Megafunds start to beat retreat from emerging markets

Post on: 2 Апрель, 2015 No Comment

Analysis & Opinion

LONDON Jan 26 (Reuters) — Big pension, insurance and sovereign funds that kept faith with emerging markets during the massive selloffs of 2013 and 2014 may be starting to waver, potentially depriving the sector of a key source of support.

While emerging markets are a tiny part of the assets of these institutional investors, anecdotal evidence from flow patterns and global asset managers suggests allocations have risen in recent years.

The massive amount of money they manage — global pension fund assets alone are more than $35 trillion — was a powerful counterweight to the more skittish mutual and hedge fund outflows during 2013-2014.

But years of weak returns and cloudy growth prospects are now souring the mood, with the World Bank this month again cutting its growth forecasts for the developing world.

The past two years saw developed market returns outpace emerging peers — U.S. bonds and stocks for instance posted double-digit returns in 2014 — tempting these relatively conservative investment firms home.

Several compelling reasons attracting institutional investors to emerging markets have been reversed, said Hung Tran, managing director at global industry body the Institute of International Finance.

IIF data last year had showed capital inflows to emerging stocks and bonds continued unabated after June 2013 when the U.S. Federal Reserve’s hints of a rate rise sparked huge market losses. The IIF attributed this to institutional investors buying newly cheap assets with an eye on the long-term.

But flows turned negative in December for the first time in 18 months. The IIF predicts a $25 billion net fall in 2015, much of it due to a pullback by institutions.

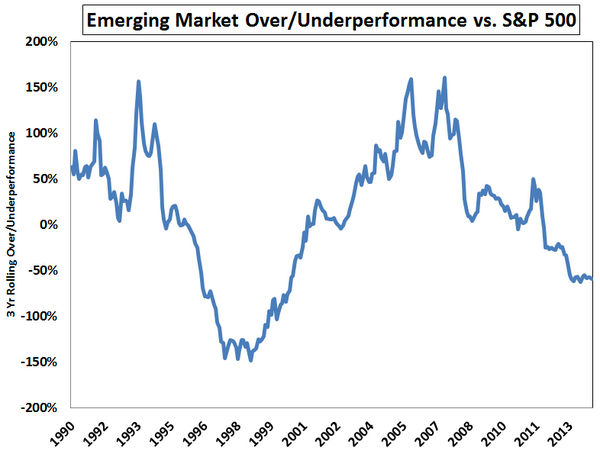

IIF research shows that as a percentage of overall portfolios, institutional investors have actually increased their weighting to developed markets and have cut allocation to emerging assets compared with recent years, as this graphic shows: link.reuters.com/xyq83w

The growth advantage of EM has been reduced to 1 percent from 5 percent a few years ago so the premise for investors to add risk there has also reduced, Tran said.

Furthermore, the push factor driving cash into emerging markets is less strong. Oil’s 60 percent price fall since June will cause funds from energy-exporting countries to withdraw money from global markets, reversing a two-decade old trend, BNP Paribas predicts.

FUNDS

One gauge of investor interest has been the mutual funds industry, where funds compete to manage cash for investors by responding to so-called requests-for-proposals (RFPs). Some fund managers say RFPs are less emerging markets-focused these days.

Instead there is more appetite for blended or unconstrained funds, which switch allocations freely between developed and emerging assets, debt and equities, says Zsolt Papp, client portfolio manager at JPMorgan Asset Management.

The main purpose of going into emerging local currency debt was to generate extra alpha but in recent years it hasn’t generated extra alpha, instead it generated very high volatility, Papp said.

Bonds in currencies such as the rouble and rand which delivered double-digit returns for years, have now become a drag on dollar-based portfolios due to the greenback’s strengthening, leaving returns flat or in the red in 2013 and 2014.

The level of conviction is not as high as it was 12 months ago, Papp said. I don’t want to say they are scared off but probably institutions who were in the process of looking at EM. I wouldn’t be surprised if they delayed the decision to invest.

There is divergence within the investor class, however.

Institutions tracked by U.S. research firm eVestment shows institutional investors pumped $500 billion into emerging equities and debt since 2006 via conventional funds, though they have scaled back inflows in the past two years.

But while sovereign funds withdrew cash from emerging assets in three of the past five quarters, eVestment said pension funds, possibly under pressure to meet the needs of ageing populations, had maintained inflows.

Pension funds reporting to eVestment ploughed $20 billion into emerging markets in 2013 and $17.5 billion in the first nine months of last year. That contrasted with $11 billion in redemptions last year by sovereign wealth funds it tracks.

My personal view on EM is that I’m not particularly constructive, said Ugo Montrucchio, head of multi-asset and portfolio solutions at Schroders, citing dollar strength and weaker exports as headwinds for the sector.

But he said pension managers who needed to provide retirees with specified monthly payments may not be able to avoid emerging markets.

But that’s a one-year view. If your pension is a longer-term, defined benefit pension scheme would I recommend getting completely out? That’s not a good course of action. (Additional reporting by Carolyn Cohn ; graphic by Vincent Flasseur; Editing by Hugh Lawson )