Lending Club is a Good Investment

Post on: 26 Июнь, 2015 No Comment

This is a follow up post to the interview that I did with Lending Club and their operation. You can read that here . The below is a transcription from the screen cast below.

H ey everybody. Jeff Rose, goodfinancialcents.com with a special treat today. I want to do a little screen cast to talk about an investment strategy or an investment option that I have been fairly partial to over the last couple of years.

I want to introduce to you for those of you who havent heard of it. I dont view this as a supplement to investing in the stock market and individual stocks, mutual funds, etc. but I definitely think that it could be a complement or something to add to your investment pie. Thats why I want to talk about it today. So without further ado, what I am actually talking about today is what is called Peer-to-Peer lending or P-to-P lending as it sometimes is abbreviated.

As youll see here, jumping the gun one of the top peer-to-peer lending companies is Lending Club .

First I want to go to Wikipedia and just read to you what exactly peer-to-peer lending is. As Wikipedia states, it says

peer-to-peer lending is a certain breed of financial transaction, which occurs directly between the individuals or peers without the intermediation of a traditional financial institution. Person-to-person lending is for the most part a for-profit activity that distinguishes it from person-to-person charities, person-to-person philanthropy, and crowd funding, which also creates connections between donors in recipients of donations, but are non-profit movements.

Basically, what peer-to-peer lending is or what I think of it is we have all had the family members or friends who have asked us for money. Maybe you havent; I know I have been in that situation on more than one occasion and its not a very fun situation to be in by the way. Essentially peer-to-peer lending is you have individuals that need to borrow money for whatever reason.

- Maybe its to pay back a student loan.

- Maybe its to pay off a credit card.

- Maybe its to fund a business venture.

Fill in the blank. I think weve all needed money at some point in time. Some of us by default go to credit cards or maybe we go to a bank, etc. What peer-to-peer lending is is that you have a mediator as a lending club that basically allows other people to invest or lend you that money and then also get a rate of return from that. That is whats really kind of intriguing about this whole process. Youre able to lend money to some individual somewhere else in the country, and you can make a decent rate of return off that by loaning to that person. In essence, youre acting as the bank or the financial institution in making that rate of return off of it.

The Leader of Peer to Peer Lending

As I mentioned, not to jump the gun, but one of the leaders of peer-to-peer lending it is Lending Club . What really attracted me to Lending Club was that they have a tremendous social media awareness. They are on Facebook, theyre on Twitter, they have a blog, and thats where I really first learned about them. To be quite frank, when I first heard of peer-to-peer lending I had no idea what they were talking about. It wasnt until I started reading some blog posts and started learning more about it that I really got the concept.

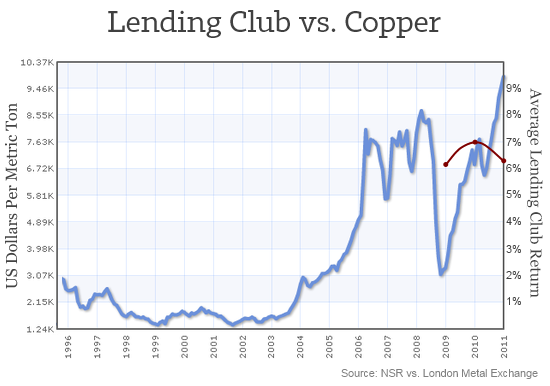

The one thing, once you go to Lending Clubs web site I think just is the immediate attractor is this: investors average returns of 9.64%. Obviously that attracted me, and when you think of the stock market and how once upon a time you could hear that the market was making double digit returns.

A lot of this happened prior to 2008 and then prior to the recent downturn that weve had. When you start talking 9.64% investor average returns I think a lot of people are going to get interested. At least theyre going to find out more about it. That was my lure or what got me in.

Lending Club Prospectus

Before you consider investing with Lending Club make sure you read the prospectus . As with any investment, make sure you have a good understanding of what you are getting yourself into.

Investing with Lending Club

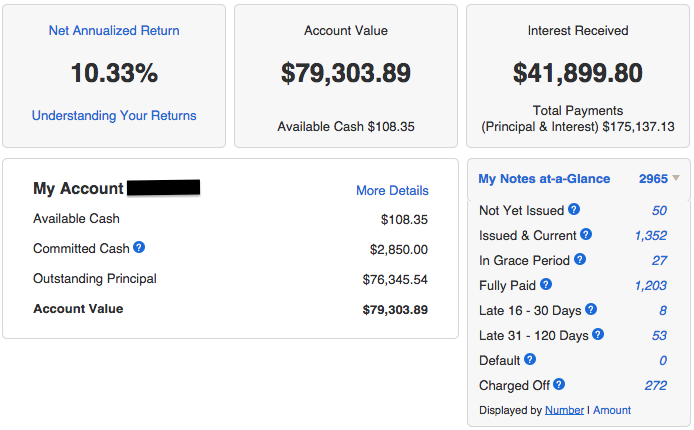

What I really wanted to do today was actually walk you through how to invest with Lending Club. I have been investing with Lending Club for a few years now. I dont have a whole lot invested, and youll actually see that here in a minute because I really didnt understand it and I wanted to test drive it first. I wanted to test drive it before 1) I put more money into it and 2) before I told more people about it as far as suggesting someone to take a look at it. Here is the website and I went ahead and logged in where you can see where Im at right now. Right now I have invested a total of $2200 so not a big investment by any means.

My net annualized return is 10.8% so right off the cuff you can see that Im already making more than the average investor in Lending Club is making, almost a full percentage point more. Thats not because I am any great investor. Im actually very passive in the way that I choose my notes, which Ill show here in a minute. Some of the details, I currently have $525 sitting in cash in my Lending Club account that I need to invest, and thats what were going to show today to show you how I invested and how you can actually do some research on that.

Really quick, how we do it is we go to invest, click on the link and here is really why I love Lending Club. For the people who dont like to spend a lot of time doing a lot of research, they make it very, very simple where you can either choose option one, option two, or option three. Lets just assume that you are a very high-risk person and that you are looking at the 17%. You look at that number. Youre drooling over it. You want it. Thats how much you want to make.

By quickly clicking that option, they then will show you where you are investing your notes. And a note basically is the agreement that you have with that person that you are lending to. Theyre ranked then just like they would a report card or like a bond, A ranking, B ranking, C ranking.

Initially, youll notice by going the more aggressive direction you do not have any of the A or B type investors. These are your higher FICO score credit people. They are less likely to default on their loan so this is definitely more of a high-yield approach when it comes to peer-to-peer lending. Of that $525 I have to invest, $100 of that is going into C investors, $200 of that is going to D investors, $150 going to E, and $75 going to F. Immediately Lending Club breaks it down for you automatically. And I cant tell you how much I love that. Thats actually the strategy I have done. I dont do the option three. I typically do the option one, but immediately they break down the notes for you.

They also show you your average interest rate on that is 17.9%, but because some of those folks are going to default on their loans they are estimating that 4.42% youll lose based on default. Then there is Lending Clubs charge of 0.52% so your projected return after its all said and done is going to be approximately 12.25%. And thats approximately. Maybe all of those people do pay you back where youre all good and you actually make more, but that should just give you a range.

Lending Club Notes

Lets just go to the next step real quick. Here is another thing where you can start seeing what some of these loans are used for. For example, credit card, consolidation August 2011 $24,000 loan, debt consolidation loan, small business loan, small business loan, etc. You can actually see what these notes are. Amount left is how much more that that person needs to borrow to take care of that debt. If you want to take it one step further you now can see more about the individual, their gross income per month you, if theyre a homeowner or not, length of employment, their current employer, where they are located, debt-to-income, their credit score range. It just gives you a lot more details about the creditor.

Even more, if you want you can ask them questions if youre not confident or just need some reassurance, for this example here they asked,

What type of business are you starting?,

and they said,

We are purchasing an existing flight school and looking for help with a short term loan to assist with down payment.

Lending Club actually gives you some direct questions to ask this. They did change that a little bit over the past few years, I think as far as privacy act as far as some of the questions you could ask, but they give you a lot of the good basic questions to ask. Thats where you can learn more about it.

One thing I didnt mention is that of that $525 that I have to invest typically only $25 of that is going per individual note, so thats where the diversification comes into play where youre not putting all your investment into one person, therefore you can diversify. I am going to do option one. Im much more comfortable. My projected of return is to be lower, but as you can see Im actually doing better than that. I think I might have done some high risk in the beginning, but typically I have stuck with option one altogether. You can see Ive got a lot more of the B borrowers and none on the F and G side. Im not much on the high yield. I like to be a little bit more conservative with this aspect. Immediately they break it down and it looks like Im doing some overlap of my last entry so lets see if we can get that straightened out.

Note. Lending Clubs minimum investment is only $25 . Thats it.

The other thing too is you could actually choose the term of the note. Lending club initially just started out with a 36-month, three-year note. They now offer a 60-month note, a five-year note so thats actually a little bit more return on that one, but you are locked into your own money. You can also sell these notes too, so if you are not wanting to hold it for the maturity you can find a buyer, just like selling stock on the open market to find someone to unload those to.

Choosing Note Options

All right, lets see if I can finally get this figured out. I just want to invest. I shouldve started with the option one to begin with. Lets start over. Sorry about that. Option one, continue, and really quick you can see some of those, pool project, other, debt consolidation loan, home improvement loan, etc. etc. I can actually go in there a La carte. I can add more money to one note, take some money away from another note, etc. You have the ability to do that. You also have the ability to build your own portfolios from scratch so if you want to go through all of the different notes that are available you can do that as well. I personally dont have interest in that so I dont. So with $525 Im going to invest into 21 different notes and my average rate of return will be approximately 9.58%. A quick look at the notes and we are going to place the order.

You can then give your portfolio a name. I havent done a very good job of managing this so Im just going to assign it to portfolio 10 and we can go from there. I will soon get a confirmation.

The one thing with Lending Club that I have noticed is Ive just invested $525 into 21 individual notes. Most likely what will happen is that not all of those notes will get the entire funding. Typically, how that happens is the investment that you thought you made you dont make. You get it refunded back to you, and then from there you can go out and find some new notes. That most likely will happen, just FYI.

That is it as far as how to invest with Lending Club . Thats how simple it is. As far as who I would recommend this to; this is not a savings account replacement. This is not a CD replacement. Even though it is a three-year and five-year note you might think of that as a three-year or five-year CD.

There is definitely more risk involved with this so do not make this an apples-to-apples comparison.

Typically, where I see this in my own investment portfolio is we have our emergency fund, we have our savings account; this is just something to complement what Im doing in my stocks. Like I said, I only have a small investment now but we are planning on shifting some more money there. We were building a house, had some other improvements that we were doing, having a third child so we want to have more in cash then we probably should, but we just felt more comfortable doing that. Now that we have some of those things out of the way I am definitely a lot more comfortable moving some more cash into here and start making some or interest.

I should also say I have never had any notes on Lending Club default up to this point. Ive been doing it for just over two years, I believe and have not had a default yet. Im not saying that I wont, but I havent had one yet. If I do I will definitely report it.

If you have any more questions let me know on this. Youll find a link below that is an affiliate link, so if you do click and open an account I do earn a bit of money for doing that. You can also go to LendingClub.com directly. I wont get the affiliate and thats fine by me as well. If you have more questions on Lending Club or if you have any experiences please share. Id love to hear more about it as this becomes more of a mainstream approach for a lot of people.

Want to learn more about investing with Lending Club? You can find more information by clicking here .

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Before investing with Lending Club make sure you read the prospectus and familiarize yourself in how their operation works.