Loads fees and mutual funds a primer

Post on: 28 Март, 2015 No Comment

Loads, fees and mutual funds

Mutual Fund A wants to charge you a load — a percentage of your investment for the privilege of doing business with them, assessed before they have a chance to prove you’ll get your money’s worth.

Mutual Fund B is a no-load fund — one that does not impose an upfront cost.

The choice is simple, right?

Not always. Performance and fees — expense ratios, 12b-1 fees, and more — make the comparison more complex.

So, to begin comparing load and no-load mutual funds, you’ll need to get up to speed on the many fees which can erode the overall rewards of your stated total return.

To fee or not to fee

No matter what anyone tries to tell you, loads and other types of fees make a difference — sometimes a big one. True, a pure no-load fund with low expense fees won’t guarantee you a better overall return, since stock selection dramatically affects the overall performance of a fund. However, all things being equal, if you invest $10,000 in a 4 percent load fund that turns in a 10 percent performance for the year, you earn the 10 percent, but not on $10,000. Instead, you earn 10 percent on $9,600. That’s $400 short of a no-load fund investor. Over time, the impact of this can be considerable.

However, there’s another twist. Just because a fund says it’s no-load doesn’t mean that there are no fees associated with it. There may be a redemption fee, and every fund charges management fees in one form or another. The trick is to find the funds whose fees are more reasonable than others and whose performance still shines relative to its objective, its peers, and your needs. To do this, you need to do your homework — a task made easier by learning the following ways in which a mutual fund’s fees can siphon off your investment dollars.

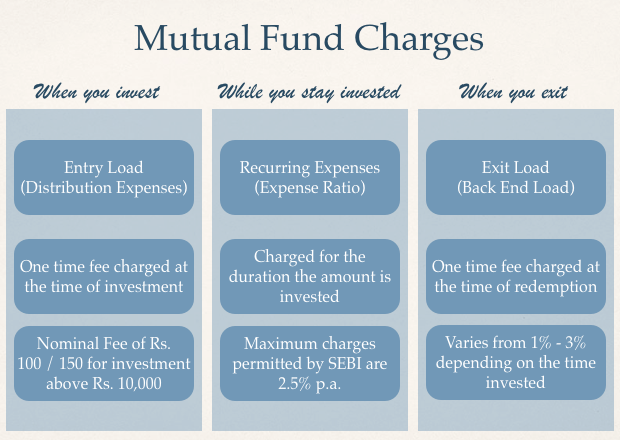

Load. A load is an upfront sales commission charged and deducted from your initial investment amount. (Load charges run as high as 8.5 percent but are more commonly in the range of 3 percent to 4.5 percent.)

No-load. No-load means no initial sales commission fee. No-load refers only to upfront sales commission charges. Many no-load funds have other fees (listed below).

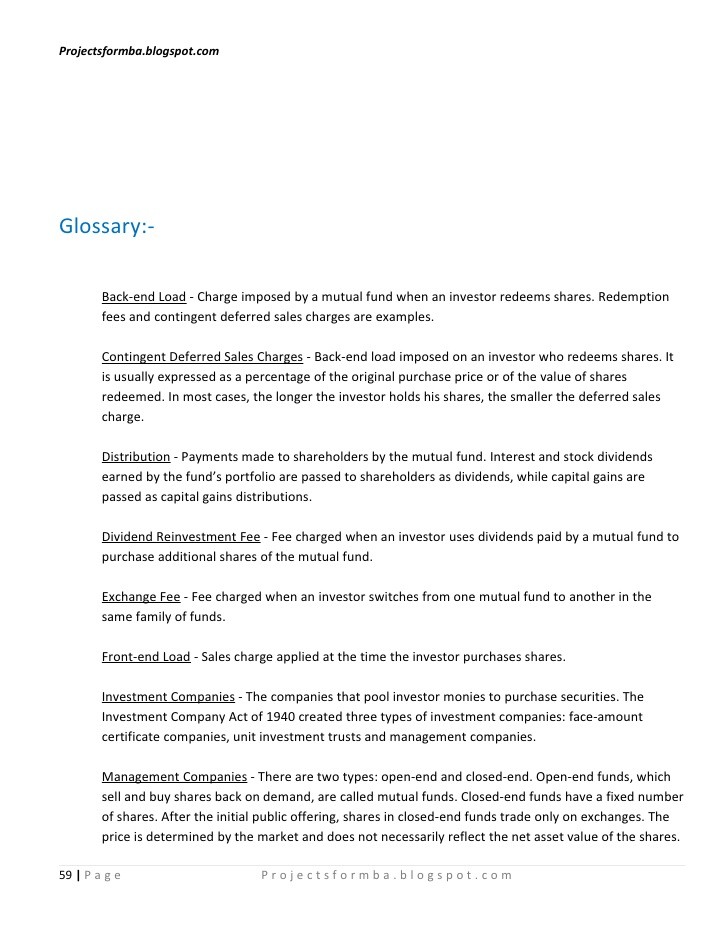

Back-end loads. Also known as redemption fees, this is a fee charged to the net asset value (NAV) of your shares when you sell them. Either your profit is cut or your loss increased.

Deferred loads (contingent deferred sales fees). A deferred load is charged by some funds only if you redeem your shares before a specified time — typically a few years. This makes these funds a poor choice if you’re investing for the short-term.

Reinvestment loads. Some fund companies dock your dividend, interest and capital gains should you decide to reinvest them. Any fund that does this is discouraging a very wise investment choice — reinvesting dividends.

12b-1 fees. Some funds deduct the costs associated with advertising and marketing themselves from the fund’s overall assets. The charge associated with such deductions is called a 12b-1 fee, and ranges as high as 1.25 percent. Some funds feed a portion of the fee to the broker who sold you the fund.

Loads vs. no-loads

There’s compelling argument for no-loads over loads — more of your hard-earned money goes to work for you right from the start in a no-load, all things being equal.

Of course, if you don’t know what you’re buying, you are putting your head into a lion’s mouth before making certain he’s not hungry. Load funds recognize that by touting themselves as advice givers who can educate novice investors. However, many of today’s no-load funds offer education, too — check out Fidelity’s PowerStreet.com or Vanguard’s Online University.

There is one point in the above argument worth keeping in mind. It’s easy to forget that a no-load’s fund fees can and often do add up — and often can surpass the level of the no-load advantage. But you should also note that simply investing in a load fund often means that, if done through a broker, you’ll likely be charged some sort of fee — not to mention the fact that the fund itself will have its own fee baggage beyond its load.

There are a few good load funds that have delivered some of the lowest-priced funds over the long term, because operating fees are low. There are also load funds that have delivered superior performance — enough to justify the load. And remember, some no-loads have whopping expense ratios; anything above 2 percent is egregious. So it’s not a perfect world — you can find abuses on both sides.