Loonie Lost Canadian Dollar ETF Falters

Post on: 22 Апрель, 2015 No Comment

Commodity ETFs News:

The PowerShares DB US Dollar Index Bullish (NYSEArca: UUP ). the U.S. Dollar Index tracking ETF, is down about 1.5% in the past month, a performance that may come as a surprise to some given all the chatter about a strong U.S. dollar and tapering of quantitative easing. UUP is up almost 2.8% in the past six months and a gain of more than 2% in just the past week shows the greenback is flexing its muscles.

Some developed market currencies have fared decently against the dollar as of late, including the British pound and even the euro. Other developed market currencies, the Australian dollar being a prime example, have struggled mightily against the greenback. Put the Canadian dollar and the CurrencyShares Canadian Dollar Trust (NYSEArca: FXC ) in the latter category. [Risky Currencies Slide ]

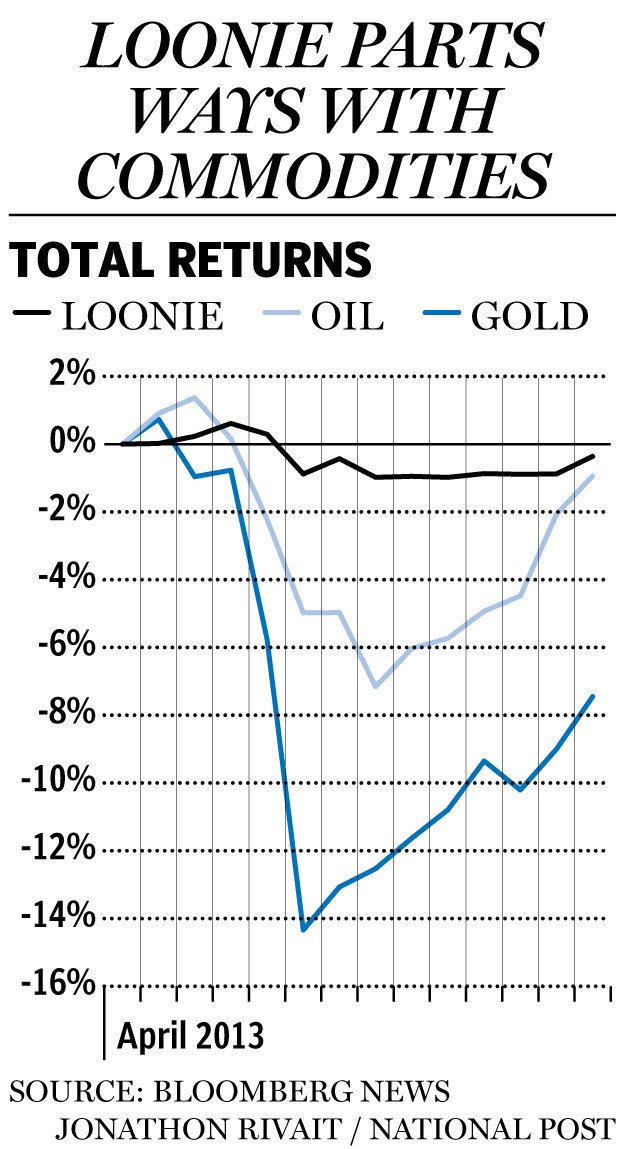

Canada’s status as major producer of gold and silver is one reason FXC is off nearly 6% year-to-date. While the loonie is a one of the commodities currencies, the commodity the loonie is usually linked to is oil because Canada is home to some of the largest oil reserves in the world outside of Saudi Arabia. It is not just the repudiation of the commodities trade that is weighing on the loonie. Intensifying speculation that the Federal Reserve will soon wind down its stimulus efforts has pressured the Canadian currency. [Slowing Exports, Fed Plans Hurt Canadian Dollar ETF ]

On Monday, the loonie touched its lowest levels in nearly two years against its U.S. counterpart as implied volatility for three-month options on the Canadian dollar versus its U.S. counterpart traded at 8.87%, the highest point in a year, reports Ari Alstedter for Bloomberg.

Last week, Canada delivered disappointing retail sales and inflation data. USD/CAD currently trades just over $1.05 and some technical analysts believe if the $1.0556 level is breached, more losses await the loonie, Bloomberg reported.

In the past 90 days, FXC has lagged the performance of the CurrencyShares British Pound Trust (NYSEArca: FXB ) and the CurrencyShares Euro Trust (NYSEArca: FXE ). indicating investors have not been wooed by Canada’s AAA credit rating. The CurrencyShares Singapore Dollar Trust (NYSEArca: FXSG) , which tracks the currency of another AAA-rated nation, has also outpaced FXC.

CurrencyShares Canadian Dollar Trust

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.