Lowfee alternatives for ETF devotees

Post on: 11 Апрель, 2015 No Comment

Exchange-traded funds have come a long way since the first Canadian index fund made its debut in 1990 on the Toronto Stock Exchange. Along with a wide range of core holdings and specialty investment mandates that have sprung up over the years, there now are also ETFs that invest in other ETFs.

E xchange-traded funds have come a long way since the first Canadian index fund made its debut in 1990 on the Toronto Stock Exchange. Along with a wide range of core holdings and specialty investment mandates that have sprung up over the years, there now are also ETFs that invest in other ETFs.

More than just building blocks for diversified portfolios, these ETFs are portfolios unto themselves.

They’re low-fee alternatives to the traditional balanced funds, portfolio funds and wrap programs offered by mutual fund companies and investment dealers.

The latest of the ETF portfolio funds are the four iShares ones sponsored by Barclays Global Investors Canada Ltd. They began trading on the Toronto Stock Exchange on Nov. 18.

There are two core funds: iShares Conservative Core Portfolio Builder (XCR), a balanced fund with an emphasis on fixed income, and iShares Growth Core Portfolio Builder (XGR), which has more equity exposure.

A third fund, iShares Global Completion Portfolio Builder (XGC), is suitable for investors who are looking for a single investment to complement their Canadian equity and fixed-income holdings.

Finally, iShares Alternatives Completion Portfolio Builder (XAL) specializes in alternative asset classes. Unlike hedge funds, however, it does not engage in short-selling.

The iShares offerings bring to six the number of TSX-listed ETF portfolio funds. They join Claymore Balanced Income CorePortfolio (CBD and CBD.A) and Claymore Balanced Growth CorePortfolio (CBN and CBN.A), offered since June 2007.

For some ETF devotees, portfolio ETFs are unnecessary. After all, investors can create their own ETF portfolios, and in the exact proportion that suits their individual needs.

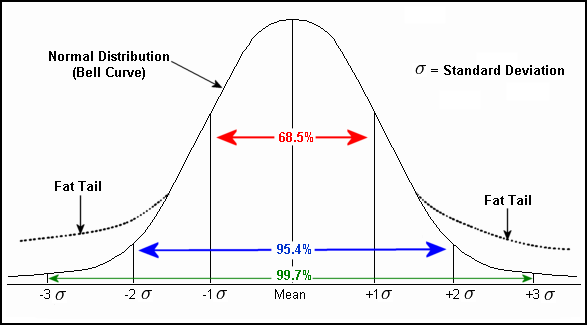

But few investors have the time or inclination to select and manage a broad range of ETFs in both core and more specialized mandates. As Heather Pelant, head of iShares at Barclays Canada notes: It’s very difficult for investors to get asset allocation right on their own.

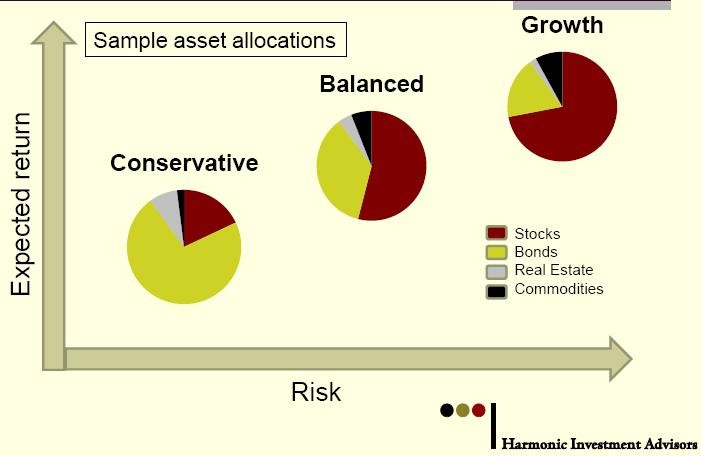

The two competing firms offering TSX-traded ETF portfolios are taking different approaches to asset allocation. The asset mix of each of the iShares portfolios will be based on a proprietary model designed to maximize risk-adjusted returns, and there are no specific limits on how much of any asset class can be held.

The Barclays model factors in various factors such as growth rates, inflation and interest rates, and historical risk-reward premiums for different asset classes.

There is an optimization process that takes place, says Cary Blake, head of the global index and markets group at Barclays Canada.

By contrast, Claymore takes a more traditional strategic approach, setting fairly tight ranges for its two funds. Both Claymore ETFs also set target ranges for domestic and foreign stocks and other components.

A common characteristic of the ETF portfolios offered by both Barclays and Claymore is their low management expense ratios. The MERs are either 0.6 per cent or 0.7 per cent for the iShares funds, and roughly 0.75 to 0.8 per cent for common units of the two Claymore funds.

The MERs of the iShares ETF portfolios, and the common units of the Claymore funds, are roughly only one-third of what balanced mutual funds typically charge. This represents a significant saving, especially for self-directed investors who are not paying for advisory services.