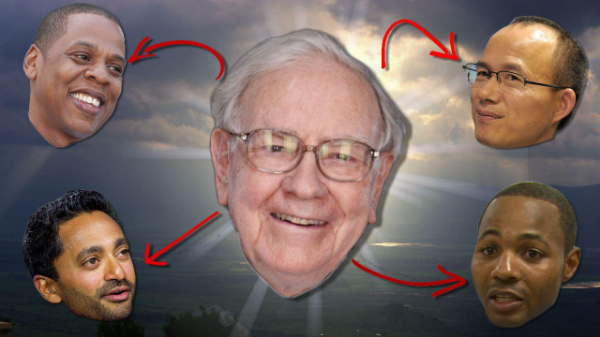

Meet Warren Buffett’s wannabes The ‘Brown Buffett’ and ‘Oracle of San Quentin’

Post on: 16 Март, 2015 No Comment

As billionaire hits 50 years at Berkshire Hathaway, fans and disciples claim his name; no female Warren Buffett

ENLARGE

Warren Buffett

As the returns of the world’s most famous investor have swelled, so has the number of people who lay claim to Warren Buffett ’s name.

The 84-year-old billionaire is chairman of Berkshire Hathaway Inc. based in Omaha, Neb. Since taking control of the company in 1965, Mr. Buffett has produced an overall gain of 693,518% through the end of 2013, trouncing the S&P 500’s increase of 9,841%.

Saturday’s release of Mr. Buffett ’s latest annual letter to shareholders will mark 50 years since he wrote the first one, and more people than ever hang on his every word. Berkshire expects about 40,000 people at the annual meeting in Omaha, in May, its largest turnout ever.

“We’re all Warren Buffett followers now,” says Guy Spier, who paid $650,100 with another investor in a charity auction to have lunch with Mr. Buffett in 2008. Afterward, Mr. Spier wrote the book “The Education of a Value Investor” about his evolution from a greed-driven hedge-fund manager to a patient investor in the Buffett mold.

Mr. Buffett pays little attention to the buffet of Buffetts, ranging from acolytes of his buy-and-hold investment strategy to name droppers to people who somehow remind someone else of the billionaire.

“I’d like George Clooney to be the Warren Buffett of Hollywood,” he says.

To some non- Buffett Buffetts, any comparison to the man who helped transform Berkshire from a struggling textile mill to a sprawling holding company with about 330,000 employees, is the highest form of flattery.

They would “like to be in the pantheon of great businessmen and icons,” says Lawrence Cunningham, author of Berkshire-related books such as “How to Think Like Benjamin Graham and Invest Like Warren Buffett. ”

More

Buffett

Reading

Buffett

Primer: A Book List

There are so many Buffett wannabes that a lawyer for Berkshire filed an application in 2006 to trademark his name. The effort was partly a response to websites, many of Chinese origin, that sprang up using Mr. Buffett ’s name to pitch their services, according to people familiar with the matter.

The lawyer later dropped the trademark push, deciding it was too much of a hassle.

Prem Watsa, the chairman and chief executive of Fairfax Financial Holdings Ltd. a Toronto company that owns insurers, restaurants and other businesses run in a decentralized, Berkshire-like style, is known as the “Warren Buffett of Canada.”

“There’s only one Buffett. and he’s in Omaha,” says Mr. Watsa, shying away from the comparison. Yet he built Fairfax, a word play on “fair and friendly acquisitions,” into one of Canada’s largest companies through acquisitions, just like Mr. Buffett, whose big takeovers include railroad BNSF in 2010.

Mr. Watsa, 64, says he first learned about Mr. Buffett’s way of doing things in the mid-1980s when a friend explained the concept of “float” in insurance. Berkshire’s chairman used float, or money collected from insurance customers as premiums that don’t have to be paid out until later, to fund Berkshire’s expansion.

Like his idol, Mr. Watsa writes a shareholder letter used as a pulpit to weigh in on global financial issues and lure investors to the annual meeting. Messrs. Buffett and Watsa each named their son after legendary value investor Benjamin Graham.

Activist investor Sardar Biglari is such a devotee of Mr. Buffett that the letter he sends shareholders of Biglari Holdings Inc. mirrors Mr. Buffett’s in its font and tone. right down to the first-name reference for Biglari’s vice chairman, as Mr. Buffett does for his partner at Berkshire, Charles Munger.