Mergers Acquisitions Corporate Transactions

Post on: 16 Март, 2015 No Comment

We help companies and investors foresee new opportunities, solve problems and efficiently drive transactions to close.

Our approach

Its an exciting time to be in the market. Global trade, regulation and the equity and credit markets are shifting rapidly. We keep investors and executives ahead of the curve, helping them close transactions that fuel future growth.

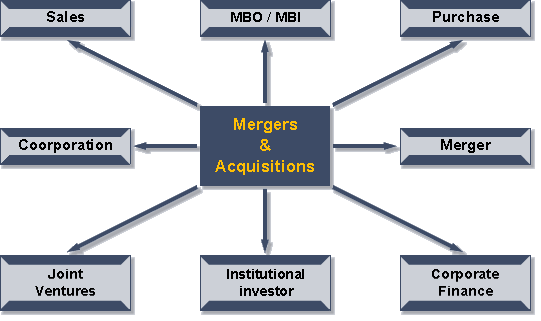

Confidence in dealmaking is growing. We learn from the hundreds of deals each year whats market and whats changing. Our collective knowledge helps businesses grow through transformational transactions such as:

- Mergers

- Acquisitions

- Divestitures

- Joint ventures

- Licensing

- Other strategic agreements

But while the opportunities grow, closing the deal now takes more skill than ever. We know how to spot and craft solutions to the issues that could derail a transactionfrom developing creative ways to bridge gaps between buyers and sellers, to overcoming regulatory and legal hurdles.

Our goal is to help buyers stand apart from fierce competition for high-value targets and protect the future value of their investments. And to provide sellers with sharp insight into the shifting dynamics of the market and the factors that impact value.

Who we work with

Companies and private investors across sectors but especially in:

- food, beverage and agriculture

- health care

- manufacturing

- consumer products

- Big Data and other technology

- life sciences

Representative Experience

- Represented Connecticut-based, nonprofit health care system, Lawrence & Memorial Corporation, on its acquisition of the assets of Rhode Island’s The Westerly Hospital

Represented Connecticut-based, nonprofit health care system, Lawrence & Memorial Corporation, on its acquisition of the assets of Rhode Islands The Westerly Hospital and certain affiliated companies. This transaction was recognized in 2014 as Healthcare/Life Sciences Deal of the Year by M&A Advisor. Advised Constellation Brands in a revised agreement with Anheuser-Busch InBev that makes Crown Imports a fully owned entity of Constellation through a complete divestiture of Grupo Modelo’s U.S. business.

Advised Constellation Brands in a revised agreement with Anheuser-Busch InBev that makes Crown Imports a fully owned entity of Constellation through a complete divestiture of Grupo Modelos U.S. business. The transaction has been called a game changer by the media and is one of the largest M&A deals of 2013. Advised the Gannett Company on its $2.2 billion acquisition of the Belo Corporation

Advised the Gannett Company on its $2.2 billion acquisition of the Belo Corporation in a deal that almost doubles Gannetts television operations. The deal is the biggest local television station sale in about a decade and comes amid of a wave of consolidation in the industry. . View all.

Advised W.P. Stewart & Co. Ltd. an equity manager, in its acquisition by AllianceBernstein L.P. a global investment management firm with $447 billion in assets under management.

Advised W.P. Stewart & Co. Ltd. an equity manager, in its acquisition by AllianceBernstein L.P. a global investment management firm with $447 billion in assets under management.

Represented Blu Homes, a maker of green, precision-built prefabricated homes based in Massachusetts and California, in completing its first institutional round of investment, totaling nearly $60 million.

Represented Blu Homes, a maker of green, precision-built prefabricated homes based in Massachusetts and California, in completing its first institutional round of investment, totaling nearly $60 million. The financing round was led by Netherlands-based Skagen Group. With initial private funding, investment in Blu Homes now totals nearly $69 million since it began operation in 2008.

Represented Wyse Technology in its highly publicized sale to Dell (NASDAQ: DELL), the worlds third-largest maker of personal computers.

Represented Wyse Technology in its highly publicized sale to Dell (NASDAQ: DELL), the worlds third-largest maker of personal computers. Wyse was a cloud computing company backed by Garnett & Helfrich.

Advised Eastman Kodak Company in the sale of its Eastman Gelatine subsidiary to Rousselot, a division of VION Food Group.

Advised Eastman Kodak Company in the sale of its Eastman Gelatine subsidiary to Rousselot, a division of VION Food Group. This transaction was recognized in 2012 as Middle-Market Deal of the Year as well as Cross-Border Deal of the Year by M&A Advisor and the Association for Corporate Growth (ACG).

Represented North American Partners in Anesthesia (NAPA), the largest single specialty anesthesia management company in the United States, in the majority recapitalization of its affiliated practice management company with Moelis Capital Partners.

Represented North American Partners in Anesthesia (NAPA), the largest single specialty anesthesia management company in the United States, in the majority recapitalization of its affiliated practice management company with Moelis Capital Partners. This transaction was recognized in 2011 as Middle-Market Deal of the Year as well as Healthcare & Life Sciences Deal of the Year by M&A Advisor and the Association for Corporate Growth (ACG).

Counsel to Exinda, a provider of next-generation WAN optimization solutions, in a variety of corporate transactions.

Counsel to Exinda, a provider of next-generation WAN optimization solutions, in a variety of corporate transactions. Backed by OpenView Venture Partners, Exinda is the recipient of the 2012 Red Herring 100 Americas Award, which recognizes the top private companies playing a leading role in innovation and technology.

Represented Kozy Shack, a family-owned business and manufacturer of refrigerated desserts, in its sale to Land OLakes, the second largest agricultural cooperative in the United States.

Represented Kozy Shack, a family-owned business and manufacturer of refrigerated desserts, in its sale to Land OLakes, the second largest agricultural cooperative in the United States.

Represented the senior management of Au Bon Pain in a management buyout from Compass Holdings that included a group of equity investors led by PNC Equity Management.

Represented the senior management of Au Bon Pain in a management buyout from Compass Holdings that included a group of equity investors led by PNC Equity Management.