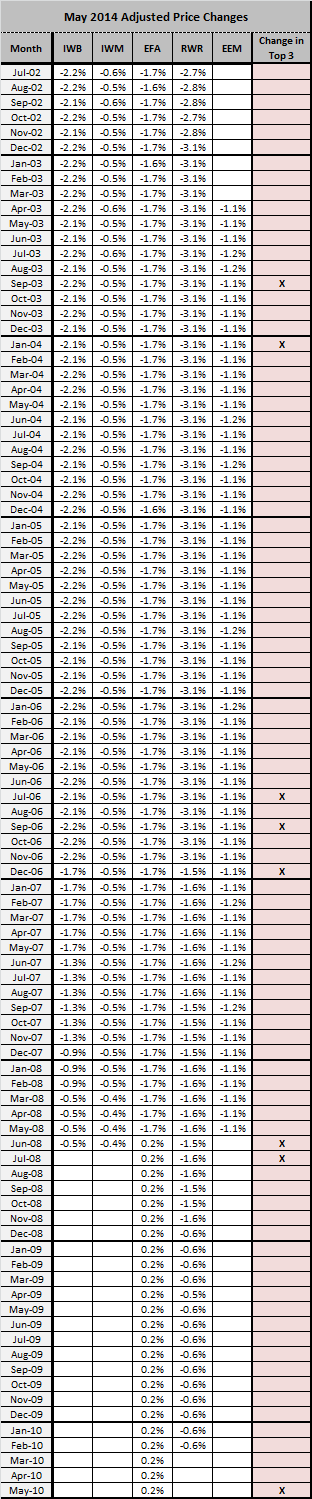

- Simple Asset Class ETF Momentum Strategy Data Changes documents a May 2014 change in source data.

Some investors may want to follow one of the strategy alternatives tracked here. Others may want to adapt them with modifications suited to their individual goals and constraints. Still others may want to apply the analysis approaches to stress other strategies. Something to keep in mind is that adding complexity to the strategy, refining variables or parameters, increases the number of ways to optimize and thereby elevates potential for snooping bias.

Cumulative Performance

The following chart shows the gross cumulative values of $100,000 initial investments in Top 1, EW Top 2 and EW Top 3 portfolios since the end of August 2006 (when all ETFs considered are first available). The chart includes two benchmarks: buying and holding SPDR S&P 500 (SPY ); and, an equally weighted, monthly rebalanced portfolio of all ETFs considered (EW All), indicative of simple diversification benefits.