Leveraged ETNs Daily Monthly and Longer

Post on: 16 Март, 2015 No Comment

As the popularity of ETFs has surged in recent years, the manner in which investors use these vehicles has evolved as well. Originally designed with cost-conscious buy-and-holders in mind, ETFs have now been fully embraced by more active traders as well (just look at the turnover of SPY ). And recent years have seen the introduction of increasingly complex and powerful exchange-traded products, including those offering exposure to investment strategies and asset classes that were previously out-of-reach for most investors [see Free Report: How To Pick The Right ETF Every Time ].

The leveraged ETF space is one example of a corner of the market that has seen tremendous growth in recent years. The basic purpose of these products is relatively straightforward; they seek to deliver results equivalent to the return on a specified index multiplied by a leverage factor (-100%, 300%, etc.) over a certain time period. For those who understand the objectives and limitations of leveraged ETPs, these securities can be powerful tools for hedging or for trading. But for those who fail grasp some of the complexities, leveraged ETPs can be dangerous. As detailed below, not all leveraged ETFs are the same, and some seemingly minor differences in investment objective can translate into very different risk/return profiles [see Basics Of ETN Investing ].

Daily Leveraged ETPs

Most of the leveraged products available to U.S. investors fall into this category, resetting the exposure offered to the underlying index on a daily basis. As a result, these products are designed to deliver amplified returns on a specified benchmark over the course of a single trading session; at the end of each day, leverage is reset to the indicated multiple (e.g. 2x, -3x, etc.) and the same leverage is offered again the next day. So while the returns delivered over a single trading session are generally predictablemost daily leveraged ETFs are extremely efficient in producing a return equal to the change in the underlying index multiplied by the leverage targetthe returns over multiple sessions will depend on additional factors beyond the move in the underlying index [see all of the ETFs in the Leveraged Equities ETFdb Category ].

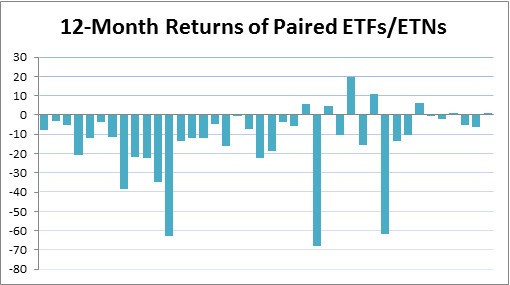

Because exposure is reset on a daily basis, the multi-period return for leveraged ETFs depends on both the change in the underlying index over the relevant time period and the path taken. In oscillating marketswhere gains are followed by losses and vice versathe return to leveraged ETFs will generally be less than the daily leverage target multiplied by the return on the index. This phenomenon played out in 2008, when unprecedented volatility caused unfavorable effects of compounding on leveraged ETFs over the course of several months [see Leveraged ETF Center ].

There is, of course, a flip side to this coin; when markets are trending, the return to leveraged ETFs will generally be better than the simple product of the daily target and the change in the index. Between the bear market lows in March 2009 and the end of that year, the ProShares Ultra S&P 500 (SSO ) gained a staggering 166%, or about 2.5 times the gain turned in by the S&P 500 SPDR (SPY) over the same period.

Monthly Leveraged ETPs

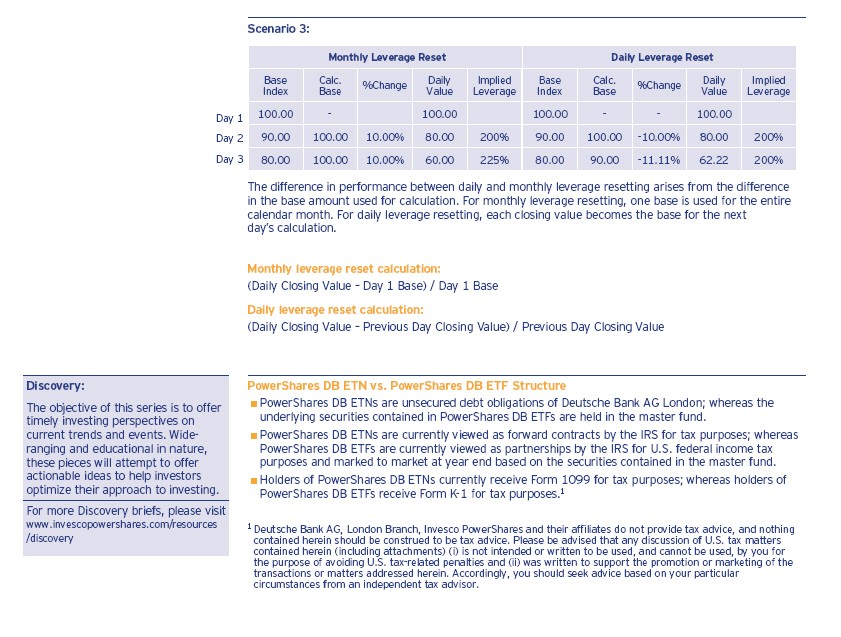

In addition to daily leveraged ETPs, there are a number of products that seek to deliver leveraged results over the course of an entire month. In other words, if the index underlying a monthly 2x fund gained 10% in December, the leveraged product would be expected to gain 20% over the same time period. Those returns would be produced regardless of the path taken by the related index during the month, a feature that makes monthly leverage different from daily leverage. Monthly leveraged products can of course still be impacted by compounding, but the lower frequency with which exposure is reset can dampen the effects somewhat [see also Leveraged Dividend ETFs: Too Good To Be True? ].

The impact of the rebalancing frequency also has an impact on the effective leverage offered. Because the exposure is reset once per month, the effective leverage can deviate from the target multiple between resets. Consider a 2x leveraged ETP that begins the month at $100, same as the underlying index. After 15 days, the index has gained 10%: