Model Portfolio #6 Merriman s FundAdvice Ultimate Buy and Hold

Post on: 20 Апрель, 2015 No Comment

(This is the sixth in my series of Model Portfolio Comparisons .)

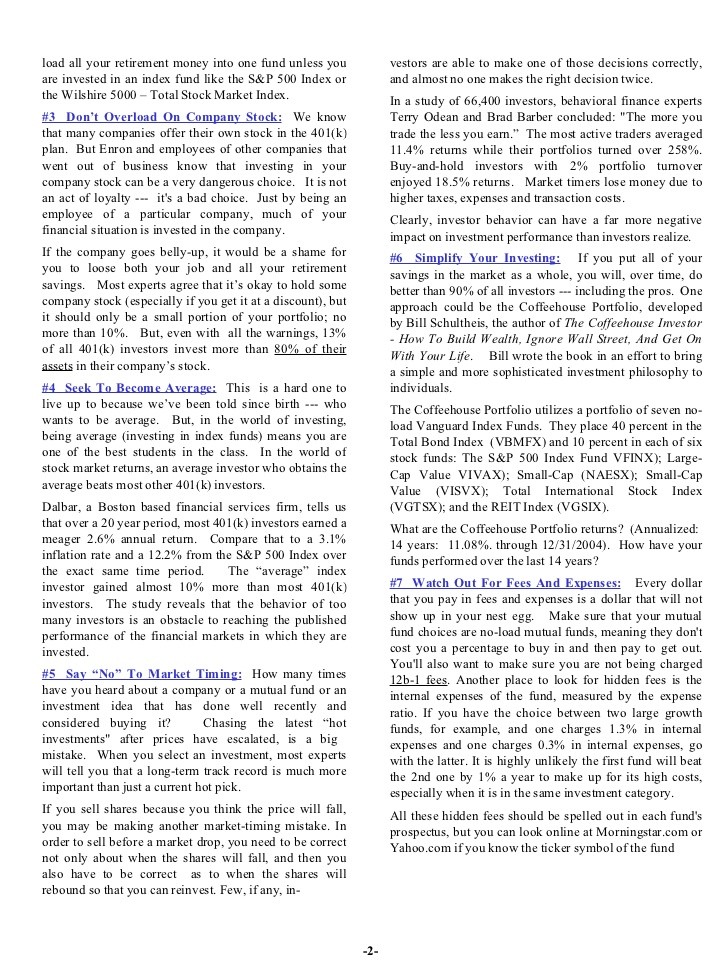

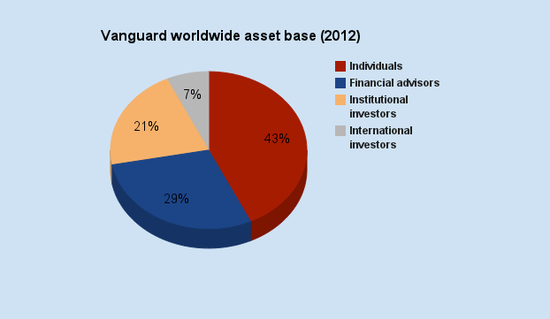

Paul Merriman also runs his own money management firm. He also writes at FundAdvice.com. which has a lot of interesting articles about investing in no-load mutual funds, with and without market timing. Here is the breakdown of their Vanguard balanced buy-and-hold portfolio.

Comments

In a recent post (link ), Paul Merriman advised a reader to use Wisdom Trees Internatinional Small Cap Dividend fund (DLS) which is an exchange-traded-fund for the all important International Small/Mid Cap/Value asset classes. Its style box looks like this:

26 28 13

Its 62.32% Mid/Small Value and 36.08% Mid/Small Growth. Its an excellent replacement for Vanguards (now closed) International Explorer (VINEX) fund.

If you purchase DLS through Vanguards Brokerage Services (VBS), you can have them set it up so that dividends are automatically reinvested without incurring a transaction cost for reinvesting which is a plus.

To get around rebalancing, I paired DLS with Forward Internationals Small Companies (PISRX) fund (which is NTF through VBS). I use a ratio of 10-33% PISRX & 67-90% DLS for the International Mid/Small Value/Core asset class. I increase/decrease shares of PISRX if I need to rebalance my portfolio.

For the US micro cap, I use John Montgomerys Bridgeway Ultra-Small Company Market (BRSIX) in combination with Vanguards NAESX for my small cap allocation.

The rest of my portfolio is based on the Buy-and-Hold Vanguard Strategy that Paul lists on his website. In other FundAdvice articles Paul suggests going outside of Vanguard to fill the International Small Cap asset classes since VINEX closed.

He added REITs recently but in the article mentioned that if you have a well diversified portfolio his research shows that in the 1970-2006 year period REITs only added 0.03% to their widely diversified portfolio.

I also substitute VGTSX (Vanguard Total Stock Market Index) in-lieu of VDMIX (Vanguard Developed Market Index) & VEIEX (Vanguard Emerging Market Index) since VEIEX charges a 0.5% Purchase/Redemption fee (thats not a load but still its 0.5% out of your pocket). That works out well since VGTSX has 58.4% Euro, 26.2% Pacific, & 15.4% EM and VTRIX has 58% Euro, 22.4% Pacific & 17.2% EM & 2.4% other (i.e. almost evenly matched) and youre not short in EM in this portfolio.

FYI. VINEXs style box looks like this:

03 03 01

20 26 21

The combination of (25% PISRX and 75% DLS) style box looks like this: