Liquid Funds Vs Saving Account Which One Offers Better Returns

Post on: 16 Июнь, 2015 No Comment

Advertisement

Today every one of us atleast have one saving or salary account which we use to keep our earnings safe. At the beginning of the month our salary gets credited into this account, after paying all the monthly expenses like bills, EMIs etc. we left with some cash balance. Some of us use this saving account for the purpose of investment where we left our cash balance in the same account to enjoy safety, liquidity and reasonable returns.

Not all us do the same, as there are ‘n’ number of ways to invest money. One of the most popular way of investment in banks is Fixed Deposit where you can lock your cash for a fixed period of time to get better returns as compare to saving account. This offers safety and good returns on the amount invested but on the cost of liquidity loss. As Fixed Deposit as name suggest will lock the cash invested for a fix time period. Although you can withdraw your cash anytime but by paying penalty for early withdrawal. Secondly the returns on FDs gets clubbed to the income of the investor and become taxable under income tax law as per your income slab which can go upto 30%.

Some investors like to put there money into stock markets or equity mutual funds to get higher returns on there investments. But for a short period (typically less than 3 years), the equity or stock markets can be quite risky and unreliable in terms of returns.

So here comes the time to look for an alternative which can offers us the benefits of all three investment options i.e safety, liquidity and higher returns.

Liquid Mutual Funds, as name suggest these are mutual funds which offers liquidity to the investors. In other words, it is one form of investment which offers liquidity plus good returns at the same time.

Advertisement

Here are the basic features of liquid mutual funds

- Open ended debt mutual funds.

- Maturity Period :- Amount invested in liquid funds are further invested in short term securities typically with the maturity period between 15 to 90 days.

- Less Prone To Market Risk :- Liquid mutual fund investments are short term investments which is less prone to changes in the market conditions i.e changes in interest rate etc. which makes it the least risky instrument.

- Easily Redeemable :- These funds are also called as cash funds as redemption of funds (conversion from fund unit to cash) can be done anytime i.e conversion happens within 24 hours of submission of withdrawal request.

- Zero Entry & Exit Load :- Unlike other securities, you can redeem units of liquid mutual funds anytime without paying any charges i.e exit load.

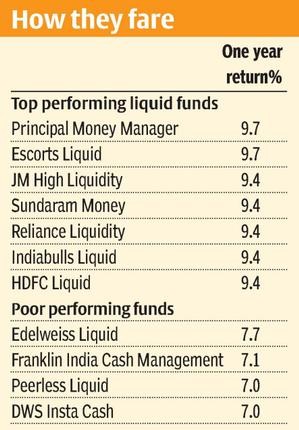

- Offers good post tax returns :- Investment in liquid mutual funds generates better returns as compare to saving bank accounts.

- Minimum Investment :- Investment in liquid mutual funds can be started with the minimum investment of Rs 1000 to 5,000.

- Portfolio :- The portfolio allocation of these funds is designed to invest the entire amount i.e 100% in money market instruments, in which a large portion being invested in call money market.

- Attracts less taxes