Launches More 401(k) Plans

Post on: 4 Май, 2015 No Comment

By Nigel Brashaw, Asset Management Partner

There’s no question that ETFs are a growing segment of the asset management business. with more than $2.4 trillion invested globally in exchange-traded products by the end of 2013, up more than 23% from a year earlier. Notably, ETF assets in Europe totaled $420 billion while assets in the Asia Pacific region account for another $170 billion. Canadian ETFs have grown steadily to $60 billion, while Latin American ETFs are growing at a slower pace with a relatively paltry $11 billion.

But it is growth in the largest market for ETFs that is particularly eye-catching: ETF assets in the United States jumped 26% during 2013 to more than $1.7 trillion by year-end. As the largest market and one that potentially offers the most insight into future developments, this post will focus on developments in this market.

Market appreciation and net new flows of $178 billion contributed equally to asset growth in the U.S. market. ETF flows mirrored industrywide flows, with many equity categories enjoying recordbreaking years while flows to bond funds reversed and commodity products saw a rush for the exits.

Broad equity categories may have captured the biggest flows, but some more specialized asset classes also benefited from widespread reallocation of assets as investors attempted to better position their portfolios for improved economic prospects in developed countries as well as a rising rate environment. With each category attracting more than $17 billion in 2013, net flows to Japanese and European stock ETFs accounted for 247% and 177% of starting assets respectively. Bank loan ETFs captured a remarkable $5.6 billion of net new flows, accounting for an astonishing 369% of starting assets.

To put the extent of flows to ETFs during 2013 into perspective, it is worth considering that they represent 13% of total ETF assets at the beginning of 2013. Compare this to traditional mutual funds, which despite having a relatively strong year attracted net new flows accounting for only 3% of assets at the beginning of 2013.

Older But Animated

The number of ETF sponsors continues to grow, with 57 ETF managers now operating in the U.S. alone. While assets and flows remain relatively concentrated, the three largest managers now account for less than 81% of total ETF assets, down from 94% just five years ago.

ETFs also continue to proliferate. While 61 ETFs were closed in 2013, another 158 were launched in the U.S. market. While the vast majority of these were index-based, active ETFs introduced in 2013 reported similar levels of average net flows to their passive counterparts. Global exposure continues to be a major driver of fund launches, with 40 new international stock ETFs attracting an average $84 million of net asset flows in 2013, compared to an average $52 million of net flows going to new U.S. equity ETFs.

With 1,543 ETFs offered in this market alone, ETFs can now be found in virtually all fund categories tracked by Morningstar. Assets are concentrated in categories represented by multiple indices on which ETFs can be based. U.S. Stock and International Stock categories alone account for two-thirds of all ETF assets.

The explosion of products has not quite kept up with fund flows, a fact underscored by the steady decline in average flows per fund over the past decade.

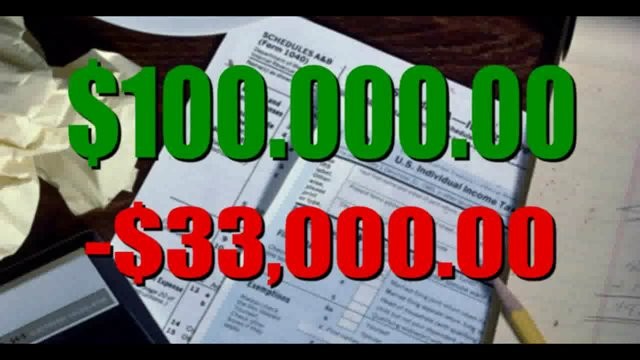

One of the most intriguing developments is the migration of ETFs into retirement plans. Progress has been slow, not least because of recordkeeping infrastructure designed for mutual funds and the fact that tax efficiency is a moot point in this market.

However, plan sponsors are finding other reasons to consider ETFs, including even lower costs than traditional index funds and access to a wider range of sectors and asset classes. After some tentative attempts at getting ETFs into 401(k) plans, Schwab has now introduced an ETF version of its Index Advantage program targeting mid-market plans. The low cost of ETFs makes it possible to bundle participant advice at a reasonable price and the company’s vertically integrated structure allows their program to easily handle the fractional ownership that comes with defined contribution plans. Schwab may be on the vanguard (no pun intended) of the trend, but expect others to join in and accelerate the growth of ETFs in the retirement market.